A bill filed by Rep. Christie England, D-Tuscaloosa, could bring the state’s online sales tax to 9.25 percent.

The sales tax, officially dubbed the Simplified Sellers Use Tax (SSUT), currently stands at 8 percent, the original rate created as a “simplified” rate so that online retailers don’t have to weed through the varying tax rates in different cities and counties.

That lags behind the total sales tax in most municipalities, however, giving online shopping a slight advantage over brick-and-mortar stores—at least in that category.

“We’ve seen over last few years just the amount of online sales skyrocket to the detriment of brick and mortar, in part due to convenience but also due to a financial advantage,” England said. “This would begin equalizing the two tax rates to support our brick-and-mortar stores and support our local businesses.”

England pointed out the 8 percent rate was initially offered to lure retailers like Amazon to begin remitting sales tax at all, as it was unclear if states could require out-of-state businesses to collect that sales tax without a physical presence in the state.

The courts have since decided that states do have that right, so there no longer needs to be an incentive to entice companies to comply.

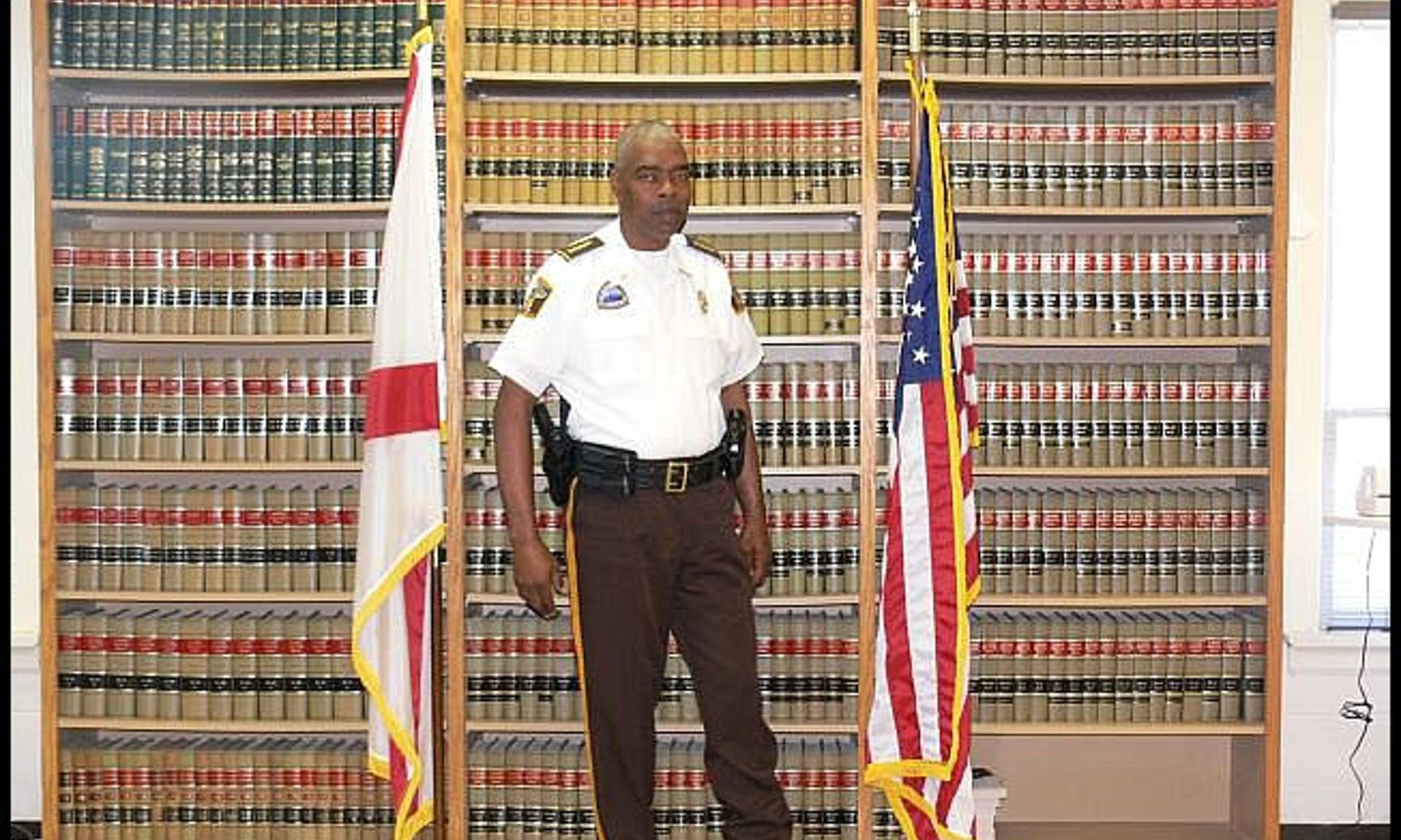

In addition to online shopping pulling in a greater share of sales tax revenue, there are also concerns about this new revenue eventually leaving schools in the lurch, as local sales taxes often fund schools. Nothing in the state statute requires any SSUT funding to be distributed to schools, although some boards of education have made deals with their counties and municipalities to share the fast-growing revenue.

Rather than change the formula that cities and counties have been banking on, England’s bill would distribute the revenue created by the new 1.25 percent tax to school boards on a per-pupil basis.

“This is a way to try to reclaim some of the money lost and create some perpetual funding for schools across the state without strings attached,” England said.

Although customers pay less sales tax on an online purchase, there’s debate over how heavily that disparity impacts decisions to shop online instead of at local stores with so many other factors to consider.

“Who is to say this wouldn’t be happening anyway,” England said. “It’s convenient to have things ordered to your house. This may not completely flip that paradigm.”