|

Getting your Trinity Audio player ready...

|

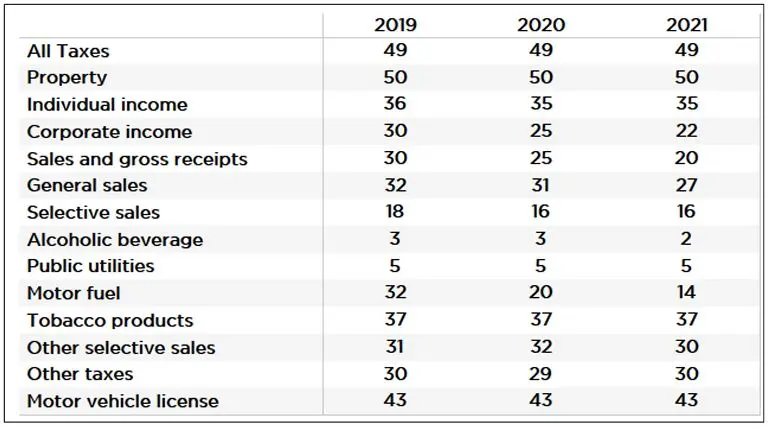

The Public Affairs Research Council of Alabama (PARCA) has released its latest edition of “How Alabama Taxes Compare” on Tax Day, revealing shifts in the state’s tax collection rankings amid ongoing economic challenges. For years, Alabama held the record for the lowest tax collections per capita in the United States. However, the 2023 report finds that, for the first time, Alabama has ceded this position to another state due to specific economic disruptions.

According to data from the U.S. Census Bureau, despite economic upheavals following the COVID-19 pandemic that began in spring 2020, Alabama continues to rank at the bottom in state and local tax collections. For fiscal year 2021, only Alaska, severely impacted by oil market fluctuations, recorded lower per capita revenues than Alabama.

The report highlights Alabama’s perennially low per capita property tax collections, which benefit homeowners, farmers, and timberland owners but result in significant revenue shortages for essential public services such as education, healthcare, and public safety. On the other hand, Alabama counters its low property tax income with one of the highest state and local sales tax rates in the nation. However, this does little to balance the scales, as Alabama’s income tax system imposes taxes on low-income workers at a lower threshold than any other state while providing generous deductions for federal income taxes paid by high-income earners.

Motor fuel tax collections saw a notable increase in the ranking, primarily because half of Alabama’s fiscal year preceded the pandemic—a period marked by a robust economy and high gas prices. This contrasts sharply with most states whose fiscal years began just as the pandemic took hold, causing gas prices to drop and travel to decrease significantly until 2022.

Furthermore, Alabama’s sales and gross receipts benefitted from high sales tax rates, increased pandemic-related purchases, and economic stimulus payments that spurred consumer spending starting in April 2020. Despite these factors, Alabama remains near the bottom in total per capita tax collections nationally.

Looking forward, Alabama has experienced a surge in tax revenues following the pandemic, driven by federal stimulus funds, low unemployment, and high inflation. This has allowed the state legislature to enact important investments in public services, particularly education. Initiatives include teacher pay raises and enhanced support for literacy and math programs. Additionally, recent tax cuts, such as the reduction of sales tax on food and an increase in the standard deduction for low-income residents, aim to provide relief during times of high inflation.

Despite these improvements, Alabama faces ongoing challenges, including addressing long-term underinvestment and deteriorating conditions in sectors like correctional services. As federal aid diminishes and economic growth potentially slows, Alabama may once again face a familiar scenario of insufficient funds to meet growing needs for public services.

The full report, including interactive charts and detailed data analysis, is available on the PARCA website. This resource is designed to deepen the understanding of Alabama’s tax structure and its broader implications, aiding in the development of effective governmental strategies in a dynamic economic landscape.