|

Getting your Trinity Audio player ready...

|

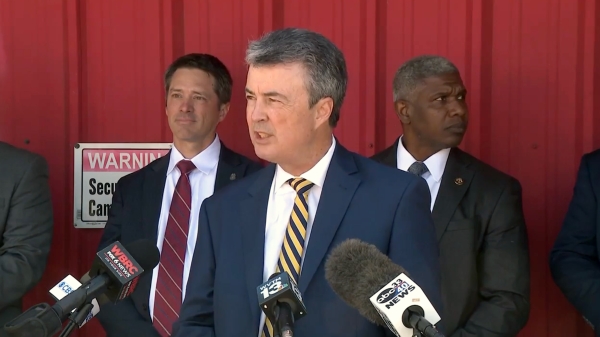

The Alabama Supreme Court on Friday upheld a lower court’s order giving a certified public accountant control of the Mabel S. Amos Trust Fund due to apparent “self-dealing” and “gross mismanagement” by the governing board – a matter that has been the subject of lawsuits pitting Attorney General Steve Marshall against and the executive director of the Alabama Ethics Commission and Regions Bank.

In its opinion, the state’s highest court also overturned a portion of the order from Montgomery County Circuit Court Judge Greg Griffin, which directed CPA, James C. White Sr., to also determine the ways in which the board members and Regions Bank had violated the explicit terms of the trust. The opinion said such an order was asking the CPA to determine matters of law and make factual findings – areas outside his expertise.

The opinion, and the order it upholds, appears ominous for the defendants, which includes Ethics Commission Executive Director Tom Albritton, along with three other board members, and Regions Bank, which administers the fund. The mishmash of lawsuits, including one from Marshall, allege that Albritton and the board failed repeatedly to adhere to the terms of the trust, and that Regions charged excessive fees to administer the fund.

The Mabel S. Amos Trust Fund was established to grant scholarships to “deserving young men and women of the state.” Amos, a former Alabama Secretary of State from 1967 to 1975 established the fund upon her death in 1999. At the time of her death, the fund had few assets, but in 2010, oil was discovered on a trust property. That discovery increased the assets exponentially almost overnight.

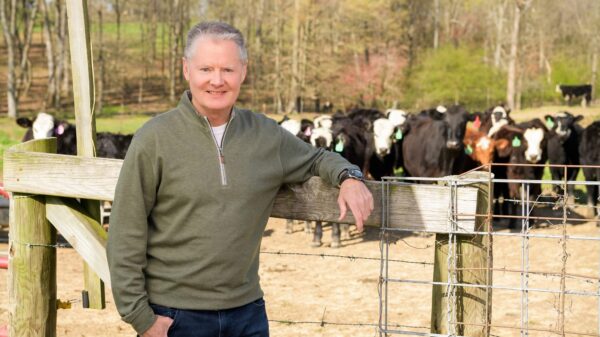

The lawsuits allege that board members Albritton, Rick Clifton, John Bell and Drew McNeese engaged in various forms of “self-dealing,” by essentially awarding scholarship money that directly benefitted themselves or their businesses and that they repeatedly violated the terms of the trust by both engaging in self-dealing and also granting money to various universities for general scholarship awards. The terms of the fund state, according to the ALSC opinion, that the board is responsible for selecting the individual recipients of the scholarships and that those scholarships are to be awarded to “deserving young men and women of the state.”

The original lawsuit in the case took issue with Albritton’s children receiving $135,000 to attend the University of Texas. But the ALSC opinion, citing Griffin’s order, documents a litany of other offenses, which the court states are “judicially noticed” because they derive from tax documents filed by the Trust board.

Specifically, Griffin’s order notes the $135,000 going to Albritton’s children, which the order states “clearly violated the Trust’s prohibition on private inurement and self-dealing on the part of the trustees.”

The order also says tax records show a number of other scholarship awardees that are not named in the tax documents after 2014. The court noted that it had been “credibly alleged” by a plaintiff that some of those awarded scholarships went to the children of staffers at a law firm where one of the trustees practiced, and to the children of wealthy clients of the firm. Other scholarships allegedly went to the children of a former law partner and the children of a judge before whom the attorney tried cases.

The tax records also allegedly show, according to Griffin’s order, that Regions “greatly increased its charges to the Trust for its administrative services although it spent the same amount of time working on Trust matters both before and after the Trust became wealthy.”

Finally, the order alleged that several state universities received awards from the Amos Trust over several years totalling just short of $375,000 for general scholarship awards. That action, according to the court, appeared to be a violation of the terms of the trust, which mandated that the board members select the individual recipients.

The Supreme Court’s opinion agreed with Griffin that a CPA could be appointed to review the relevant tax records and other records associated with the trust and issue general findings of the money received by the trust and how it was distributed. However, the justices determined that asking the CPA to determine whether the board members and Regions violated the law was a step too far. It vacated that portion of the order, and that responsibility will be left to Griffin.

Judging by the plain language of his order, that seems like trouble for the board and Regions.