In an alarming saga of prosecutorial excess, the tale of Jonathan Barbee, a former Jefferson County Constable and Republican political consultant, emerges as a stark warning. Driven by what appears to be an unbridled fervor, an overzealous lawyer at the Alabama Ethics Commission, alongside an equally unchecked agent at Alabama’s Department of Revenue, embarked on a relentless quest against Barbee. This pursuit, marked by an almost predatory zeal, spanned several years, painting a grim portrait of a legal crusade in pursuit of a man for crimes he never committed.

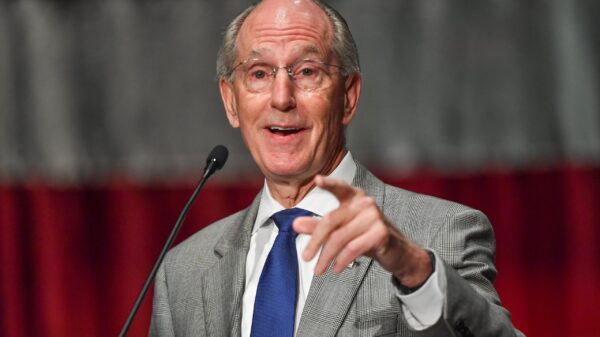

In an episode that mirrors the darkest twists of a legal thriller, Barbee was subjected to a protracted legal battle over alleged crimes that a three-judge panel, appointed by the Alabama Supreme Court, ultimately declared nonexistent. Despite this vindication, Attorney General Steve Marshall’s office, in a move that reeks of political manipulation, chose to press forward with charges. This brazen persistence after Barbee’s clearance by the Ethics Commission raises alarming questions about the motives behind his prosecution.

The legal quagmire deepened when the Alabama Department of Revenue, spurred by a rogue lawyer from the Ethics Commission, malevolently launched a parallel, baseless probe against Barbee. This witch hunt tormented his clients and family for over two excruciating years, culminating in the ludicrous accusation of three felony counts of tax evasion — over a measly $1,600. In a theatrical conclusion to this farcical saga, the charges were unceremoniously dropped, with Barbee coerced into pleading guilty to a mere misdemeanor for failing to file his taxes. The whole ordeal reeks of a vindictive, overzealous prosecution, spearheaded by those hell-bent on tarnishing his reputation.

The situation reached a surreal peak when the Alabama Department of Revenue issued a grossly misleading statement, on Monday, prompting Barbee’s attorney, the esteemed defense lawyer and former prosecutor Matt Hart, to publicly decry the charges as unfounded. Hart’s outrage is palpable as he outlines the sequence of events: initial exoneration by a panel of judges, followed by the state’s baffling decision to indict anyway, leading to a protracted legal battle ending with the dismissal of all serious charges and a final guilty plea to a minor misdemeanor.

“After many months of rigorous investigative activity, the State of Alabama charged my client, Jonathan Barbee, with five felonies involving ethics and tax matters. This came after a panel of three experienced Circuit Court Judges, appointed by the Alabama Supreme Court, found no probable cause that the ethics laws had been violated and closed the matter. Inexplicably, the State charged Barbee anyway,” Hart said.

“Jonathan Barbee was actually innocent of all charges in the indictment, and the proof is—finally—in the pudding. First, the State simply dismissed their premier charges of ethics violations last October. Second, they dismissed the three felony tax evasion charges.”

Barbee pleaded guilty to one count, a simple failure to file taxes with the State in the year 2018, a non-moral turpitude misdemeanor,” said Hart.

“In my many years as a state and federal prosecutor, and now as a defense attorney, I have never seen an indictment that was less supported by the facts and the law. Now, I intend to determine why this unfounded and irregular investigation and prosecution was conducted in the first place,” Hart concluded.

The legal odyssey that unfolded is a bewildering spectacle of justice gone awry. Barbee faced a relentless barrage of felony charges for ethics violations and tax evasion, only to see these accusations crumble spectacularly. The culmination of four exhaustive years, four investigations, and the involvement of three state agencies resulted in a mere misdemeanor plea for failing to file his taxes—a paltry $1,000 infraction.

As Barbee rebuilds his life, the story leaves a lingering aftertaste of injustice and a poignant reflection on the potential perils of a justice system that appears to lose its way. It’s a stark reminder of the personal toll extracted in such a caustic crusade, underscoring the resilience required to withstand the onslaught of such capricious legal warfare. The story serves as a critical cautionary tale about the dangers of prosecutorial excess, especially when it seems to be driven more by political vendettas than by the pursuit of justice.