|

Getting your Trinity Audio player ready...

|

Alabama Senator Katie Britt was one of ten Republican senators to cosponsor a bill changing the funding model for the Consumer Financial Protection Bureau last week. Established as a response to the 2008 financial crisis and first proposed by now-Senator Elizabeth Warren, the CFPB consolidated regulations on consumer financial markets under one agency.

Explaining her support for the new bill, Britt declared that “the CFPB has continued to operate as a partisan, rogue regulator, acting far outside of its congressional mandate and without any true accountability to Congress.”

She said the new legislation, titled the Consumer Financial Protection Bureau Accountability Act, would make the CFPB “accountable to the American people by subjecting it to the congressional appropriations process.”

The CFPB has long been attacked for supposedly being unaccountable to Congress and the American people. In 2011, Alabama Senator Richard Shelby, who Britt replaced in 2022, wrote an op-ed in the Wall Street Journal criticizing the CFPB’s single director structure and alluding to a critique of its funding source.

Conservatives’ main issue with the CFPB after the Supreme Court found restrictions on removing its director to be unconstitutional in 2020 has been how the bureau is funded. Under the Consumer Financial Protection Act of 2010, the CFPB simply takes the “amount determined by the Director to be reasonably necessary to carry out the authorities of the Bureau” from the Federal Reserve every year.

While this annual funding is limited to 12 percent of the Federal Reserve’s total operating expenses, unlike most federal agencies, the CFPB does not have to have its funding approved by Congress every year. If the Consumer Financial Protection Bureau Accountability Act is passed, the CFPB will first receive “such funds as may be necessary to carry out this title for fiscal year 2026” and then Congress will have to approve all future appropriations.

The CFPB’s ability to draw funds from the Federal Reserve is somewhat unique but a September 2023 report from the Congressional Research Service noted that “other agencies, such as bank regulators (OCC, FDIC, and Federal Reserve), are also funded outside of the congressional appropriations process.” Most of these agencies are primarily funded by selling services, like the Post Office, or by returns on investments.

In addition to requiring the CFPB to be funded via Congressional appropriation instead of transfers from the Federal Reserve, the Consumer Financial Protection Bureau Accountability Act would also place all excess revenues from civil penalties in the U.S. general fund, instead of allowing the CFPB to use them.

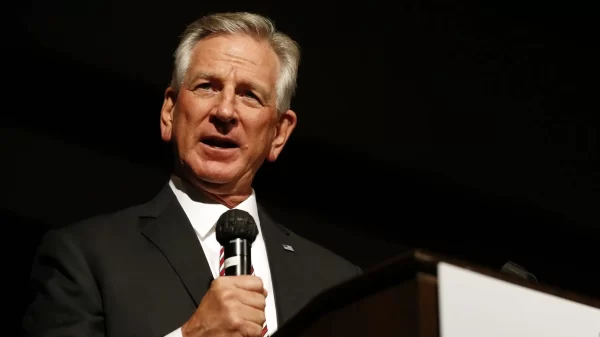

In 2023, Britt and fellow Alabama Senator Tommy Tuberville both signed an amicus brief asking the Supreme Court to find the CFPB’s funding structure unconstitutional. Britt said the CFPB had “been operating outside of [the lawful Congressional appropriations process] with little oversight or taxpayer accountability” and called the funding structure “unsustainable and unconstitutional.”

However, in May, the Supreme Court declared that the CFPB’s funding structure is constitutional in a 7-2 ruling, with only Justices Alito and Gorsuch dissenting.

Writing for the majority, Justice Clarence Thomas said that under the Constitution an “appropriation is simply a law that authorizes expenditures from a specified source of public money for designated purposes.” Using this definition, the majority found Congress allowing the CFPB to draw money from the Federal Reserve to be a constitutional appropriation.

Responding to the Supreme Court’s decision, the CFPB said that “for years, lawbreaking companies and Wall Street lobbyists have been scheming to defund essential consumer protection enforcement.” The bureau also pointed to the “more than $20 billion in consumer relief” that it has distributed since its creation.

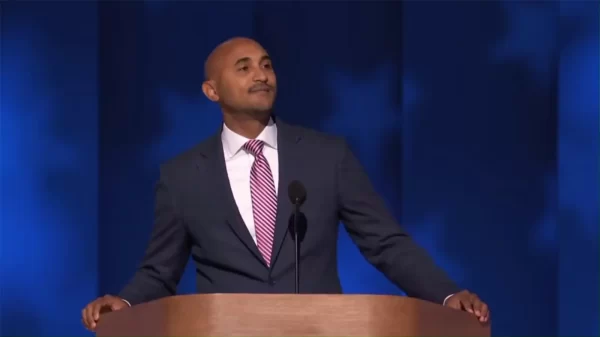

Speaking to the Senate Committee on Banking, Housing, and Urban Affairs on June 13, CFPB Director Rohit Chopra discussed recent restrictions the CFPB has placed on medical bills being used in credit scores, unfair credit card fees, late fees, and disappearing reward points.

Chopra also responded directly to a line of questioning from Sen. John Kennedy, R-Louisiana, who claimed that the CFPB “have been operating illegally” by drawing funds from the Federal Reserve when the Federal Reserve has not been making a profit. Chopra responded by saying they “believe wholeheartedly everyone is complying with this statute.”

During Chopra’s report to the Senate committee, Senate Democrats seemed quite supportive of the CFPB’s recent work. With a Democratic majority in the Senate and a Democrat in the White House, the Consumer Financial Protection Bureau Accountability Act is likely to meet the same fate as previous legislation changing the CFPB’s funding model and fail to pass.

However, the introduction of this bill does suggest one potential legislative priority for Republicans if they win a trifecta this November.