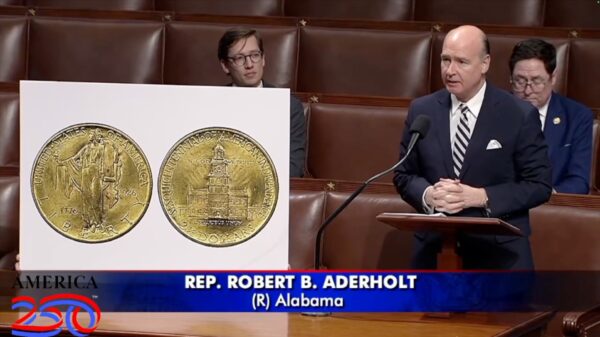

Rep. Danny Garret, R-Trussville, introduced four bills last week to offer tax relief to Alabamians and the bills are moving quickly as the package will be the first order of business when lawmakers return form spring break.

Garrett, chair of the House Education Budget, introduced the bills on the floor Wednesday and immediately scheduled them on his committee agenda for Thursday, where all four bills gained approval.

“While I am proud that Alabama’s taxes are consistently among the lowest in the nation, there are still commonsense, conservative measures we can take to put more money back into the pockets of hardworking Alabamians,” Garrett said. “These bills will lower grocery costs, reduce state income taxes, and ensure everyday families see tangible savings.”

Collectively, these measures would save Alabamians approximately $314.6 million annually. HB386 proposes accelerating the state’s Grocery Tax Cut by an additional 1 percent, bringing the total grocery tax reduction to 2 percent since 2023, and delivering an estimated additional $123 million in annual savings. HB386 would take effect on September 1.

Another measure, HB389, seeks to provide relief by raising the income floor and adjusting thresholds for the optional standard deduction and dependent exemptions, which would lower state income taxes for many residents, saving about $23.8 million annually.

Additionally, HB388 reduces Alabama’s tax burden by nearly $45 million through changes in income taxation, including reducing obligations tied to federal taxes. HB387 would empower local governments to further reduce the grocery tax at the municipal level, adding flexibility for cities seeking to provide residents with additional relief.

“Since 2022, the Legislature has passed over a dozen tax cuts, saving Alabama families thousands of dollars,” said House Speaker Nathaniel Ledbetter, R-Rainsville. “We continue to balance responsible financial stewardship with meaningful relief that directly benefits our citizens.”

The original bill reducing the grocery tax passed by lawmakers last year planned to reduce the grocery tax by up to 2 percent with the first 1 percent reduction taking effect last September. But guardrails in that legislation would have meant the state would not have seen another 1 percent reduction this year.

That bill also capped the opportunities for counties and municipalities to reduce local grocery taxes, a provision eliminated under HB387.

“Further reducing and ultimately eliminating the state sales tax on groceries would provide meaningful help for Alabamians who struggle to make ends meet,” said Robin Hyden, executive director of Alabama Arise. “Reducing the grocery tax benefits every Alabamian. And it is an important step toward righting the wrongs of our state’s upside-down tax system, which forces Alabamians with low and moderate incomes to pay a higher share of their incomes in state and local taxes than the wealthiest households.

“The state grocery tax is a cruel tax on survival. It drives many families deeper into poverty. And Arise remains committed to the goal of eliminating it entirely. Arisemembers from every corner of our state have advocated relentlessly for decades for Alabama to untax groceries. Our work will continue until the state grocery tax is in the dustbin of history where it belongs.”