|

Getting your Trinity Audio player ready...

|

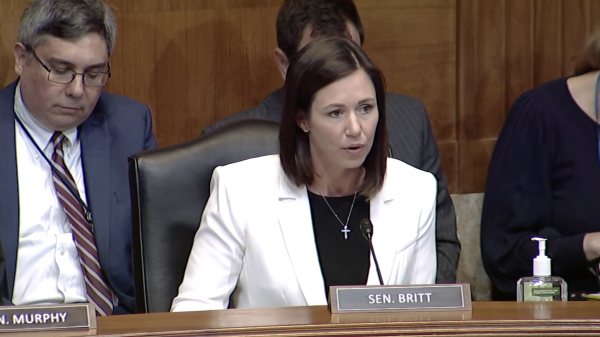

U.S. Senator Katie Britt, R-Alabama, joined Senators Kyrsten Sinema, I-Arizona, Thom Tillis, R-North Carolina, and a bipartisan group of senators questioning the Federal Reserve about clear warning signs — including bank leadership’s clear failure to appropriately manage customer deposits — it missed as part of its responsibilities to conduct oversight and examinations ahead of Silicon Valley Bank’s collapse.

The Federal Reserve has already announced an internal investigation into its regulatory oversight, supervision, and examination of Silicon Valley Bank. The Senators urged that as part of this investigation, the Fed should place particular focus on the role of concentration risk in the bank examination process and review the financial arrangements between Silicon Valley Bank and its customers to determine their impact on the bank’s collapse.

“It is gravely concerning that retail participants, utilizing only publicly available information, were able to identify clear and compelling examples of financial mismanagement and asset over-concentration at SVB, while the Fed, which can draw even deeper from non-public supervisory information, was unable to ascertain a similar conclusion. The fact that the San Francisco Fed, among other regulatory agencies, found no reason to take appropriate regulatory action or even investigate SVB further in the months, weeks, and days prior to the bank’s collapse must be addressed in a manner that restores public confidence in Fed supervision,” wrote the Senators.

Joining Britt, Sinema, and Tillis in cosigning the letter were Senators John Hickenlooper, D-Colo., Kevin Cramer, R-N.D., Chris Murphy, D-Conn., Mike Rounds, R-S.D., Cynthia Lummis, R-Wyo., Bill Hagerty, R-Tenn., Catherine Cortez Masto, D-Nev., J.D. Vance, R-Ohio, and Michael Bennet, D-Colo.

News reports show that Silicon Valley Bank had a uniquely concentrated customer base of venture capital funds, venture investors, and start-ups, many of whom have or have had financial relationships or business partnerships with one another. That customer base includes a significant level of financial interdependency that potentially increased risk.

The full text of the letter can be found here.

Senator Britt is a member of the Financial Institutions and Consumer Protection Subcommittee of the Senate Committee on Banking, Housing, and Urban Affairs. She released a statement on the Silicon Valley Bank and Signature Bank failures last week, and she discussed the situation during a hearing of the Senate Committee on Banking, Housing, and Urban Affairs on Thursday.

“SVB is a clear case of regulators refusing to do their job despite the fact that all of the red flags were there,” said Senator Katie Britt. “The Fed failed to use the tools in their toolbox to prevent what we saw in recent weeks, and I want to know why. Alabamians don’t just want answers, they deserve answers. And I, for one, will not stop until we get them.”