|

Getting your Trinity Audio player ready...

|

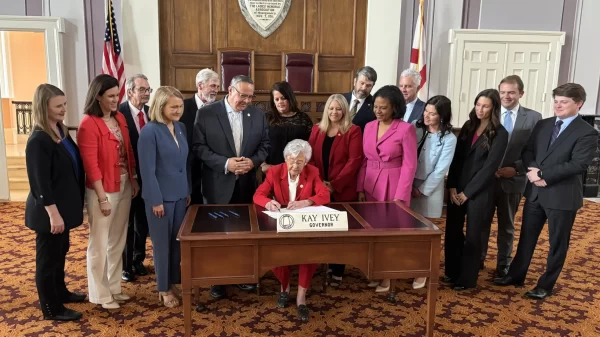

Senator Katie Britt, R-Ala., joined Senator John Thune, R-S.D., and 40 of their Senate colleagues in reintroducing legislation to permanently repeal the federal estate tax, more aptly known as the “Death Tax.” The Death Tax Repeal Act would end this purely punitive tax that has the potential to kill family farms, ranches, and businesses as the result of the owner’s death.

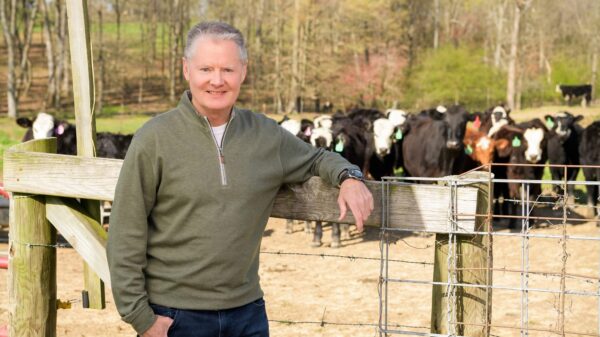

“Alabama’s incredible farmers and cattlemen work tirelessly throughout their lives to feed and clothe our state, nation, and world, while responsibly stewarding their land for future generations,” said Senator Britt. “The Death Tax effectively forces the next generation of farm families to decide between bankruptcy or selling their farm to a corporation or a foreign entity. No American farm family, already suffering from the loss of their loved one, should be faced with this devastating choice. This is not only a matter of what is just, but also one that affects our food security. Repealing the Death Tax safeguards Alabama’s over 44,000 farms, 97 percent of which are family-owned. I will continue to fight to protect the ability of Alabama farmers, cattlemen, and small business owners to live the American Dream and pass on their family’s legacy and livelihood to their children.”

The “Death Tax” is a form of double taxation, which is inherently unfair. Adding insult to injury, the “Death Tax” is more burdensome on people with smaller estates – meaning it predominantly harms working-class landowners, such as mom-and-pop businesses and family farmers and cattlemen. Finally, studies have shown that repealing the “Death Tax” would spur economic growth, create jobs, and increase wages.