The Alabama Legislature met for Day 5, 6 and 7 of its 2023 Regular Session this past week. 29 committee meetings were held throughout the week.

DURING THE WEEK

Governor Ivey and Legislative Leaders announced “The Game Plan” for a four bill package to enhance economic growth in Alabama. The plan consists of bills to expand the Alabama Jobs Act and the Growing Alabama Act (HB241/SB164), provide incentives for site development (HB257/SB165), authorize tax credits to encourage the development of small tech and innovative industries (HB247/SB152), and require the publishing of certain information regarding economic development incentives (HB240/SB151).

Last Tuesday, Angel Tilvar, the Defense Minister of Romania, addressed the House and the Senate thanking western partners and businesses for their solidarity again Russia’s “unprovoked attack against a sovereign and independent nation.”

The House passed 16 Sunset bills to continue certain state agencies and boards including the Alabama Board of Massage Therapy, the Alabama Historical Commission, the Alabama Real Estate Commission, and the Alabama Professional Bail Bonding Board.

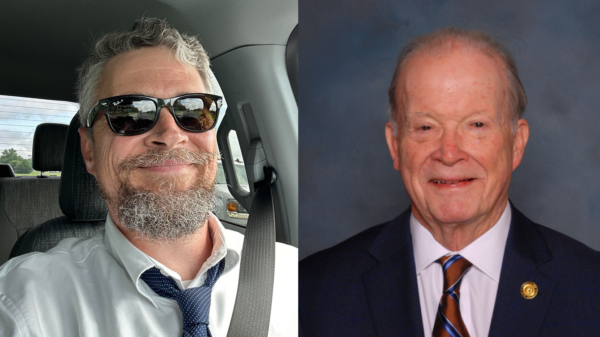

The Senate confirmed several board appointments and reappointments including Alvin K. Hope to the Alabama Trust Fund Board, Horace H. Horn and Elizabeth Stevens to the Board of Trustees of the Alabama Department of Archives and History, Senator Arthur Orr and former House Speaker Mac McCutcheon to the Athens State University Board of Trustees, and Anitra Henderson to the State Course of Sudy Committee: Science.

A bill was introduced in both Houses (HB250/SB177) by the respective chairs of the education finance committees to define “food” and begin phasing out the state sales and use tax.

NOTABLE FLOOR PASSAGE THIS WEEK

HOUSE

HB3 by Rep. Hollis: To prohibit smoking or vaping in a motor vehicle when a child under 14 years of age is present.

HB115 by Rep. Garrett: To phase-in a reduction in the top individual income tax rate from 5 percent to 4.95 percent (as amended).

HB116 by Rep. Garrett: To eliminate the 2 percent tax rate on the first $500 of taxable income (as amended).

SB113 by Sen. Gudger: To provide that residents, clients or patients of a health care facility have the right to visit with any individual of their choosing during the facility’s visiting hours.

SENATE

SB9 by Sen. Chambliss: To require any approved electronic vote counting system used in an election to require the use of paper ballots.

SB10 by Sen. Chambliss: To prohibit the use of electronic vote counting systems that are capable of connection to the internet or cell phone networks or that possess modem technology.

SB33 by Sen. Livingston: To provide that a municipality may not set speed limits on county-maintained streets within its corporate limits (as amended).

SB40 by Sen. Elliott: To provide that a municipal or county governing body, or any agency thereof, may not directly or indirectly adopt or enforce any ordinance, rule, bylaw, order, or local building code provision that would require, in the construction of a residential structure, certain latent features including wiring, plumbing, gas tubing, or framing, which features would not be operational at the time of completion (as amended).

SB58 by Sen. Smitherman: To prohibit certain motor vehicle speed contests, motor vehicle exhibitions of speed, and motor vehicle sideshows and to provide criminal penalties for a violation (as amended).

SB66 by Sen. Melson: To prohibit the sale, distribution, marketing, or possession of psychoactive cannabinoids found in hemp for certain age groups, and to levy a 5 percent tax on the gross proceeds of products containing psychoactive cannabinoids sold at retail (as amended).

SB68 by Sen. Gudger: To reopen the State Police Tier II Plan to any employee of the Alabama State Law Enforcement Agency (ALEA) who is certified by the Alabama Peace Officers’ Standards and Training Committee and performs law enforcement duties.

SB96 by Sen. Melson: To amend the Alabama Medical Liability Act of 1996 to provide that the term “health care provider” would include emergency medical services personnel and any emergency medical provider service.

SB108 by Sen. Coleman-Madison: To increase the threshold dollar amount for which competitive bidding is generally required for certain state and local public awarding authorities.

SB131 by Sen. Figures: To rename the Alabama Board of Funeral Service and the Alabama Board of Funeral Services, and to transfer the Preneed Funeral and Cemetery Act, and the regulation of preneed contracts from the Department of Insurance to the Alabama Board of Funeral Services (as amended).

SB142 by Sen. Figures: To alter, rearrange, and extend the boundary lines and corporate limits of the municipality of Spanish Fort in Baldwin County.

SB147 by Sen. Sessions: To provide that no municipal governing body may adopt or continue in effect any ordinance, rule, resolution, or directive that prohibits the permitting of livestock or animals to run at large upon the premises of another or public lands but does not require the same mental state as state law.

SB117 by Sen. Waggoner: To authorize a licensed manufacturer or importer of alcoholic beverages to donate a limited amount of alcoholic beverages to a licensed nonprofit special event.

NOTABLE INTRODUCTIONS THIS WEEK

HOUSE

HB227 by Rep. Cole: To further provide for the conditions that are considered qualifying medical conditions for the use of medical cannabis, and to require that a registered certifying physician may only certify a patient for medical cannabis use if he or she is board certified in the field of specialty required to diagnose a qualifying medical condition.

HB234 by Rep. R. Wood: To prohibit the possession and use of a trigger activator and provide criminal penalties for a violation, and to further provide for the duties of a law enforcement officer during an investigatory stop involving a firearm.

HB240 by Rep. Almond: To require the Department of Commerce to publish certain information regarding economic development incentives awarded under the Alabama Jobs Act.

HB241 by Rep. Garrett: To extend the Alabama Jobs Act and the Growing Alabama Act sunset dates to July 31, 2028, to increase the annual cap on outstanding Alabama Jobs Act incentives by $25 million each year for five years up to $475 million, to increase the annual cap on funding approved pursuant to the Growing Alabama Act to $35 million, and to remove certain programs from the Growing Alabama Act for transfer to Innovate Alabama.

HB247 by Rep. Daniels: To change the name of the Alabama Innovation Corporation to Innovate Alabama, to reestablish the technology accelerator tax credit program and the under-represented company tax credit program a the Innovating Alabama tax credit program, and to exempt working groups, task forces, and subcommittees of the Alabama Innovation Corporation from the Alabama Open Meetings Act.

HB249 by Rep. Faulkner: To establish certain conditions under which a contractor who performs work on a road, bridge, highway, or street shall be granted civil immunity.

HB250 by Rep. Garrett: To define “food” and begin phasing-out the state sales and use tax on food on September 1, 2023, to require certain growth targets in the Education Trust Fund for future sales tax reductions on food, to establish the sales and use tax rate on food for purposes of county and municipality sales and use taxes, and to authorize a county or municipality to reduce the sales and use tax rate or exempt food from local sales and use taxes.

HB253 by Rep. Clarke: To increase the amount of Historic Rehabilitation Tax Credits that may be provided in a tax year, to allow rehabilitation credits to be tied to the year in which the reservation is allocated, and to provide for additional rehabilitation credit allocations.

HB254 by Rep. Clouse: To require the proceeds from motor fuel taxes levied by a municipality or county be used for road and bridge construction and maintenance with certain exceptions.

HB255 by Rep. Clouse: A proposed Constitutional Amendment to require local Constitutional Amendments to be advertised prior to introduction.

HB257 by Rep. Garrett: To authorize the State Industrial Development Authority to make site assessment grants and site development grants to certain companies, to provide for the criteria that must be met for grant approval, to limit the funding that may be received by any site under the grant program, and to provide for an annual appropriation to the State Industrial Development Authority.

HB259 by Rep. Wilcox: To limit an industrial or research enterprise tax abatement recipient to using the same method used by the county for calculating the fair market value of its property when appealing the county’s ad valorem tax assessment, and to prohibit the consideration of obsolescence in determining the fair market value of an industrial or research enterprise’s property, for the duration of any period that the enterprise receives a tax abatement.

HB261 by Rep DuBose: To prohibit a biological male or female from participating on an athletic team or sport designated for the opposite gender at a public institution of higher learning.

HB270 by Rep. Stringer: To restrict the location or expansion of junkyards under certain circumstances.

SENATE

SB151 by Sen. Gudger: To require the Department of Commerce to publish certain information regarding economic development incentives awarded under the Alabama Jobs Act.

SB152 by Sen. Singleton: To change the name of the Alabama Innovation Corporation to Innovate Alabama, to reestablish the technology accelerator tax credit program and the under-represented company tax credit program a the Innovating Alabama tax credit program, and to exempt working groups, task forces, and subcommittees of the Alabama Innovation Corporation from the Alabama Open Meetings Act.

SB156 by Sen. Elliott: To establish the Occupational Licensing Boards Division within the office of the Secretary of State for the oversight and regulation of certain occupational licensing boards.

SB159 by Sen. Scofield: To establish certain conditions under which a contractor who performs work on a road, bridge, highway, or street shall be granted civil immunity.

SB163 by Sen. Williams: To authorize any county, municipality, or governmental entity subject to a countywide civil service system established by a local law to elect by a majority vote of the governing body of the county, municipality, or governmental entity to be exempt from the countywide civil service system for the recruitment and hiring of all employees.

SB164 by Sen. Reed: To extend the Alabama Jobs Act and the Growing Alabama Act sunset dates to July 31, 2028, to increase the annual cap on outstanding Alabama Jobs Act incentives by $25 million each year for five years up to $475 million, to increase the annual cap on funding approved pursuant to the Growing Alabama Act to $35 million, and to remove certain programs from the Growing Alabama Act for transfer to Innovate Alabama.

SB165 by Sen. Orr: To authorize the State Industrial Development Authority to make site assessment grants and site development grants to certain companies, to provide for the criteria that must be met for grant approval, to limit the funding that may be received by any site under the grant program, and to provide for an annual appropriation to the State Industrial Development Authority.

SB173 by Sen. Givhan: To create the Alabama Local Government Investment Pool Program within the office of the State Treasurer to provide one or more investment pools in which state and local public entities may deposit monies for investment in the program to be administered by the treasurer.

SB175 by Sen. Orr: To establish the ReEngage Alabama Grant Program to provide grant award payments to assist eligible adult learners returning to college to complete a degree that is linked to Alabama’s high demand workforce needs.

SB177 by Sen. Orr: To define “food” and begin phasing-out the state sales and use tax on food on September 1, 2023, to require certain growth targets in the Education Trust Fund for future sales tax reductions on food, to establish the sales and use tax rate on food for purposes of county and municipality sales and use taxes, and to authorize a county or municipality to reduce the sales and use tax rate or exempt food from local sales and use taxes.

SB180 by Sen. Smitherman: To require social studies and history instruction in public K-12 school to be fact-based, historically accurate, and inclusive.

SB182 by Gudger: To revise the amount of alcoholic beverages that may be sold using curbside pick-up or takeout services in a 24-hour period to match the amounts that may be sold by a delivery service licensee.

NOTABLE COMMITTEE ACTION THIS WEEK

HOUSE

HB20 by Rep. Brown: To provide for permits for living shoreline restoration from the State Lands Division of the Department of Conservation and Natural Resources and the Department of Environmental Management and for the use of source sediment by riparian property owners (Substituted in House State Government Committee).

HB64 by Rep. Bolton: To provide that no alien who is in the U.S. unlawfully or through a non immigrant visa provided by the federal government may own, possess, or have under his or her control a pistol or other firearms (House Judiciary Committee).

HB86 by Rep. D. Wood: To prohibit a municipality from setting speed limits on county-maintained streets within its corporate limits (House Transportation, Utilities and Infrastructure Committee).

HB153 by Rep. Treadaway: To make it a crime to place an electronic tracking devise on the property of another person without the consent of the owner (Amended and Substituted in House Judiciary Committee).

HB164 by Rep. Whitt: To require public high school students to successfully complete a personal financial literacy and money management course before graduation (House Education Policy Committee).

SENATE

SB71 by Sen. Williams: To provide counties with alternative virtual or electronic methods for the posting of certain public notices required by law (Amended in Senate Banking and Insurance Committee).

SB89 by Sen. Sessions: To provide for an optional 8 year renewal period of driver licenses (Senate Transportation and Energy Committee).

BUDGETS

SPONSOR SUBJECT STATUS NO.

HB124 Rep. Reynolds: General Fund Budget Pending in House Ways and Means General Fund Committee

HB169 Rep. Garrett: Education Budget Pending in House Ways and Means Education Committee

SB82 Sen. Albritton: General Fund Budget Pending in Senate Finance and Taxation General Fund Committee

SB88 Sen. Orr: Education Budget Pending in Senate Finance and Taxation Education Committee