|

Getting your Trinity Audio player ready...

|

Since last June, when the Supreme Court ruled 6-3 that President Joe Biden’s student debt relief plan was unconstitutional, the Biden administration has been seeking ways to relieve debt through plans that are already available.

The Public Service Loan Forgiveness program is targeted towards borrowers who work as teachers, members of law enforcement or public safety and employees at non-profits. Those who qualify would have their remaining loan balance forgiven after working in one of these disciplines for 10 years and completing 120 monthly payments.

Another of these plans, and a direct response to the scrapped student relief plan, is the Saving on a Valuable Education Plan. The SAVE Plan is an income-driven repayment plan, but payments are calculated based on income and family size, not the owed balance, and balances are forgiven after a certain amount of years.

This July, through the SAVE Plan, payments for borrowers who have undergraduate student loans will be slashed from 10 percent of their discretionary income to 5 percent. But there is currently a lawsuit filed by 11 states, including Alabama. The main issue these states have is with the cost estimates of these programs and the taxpayers who would pay off the forgiven loans.

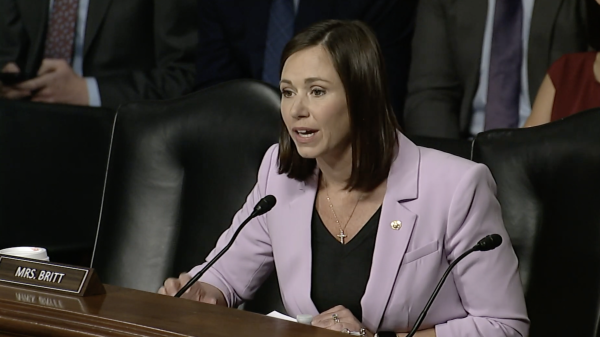

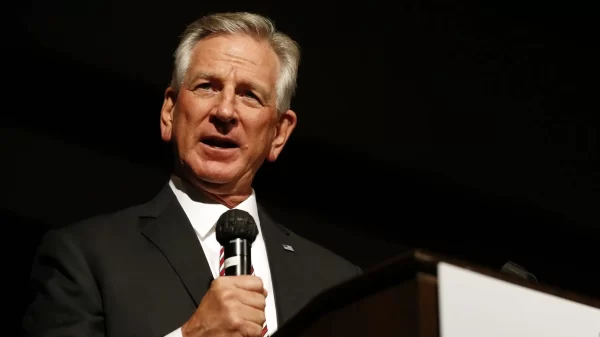

On Monday, both of Alabama’s U.S. Senators, Katie Britt and Tommy Tuberville, signed on to a bicameral letter urging the Department of Education to rescind its most recent Notice of Proposed Rulemaking authorizing the latest round of loan forgiveness, which President Biden announced on Wednesday, canceling student debt for an additional 160,000 borrowers for a total of $7.7 billion forgiven. The total amount of forgiven debt is now $167 billion.

The letter continues, calling borrowers “political pawns” and putting quotation marks around the word hardship, calling it a broad term regardless of its straightforward definition. The letter ends, pleading instead to work with Congress to fix the nation’s higher education financing system, but at the moment, some constituents the two represent do require help with debts.

As of 2024, according to the Education Data Initiative, 13 percent of Alabamians owe student loan debt and the average amount owed per person in Alabama is $36,589, which exceeds the national average. The state’s total student loan debt sits at $23.9 billion.

What really makes student debt loans so unmanageable for borrowers is the interest rates. As interest rates increase, less of the monthly payment goes towards paying off the principal loan amount and more is contributing to the interest the loan has accrued.

Calculating the current average debt amount for borrowers in Alabama with the current fixed federal interest rate for subsidized and unsubsidized loans for undergraduate students, 3.73 percent, has the average Alabamian paying a little over $7,300 in interest over the course of 10 years. This would also require a monthly payment of $365.77 a month, which is only attainable for some when the average income in Alabama sits just above $49,000 a year.