|

Getting your Trinity Audio player ready...

|

The Alabama House of Representatives on Thursday passed a package of bills designed to increase workforce participation in the state.

The “Working for Alabama” set of bills has the backing of Gov. Kay Ivey as well as leaders in both chambers and broad bipartisan support.

The bills range from education programs to new tax credits for housing and childcare.

Rep. Cynthia Almond, R-Tuscaloosa, introduced the package.

“I know that we’ve had groups, both in the House and the Senate, working to identify reasons that we have people in our state who are able to work and are not working — there is, of course, lots of reasons for that ,” Almond said.

All five bills passed unanimously.

Childcare tax credit

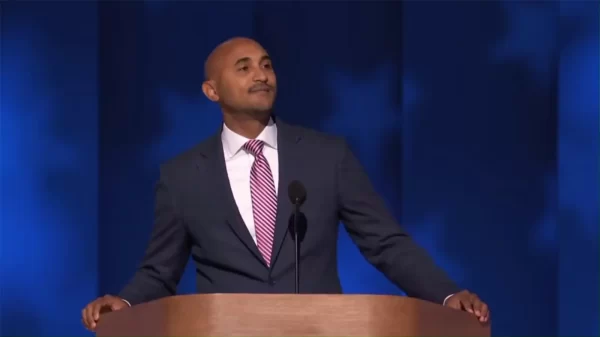

HB358 by House Minority Leader Anthony Daniels, D-Huntsville, would create a variety of boons to childcare, including up to $600,000 in tax credits to employers on childcare-related expenses including construction of a childcare facility or payments to a third-party childcare center on behalf of an employee.

It would also allow up to $25,000 in tax credits for childcare facilities to ease their tax burdens.

“Not only will it incentivize industries, but it will give a number of women who need to get into the workforce and those that are in the workforce — it will help them greatly,” said Rep. Barbara Drummond, D-Mobile, who presented the bill on Daniels’ behalf.

Tax credits would be capped at $15 million in the first year, and step up to $20 million before sunsetting in 2027 to allow legislators to evaluate the impact of the program.

“Every workforce committee that’s looked at labor participation has identified this — child care —as a major impediment, and so we’re believing this is a good tool to help address that issue and to get people back into the workforce,” said Rep. Danny Garrett, R-Trussville.

Housing credit

HB346 by Almond would create tax credits in incentivize developers to create more affordable housing in the state.

The bill would supplement federal low-income housing tax credits that already exist.

“Our rent is too low to make the math work for the developer to build this type of housing without the housing tax credit. So the credit incentivizes the developer to do something that he or she otherwise would not do,” Almond said.

Rep. Laura Hall, D-Huntsville, said landlords are not accepting Housing Choice Vouchers, formerly known as Section 8, that could already help solve some of the housing troubles for low-income individuals.

“There are people that are working, who has this, but their homes have been taken or where they were living has been taken from them. So you have this place here, where these people are falling into, and they cannot get— what I have been told by the individuals that have reached out to me, those individuals are finding themselves homeless,” Hall said.

Almond said this tax credit wold supplement “exactly (that) type of housing.”

The bill sets aside $5 million toward the tax credits, with Rep. Curtis Travis, D-Tuscaloosa, said doesn’t go far enough.

“My only concern is that because $5 million goes rather quickly. In these areas, we’re talking about Huntsville, from what I know, is a very hot market,” Travis said.

Alabama Growth Alliance

SB252 by Senate Majority Leader Steve Livingston, R-Scottsboro, would create a public corporation to act as an advisory board making economic development recommendations.

Rep. Randall Shedd, R-Fairview, who carried the bill in the House, explained the alliance’s advisory capacity as “asking the private sector to give us their greatest ideas.”

Some Democrats said the group seems shady.

“We should not be creating bodies of individuals that we give authority to act on any matter of fiscal responsibility for the state of Alabama, and they are not held to a standard,” said Rep. Juandalynn Givan, D-Birmingham.

The alliance would not have the direct ability to make any decisions for the state.

The House amended the bill, which now goes back to the Senate for concurrence before heading to Ivey’s desk to be signed.

The House also approved Sb247 by Livingston renaming the Secretary of Labor and Department of Labor as the Secretary of Workforce and Department of Workforce and expanding the department’s duties to oversee all workforce programs.

SB253 by Sen. Donnie Chesteen, R-Geneva, creating alternate diploma pathways for students pursuing career education, also passed without dissenting vote.