|

Getting your Trinity Audio player ready...

|

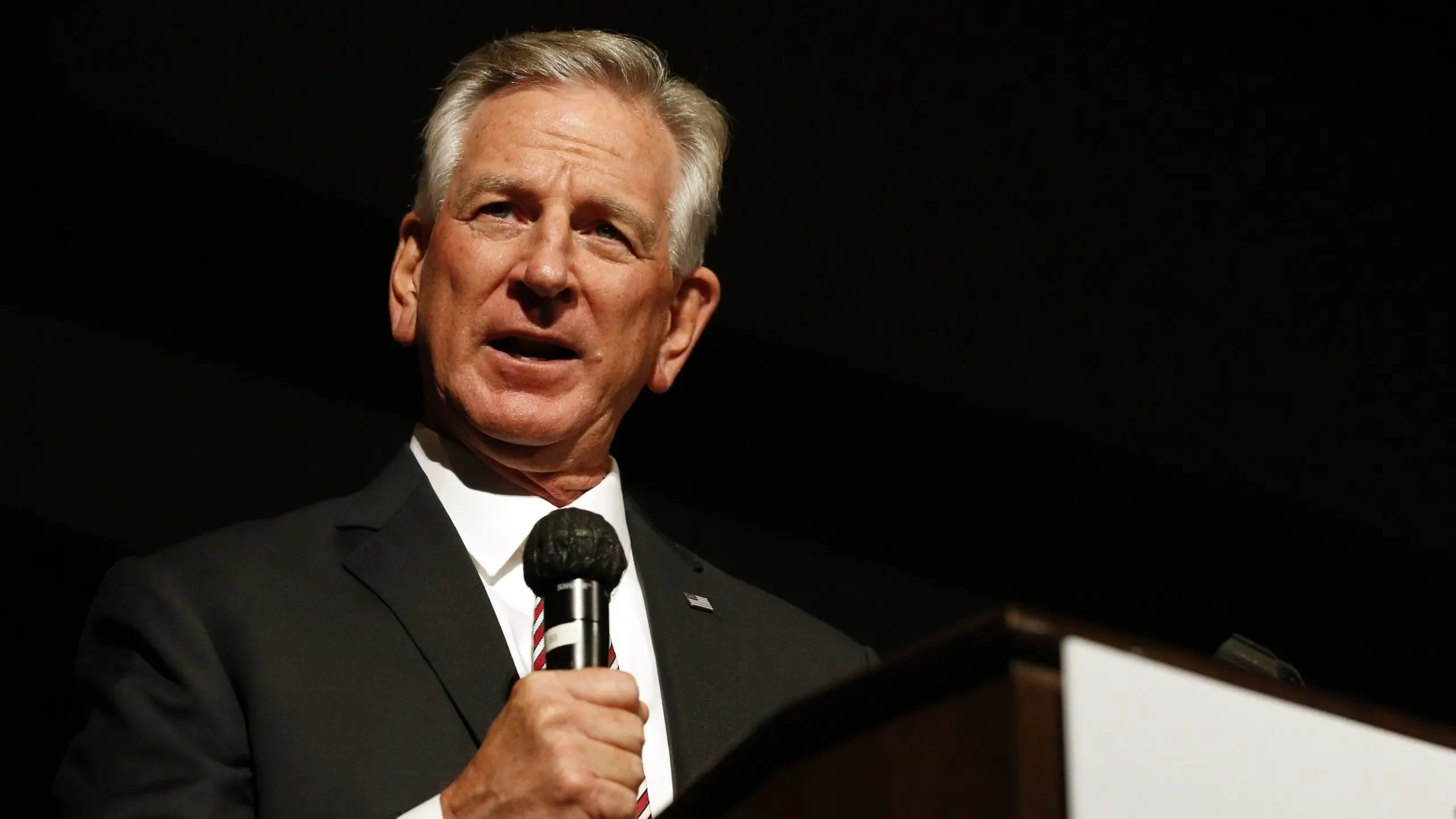

On Tuesday, Alabama Sen. Tommy Tuberville told Newsmax host Carl Higbie that the American people had been “sold a bill of goods” when Social Security was passed. He frankly stated that “most people won’t get Social Security.”

In a tweet on Wednesday linking to a Newsmax article about his comments on Social Security, Tuberville said: “We need to close Washington, D.C. for the next 6 months and save America.”

According to the Social Security and Medicare Boards of Trustees’ 2024 report, the primary Social Security fund will be unable to pay 100 percent of current scheduled benefits by 2033.

This is because Social Security’s old age pensions ran a $41.4 billion deficit in 2023, or 1.13 percent of taxable payroll. If nothing is changed about Social Security taxes or benefits, this deficit is expected to increase to 5.08 percent of taxable payroll by 2080 and then begin declining. The fund’s current balance is approximately $2.6 trillion.

However, the boards also estimated that “continuing program income will be sufficient to pay 79 percent of scheduled benefits.” This means that even if nothing else is changed, people could likely continue receiving Social Security benefits, if not at the same level as before.

Over the past few months, Tuberville has publicly discussed his belief that Americans are unlikely to receive any benefits from Social Security in coming decades several times.

In March, Tuberville complained about Social Security’s funding as a guest on Fox Business’ “Kudlow.”

“The money you’ve been paying for Social Security, Medicare for years out of your monthly paycheck or weekly paycheck—it’s not up here, it’s gone,” he said. “The politicians have spent it, and so we’re having to tax and take money and have a bigger budget just for that.”

In February, Tuberville told a meeting of the Senate Health, Education, Labor, and Pensions committee that “there’s gonna be about 150 million people coming up here saying, ‘Where’s our damn money that we paid in?’”

“I could’ve put my Social Security money for 40 years in the market and it probably would be worth eight to ten million today, but the federal government wasted it,” he said. He repeated this comparison on Newsmax on Tuesday as well.

In 2019, Tuberville suggested that the government “start a 401(k) for everybody” by allowing people to invest their mandatory Social Security contributions on the market.

This would be one form of Social Security privatization, a frequently proposed policy meant to ‘fix’ Social Security. Privatization plans, to varying degrees, suggest moving away from collecting payroll taxes and issuing guaranteed benefits and towards mandating workers invest a certain percentage of their income.

Proponents of Social Security privatization point, like Tuberville, to the average returns on market investments over time. Currently, Social Security trust funds are invested exclusively in U.S. Treasury bonds and earned an average of 2.4 percent interest in 2022. In comparison, the average annual return on the S&P 500 over the last forty years is approximately 9.3 percent.

Critics of privatization point to the difficulty of transitioning away from a fixed benefits model, the greater risk that would be incurred by retirees, and the probable massive increase to the national debt. The national debt would increase because people who paid Social Security taxes before privatization would still need to receive pensions but payroll tax revenue would be placed in private investment accounts and could not be used to pay remaining obligations.

Liberal think tanks and politicians, including Rep. Terri Sewell, have proposed an alternative solution: uncapping the amount of income that is subject to payroll taxes. Currently, only income below $168,600 a year is subject to Social Security taxes.

A December 2022 report from the Congressional Budget Office found that collecting Social Security payroll taxes on income above $250,000 a year would reduce the program’s deficit by $1.2 trillion over the next ten years. Under the proposal that the CBO analyzed, Social Security payroll taxes would still not be collected on earnings between $160,200 and $250,000 in annual income.