|

Getting your Trinity Audio player ready...

|

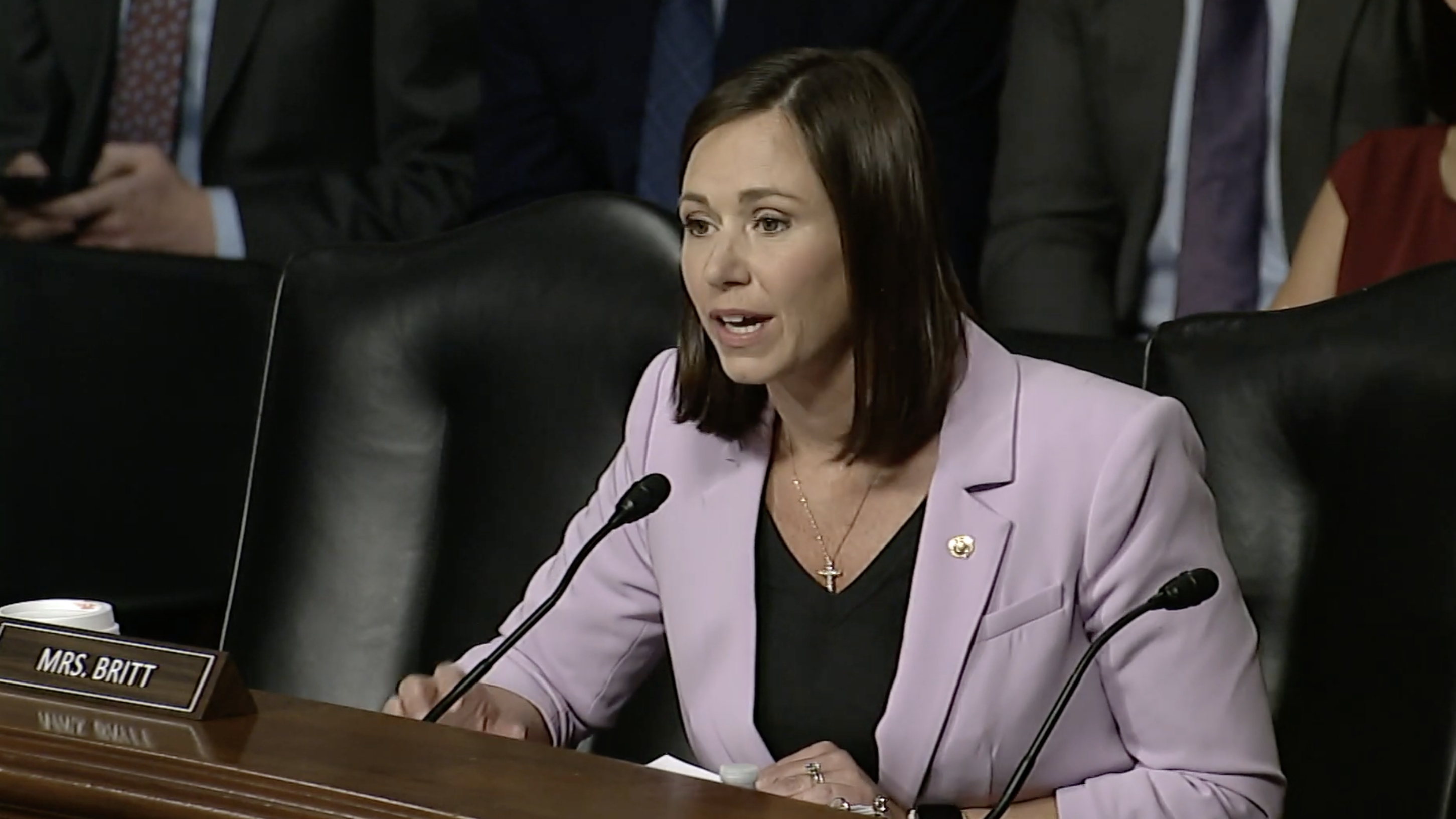

U.S. Senator Katie Britt, R-Ala., during Wednesday’s hearing of the Senate Committee on Banking, Housing, and Urban Affairs highlighted how federal regulators failed to properly conduct oversight of Silicon Valley Bank (SVB) and Signature Bank before these financial institutions collapsed in March.

Postmortem reviews of SVB and Signature Bank found that both mismanagement and regulators failing to properly supervise these institutions significantly contributed to the collapses. In particular, SVB’s executives were taking home millions in performance-based bonuses while engaging in speculative transactions and operating without a Chief Risk Officer for the last eight months of 2022. The reports also found that SVB had 31 open supervisory findings from the Federal Reserve at the time of its failure in March 2023, including a number of Matters Requiring Immediate Attention (MRIAs).

Despite assertions from Democrats that these bank failures were the result of insufficient statutory authorities, Michael Barr, the Federal Reserve’s Vice Chair for Supervision, noted in his response to Senator Britt’s questioning that his regulators did not act swiftly enough to utilize their existing tools to hold SVB accountable. Senator Britt emphasized that they failed to effectively escalate supervisory findings, take enforcement actions, or levy fines despite a clear and troubling pattern of mismanagement by SVB executives.

Earlier this week, Senator Britt joined her colleagues on the Banking Committee in demanding answers from the former SVB CEO about his bank’s management failures and the $1.5 million performance-based bonus he received despite the risky business practices at his institution that contributed to its collapse.

Transcript:

BRITT: “You mentioned earlier that the day that SVB failed, there were 31 supervisory findings that were outstanding. Is that correct?”

BARR: “Yes.”

BRITT: “And so of those, my question is why your people didn’t do more. It is my understanding that they could have downgraded the supervisory ratings, which obviously would have resulted in more frequent supervision and exams, or they could have taken enforcement actions like prohibiting dividends to shareholders, requiring immediate capital increases, fines, other things like that, but they did neither. Is that correct?

BARR: “The supervisors had downgraded the firm in the summer in regards to broad-based problems in governance and control of risk management functions to ‘Deficient 1,’ which means the firm is not well managed, and because of that, the firm was subject to a 4M limitation, which meant it could no longer merge with or acquire non-banking entities. The staff was also in the process of developing a detailed Memorandum of Understanding, which is the first level enforcement action after a deficient downgrade occurs. So, the steps were in train, but what the report found was that our supervisors were not moving fast enough with respect to those actions.”

BRITT: “So they had the tools in their toolbox, but they weren’t using them with the force that they could have?”

BARR: “Yes, I think it’s fair to say that the tools were there.”

BRITT: “The tools were there, they just didn’t use them with force. I’m hoping that moving forward, I don’t think we need new tools, but to your earlier point about creating a culture where those tools are used. You can do that internally, that’s a leadership issue, that’s not something where we need more rules and regulations to do that.”