|

Getting your Trinity Audio player ready...

|

Last week, the Alabama Legislature sent Gov. Kay Ivey an overtime tax repeal bill with a $25 million cap. On Tuesday, she sent it back without one.

An executive amendment added by Ivey removed the cap, explaining that it would be “easier to administer” for businesses across the state and could “potentially put more money in the pockets” of Alabama workers. Both the House and Senate concurred on the changes.

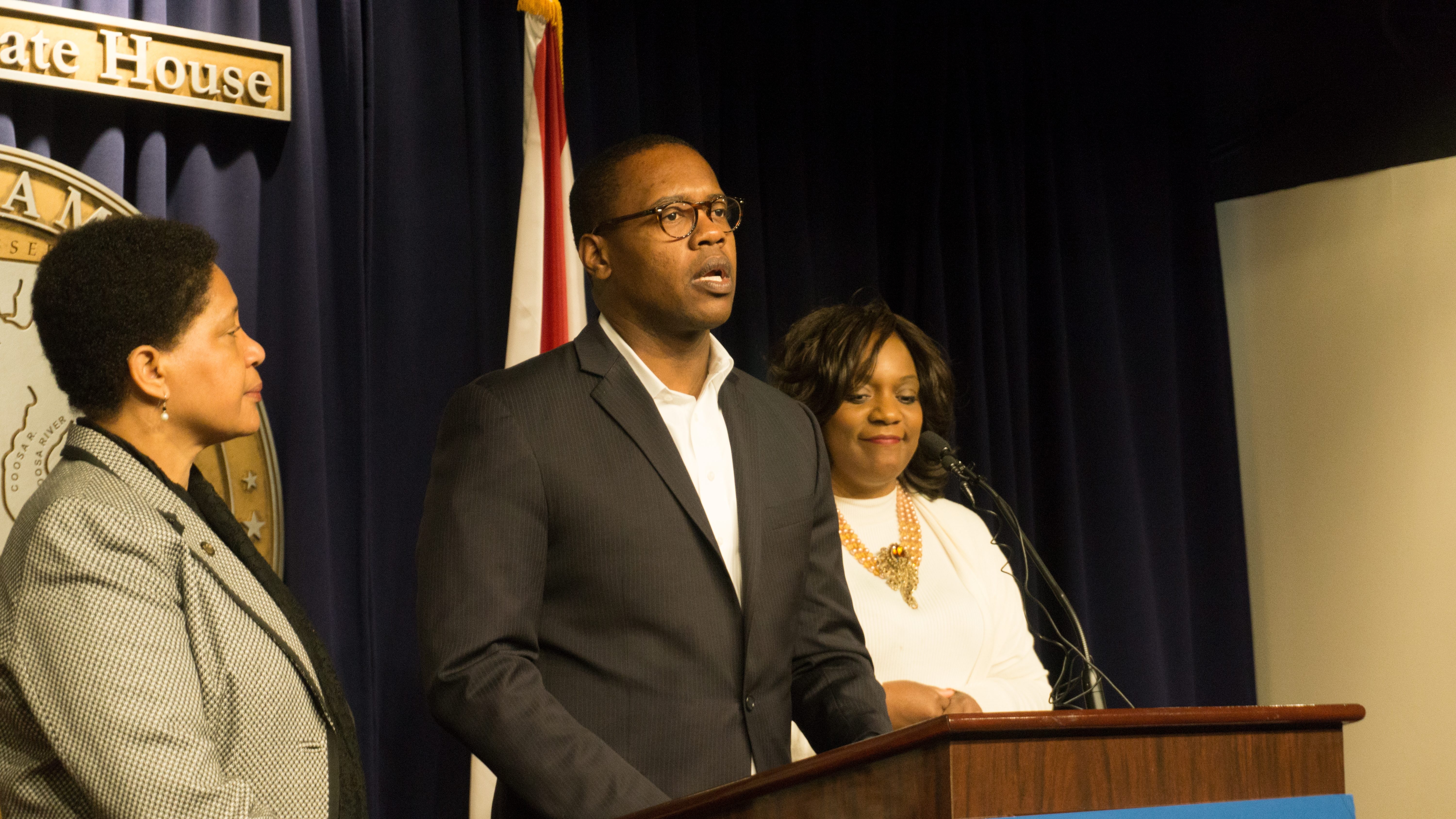

The bill, sponsored by House Minority Leader Anthony Daniels, D-Huntsville, repeals the 5-percent state tax on overtime pay. The legislation drew broad support from both Republicans and Democrats in the Legislature and from various business groups and employee unions – a rare coalition of support for any bill.

“First, I want to thank Gov. Ivey for restoring this bill to its original form and making sure that Alabama’s hardest workers get the full tax break they deserve,” Daniels said in a statement. “This was the product of a bipartisan effort from start to finish, and I want to thank my colleagues in both the House and Senate, and especially Sen. Sam Givahn, who carried the bill in the senate. This process shows that if we come together, Alabama government can work for the working people of this state.”

Ivey’s amendment became necessary after a flurry of late activity last week, led by Sen. Arthur Orr, R-Decatur. Orr held the bill up for weeks, saying he was concerned about the number of tax cut bills removing money from the education trust fund budget, which he chairs.

In a committee last week, Orr attached an amendment that would cap the repeal after $2,000 for each worker. That amendment was later removed on the senate floor and replaced with another amendment that capped the total costs at $25 million.

The $25 million cap would have been about 65 percent of the total projected costs of the legislation. But it also would have potentially limited the ability of some workers – whose available overtime opportunities could come at various times during the year – to take advantage of the repeal.

Additionally, proponents of the bill argued that the ETF budget wouldn’t lose that much money, because the people earning the tax break will put much of the money saved back into the economy.

To be sure, Ivey’s amendment also moved up the sunset date – the date the bill either expires or has to be renewed by the legislature – to just two years, instead of the proposed three. But as Daniels pointed out on the House floor: “that’s right before the 2026 election, so I think we’ll be OK on that.”