As State officials were approached about trying to salvage Birmingham-Southern, the college had already established a dismal financial track record of the following:

- Significant ill-considered borrowing to build facilities from 2004-2010.

- Miscalculating millions of dollars in Pell Grant awards.

- Depleting its endowment fund which had been $130 million in 2000.

- Downgrading of its bonds to the worst risk status by Moody’s Investor Service.

- Management instability with eight presidents of the College over the last 20 years.

- Creating serious doubt about its future by declaring in December 2022 that it would close.

- Declining enrollment of 1,268 students in 2018 to only 721 in 2023, a decrease of 43 percent.

State officials had nothing to do with creating that track record.

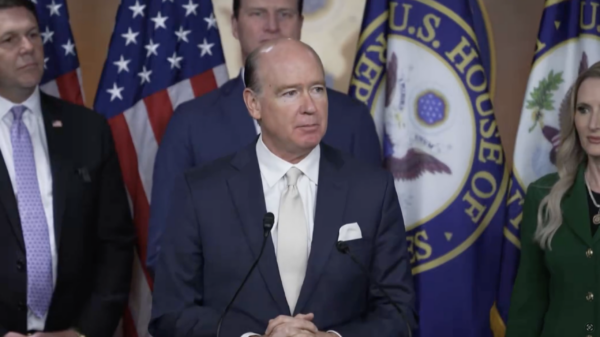

The Alabama Legislature passed a bill in 2023 giving undisputed sole discretion to a Constitutional Officer with 50 years of banking, finance and investment expertise. For this reason, I believe the Legislature’s “intent” was for me to do exactly as the law stipulates:

- The State Treasurer shall require the applicant to meet five minimum criteria to be eligible and to submit a written financial restructuring plan documenting the applicant’s ability to repay the loan.

- The State Treasurer shall review all applications for loans and shall make a careful and thorough investigation of the ability of each applicant to repay a loan under the program.

Birmingham-Southern does not have sufficient collateral to pledge toward yet another loan. It also cannot provide a first perfected security interest in all collateral assets.

Furthermore, last December, Birmingham-Southern was placed on “Warning” by its accrediting body, the Southern Association of Colleges and Schools Commission on Colleges (SACSCOC) citing the college’s failure to comply with governing board characteristics, financial resources, financial documents and financial responsibility. Additionally, Moody’s Investor Services withdrew its debt rating entirely after previously downgrading it to junk bond status.

And just this week, Senate Bill 31 has been introduced in the current legislative session to get $30 million of taxpayer money to Birmingham-Southern by stripping away any loan review from the State Treasurer, giving it to the bank that is already on the hook for millions loaned to the college – that would effectively surrender the hen house to the foxes!

After MANY hours of thoroughly reviewing and investigating the information provided by Birmingham-Southern, I stand by my decision to deny using Alabama taxpayer dollars for a loan to an institution that I believe has been grossly mismanaged for many years. It is beyond distressed.