|

Getting your Trinity Audio player ready...

|

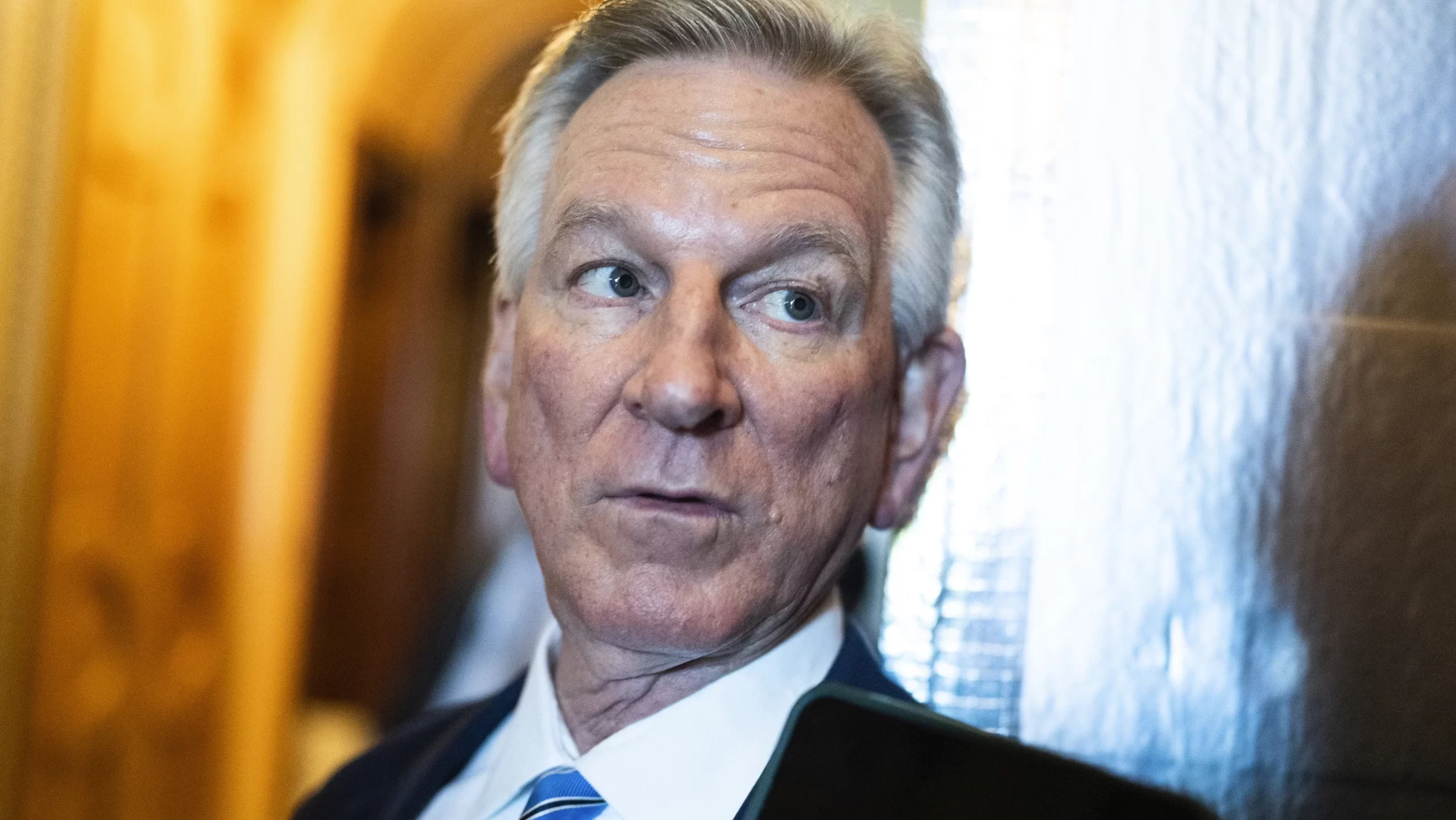

Sen. Tommy Tuberville, R-Ala., was one of at least 37 members of Congress and their families who traded defense stocks in 2024, amidst U.S. involvement in major conflicts in Ukraine and Gaza.

According to Truthout, “a nonprofit news organization dedicated to providing independent reporting and commentary on a diverse range of social justice issues,” Tuberville was the seventh-most active defense stock trader in the U.S. Congress in 2024, disclosing between $63,007 and $245,000 worth of trading in defense stocks this year. Tuberville sold stakes in IBM, Honeywell, and Accenture, among other defense contractors.

Tuberville is a member of the Senate Armed Services Committee, raising serious questions about potential conflicts of interest. Last September, Tuberville participated in a committee hearing on defense innovation headlined by Lockheed Martin CEO James Taiclet, despite Tuberville himself having a vested interest in Lockheed’s success, owning up to $50,000 in the company’s stock.

And Tuberville is not shy about his desire to use his position as a public servant to boost his own wealth, having publicly stated that placing limits on lawmakers’ ability to trade stocks would be “ridiculous” and would “really cut back on that amount of people who would want to [serve in Congress].”

Activists have long questioned congresspeople’s ability to trade stocks given their access to nonpublic information. According to the SEC’s definition of insider trading, an “insider” includes “any employee who has obtained material non-public corporate information, as well as any person who has received a ‘tip’ from an Insider of the Company concerning information about the Company that is material and nonpublic, and trades (i.e. purchase or sells) the Company’s stock or other securities [emphasis added].”

In 2012, Congress passed the STOCK Act, a law which intends to prevent congresspeople from trading on information they learn in their official capacities and requires them to file frequent financial disclosures. However, the STOCK Act allows weeks to pass before congresspeople must publicly disclose their trades, making it difficult to discern members’ compliance with the law. Since its passage, no senators or representatives have ever been charge with violating the STOCK Act.

Tuberville’s trading of defense stocks is just one of many eyebrow-raising instances of congressional trading in recent years. After Senate briefings on COVID-19 in January and February of 2020, U.S. Sen. James Inhofe, R-OK, sold between $180,000 and $400,000 of his total stock holdings. In March of 2023, the children of Rep. Jared Moskowitz, D-FL, sold between $65,000 and $150,000 in shares of Seacoast Banking Corp. after Moskowitz attended a briefing on the impending banking crisis. Days later, Seacoast’s shares fell by nearly 20 percent.

Former Speaker of the House Nancy Pelosi, D-CA, and her husband Paul Pelosi may be the most well-known — and suspiciously successful — congressional traders. In 2022, Paul Pelosi husband purchased over $1 million in Nvidia call options just one week before Congress voted to provide major subsidies to the chip manufacturing industry. Since then, Pelosi herself has also acquired a large position in Nvidia which has since grown by 93 percent, amassing nearly $4 million in gains. In 2021, the Pelosis exercised over $5 million in Alphabet options just before a House panel considered taking antitrust action against the Google parent company.

The Pelosis are so unusually successful with their trades that an independent app, Autopilot, was created to allow users to mirror the couple’s market moves in hopes of securing themselves similar returns.

However, as his time in office comes to a close, President Joe Biden has publicly endorsed a ban on congressional trading. “I think we should be changing the law…at the federal level [so] that nobody in the Congress should be able to make money in the stock market while they’re in the Congress,” Biden said.

A bipartisan proposal to do just that has remained stalled in the House since 2023. The so-called Bipartisan Restoring Faith in Government Act, would prohibit members of Congress and their direct families from purchasing or selling certain investments including individual stocks. If the bill were to pass, Congress members and their families would be forced to sell their current stock holdings within 90 days of the act’s effective date or place them in a blind trust.

It is unclear if the President’s comments will materialize into any tangible legislative action before he leaves office, but if they do, we may begin to see some changes in the wallet size — and maybe even the policy positions — of members of Congress. One thing is for certain: Tommy Tuberville would not approve.