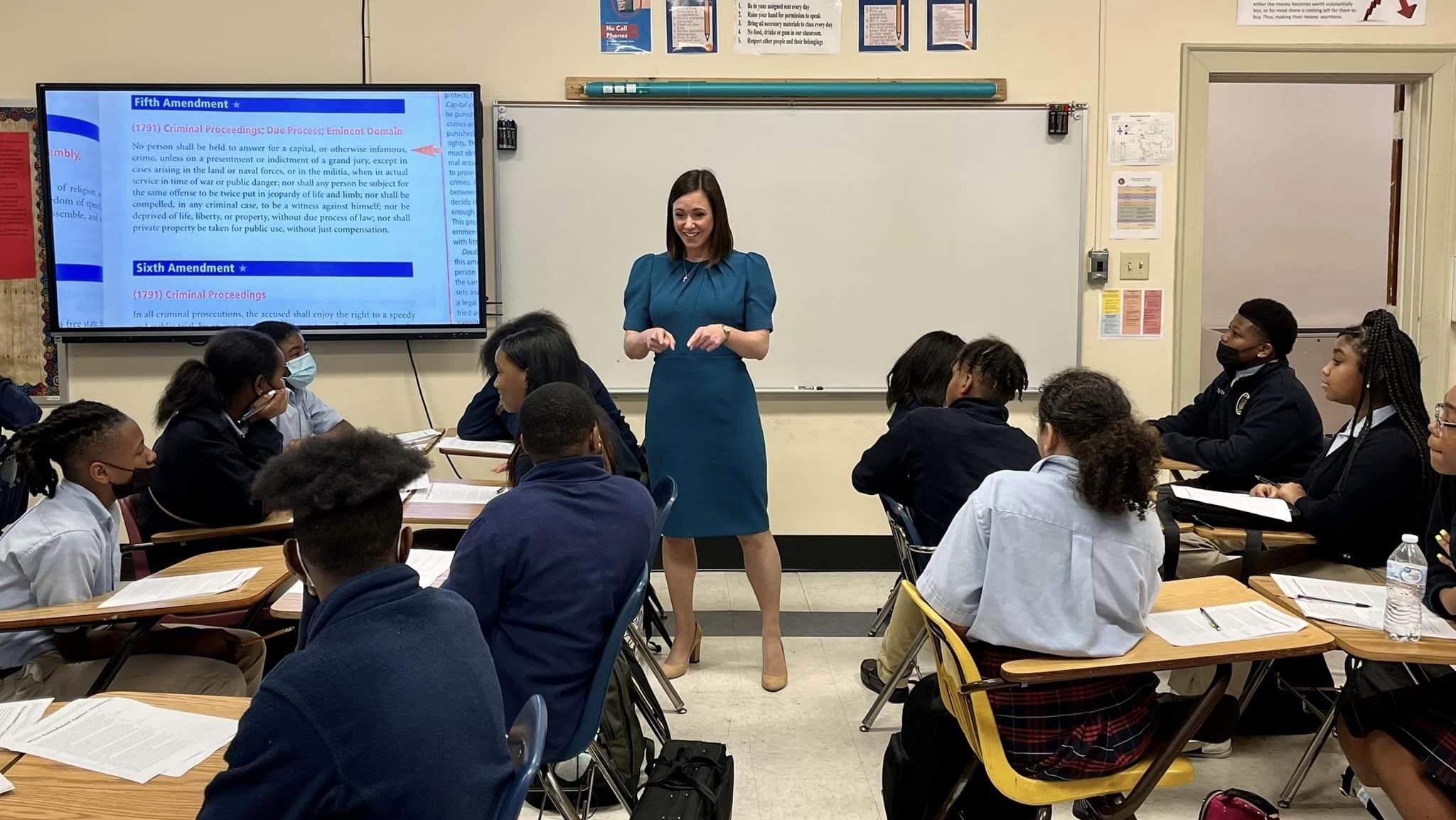

On Wednesday, Senators Katie Britt, R-Alabama, and Tim Kaine, D-Virginia, introduced two bills that would drastically increase federal funding for childcare.

One bill, the Child Care Availability and Affordability Act, would make several childcare-focused tax credits and deductions more generous.

The Child and Dependent Care Tax Credit would become refundable and the maximum credit for families with one child would be increased from $3,000 to $5,000. Families would be able to deduct more of their childcare expenses from their taxed income and employers would receive more in tax credits for providing childcare.

The other bill, the Child Care Workforce Act, would give grants to state and local governments that supplement childcare workers’ salaries.

During a Zoom call with reporters Wednesday morning, Britt echoed some of her previous comments when talking about her family’s experience dealing with childcare costs. “I felt like we were actually writing checks for [my kids’] college tuition and not for their childcare,” she joked.

One 2021 report from Alabama State University found that, depending on the age of the child, full-time childcare in Alabama costs between $114 and $131 a week on average. Senators Britt and Kaine cite a 2022 study which estimated childcare prices had increased nearly 220 percent over the previous three decades.

Britt’s new legislation is hardly the first proposed solution to this crisis in the childcare industry. Earlier this year, the Alabama state legislature unanimously passed a bill, HB358, meant to encourage employers to provide childcare for their workers by creating new tax credits and grants.

Already in the Senate and set for a vote later this week, the Tax Relief for American Families and Workers Act would significantly increase the child tax credit by multiplying the current benefit amount by the number of children a family has. Fatima Goss Graves, president/CEO of the National Women’s Law Center, says expanding the child tax credit “could help millions of families afford essentials such as food, rent, and child care.”

But during the Wednesday Zoom Britt told reporters she won’t vote for the bill because it wasn’t debated in the Senate Committee on Finance and she thinks the expanded child tax credit has insufficient work requirements.

Britt explained that she “strongly support[s]” parts of the bill, but “other parts … need an opportunity to be amended and need an opportunity to be improved for the American people.” She called Senate Majority Leader Schumer’s decision to hold a vote on the bill part of a “Summer of Scare Tactics,” a slogan she has used in the past to criticize Schumer for holding votes on bills that would protect IVF and contraception.

While the Tax Relief for American Families and Workers Act has not passed through the Finance Committee, it was approved by a bipartisan supermajority in the House. 169 Republicans and 188 Democrats voted in favor. And before it was passed by that supermajority, it was edited and approved by the House Committee on Ways and Means.

Britt’s fellow senator from Alabama, Tommy Tuberville, has also said he will not support the tax reform bill when a vote is held this week. Tuberville said he wants to pass the business tax breaks included in it but the wider bill is “another attempt by the left to buy votes in an election year.”

In the press call, Britt sought to differentiate her new bills from the proposed child tax credit expansion by repeatedly stressing that her legislation “does not create another entitlement.”

While making the Child and Dependent Care Tax Credit refundable would help low income families actually take advantage of it, the tax credit would still be capped at the amount of income an individual in the family earns in a year.

In addition to a host of national organizations and organizations from Virginia, both bills are already endorsed by Alabama Arise, Alabama School Readiness Alliance, the Business Council of Alabama, Healthy Kids AL, and Manufacture Alabama.

However, currently the only senators to sponsor the Child Care Availability and Affordability Act and the Child and Dependent Care Tax Credit are Katie Britt and Tim Kaine. In order for the bills to pass, they’ll need to attract far more sponsors from both parties, pass a floor vote, and then be approved by the Republican-led House.

And with the Senate set to recess until September on Friday and the presidential election quickly approaching, Britt and Kaine are fully aware that it could be a long, long time until their bills are passed.

“The real rubber will meet the road when we return in January,” Britt told reporters.