The Alabama Legislature began its annual Regular Session on Tuesday, March 7. As the annual Session is limited by law to 30 session days within a 105 calendar day period, the Session must conclude by June 19, 2023. Generally, the Legislature meets in Session on Tuesdays and Thursdays with Committee Meetings held chiefly on Wednesdays.

The action on the first day of the Regular Session centered on the introduction of 174 bills.

Governor Ivey delivered her annual State of the State address to the Legislature and the public on Tuesday evening. She laid out her plans for the Regular Session and indicated her focus would be on education, including supporting start-up funds for Charter Schools, a 2 percent pay raise for teachers, and a goal of reaching the highest paid teachers in the southeast by the end of her term. She also focused on the hiring of correction workers in the prison system, upgrade of mental health facilities and outreach, and supporting a one-time $400 rebate to taxpayers.

SPECIAL SESSION

The Governor issued a proclamation calling for a Special Session to begin the next day, Wednesday, March 8 to appropriate the remaining American Rescue Plan Act (ARPA) monies. Her proposal of spending of ARPA monies are in broad categories similar to the $1.1 billion appropriation bill which was passed last year expending the first round of the ARPA monies. The major categories are once again healthcare, water and sewer, broadband infrastructure, and community projects addressing negative economic impacts of COVID-19.

The Legislature convened the 1st Special Session of 2023 on Wednesday, March 8 to appropriate the remaining $1,060,181,797.72 in federal funds from the American Rescue Plan Act (ARPA). The Regular Session is now suspended while the Legislature is in this Special Session.

Although there were several other bills introduced in the Special Session, the ARPA appropriation bill is HB1 by Representative Rex Reynolds. The bill proposes appropriations as follows:

Up to $339,175,000 to be used to support the delivery of health care and related services to citizens related to the coronavirus pandemic, of which:

Up to $200,000,000 to be used to reimburse hospitals and nursing homes for eligible expenses;

Up to $5,000,000 to be used to reimburse veterans’ hospitals for eligible expenses;

Up to $40,000,000 to be used to reimburse the State Employees’ Insurance Board for eligible expenses;

Up to $25,000,000 to be used to support mental health programs and services;

Up to $9,000,000 to be used to facilitate the expansion and use of telemedicine with eligible uses to include the facilitation and expansion of healthcare specializations in rural and community hospitals through telemedicine affiliation with hospitals or health systems in the state and the utilization of telemedicine delivery systems in rural and educational settings;

Up to $20,000,000 to be used to assist with a voluntary clinical trial and health care research program to enable greater access to personalized medicine;

Up to $175,000 to be used to reimburse expenses related to coronavirus vaccine voucher programs for public university students.

Up to $660,000,000 to be used for eligible water, sewer, and broadband infrastructure investments, of which:

Up to $260,000,000 shall be used to support the improvement and expansion of broadband network access to the citizens, and for the modernization of cybersecurity and new broadband infrastructure for existing and new state agencies and entities;

Up to $400,000,000 to be used to improve access to clean water through investments in water and sewer infrastructure projects:

Up to $395,000,000 may be delegated through memorandum of agreement to the Alabama Department of Environmental Management to implement the following programs;

Up to $195,000,000 to be provided as grants to water and sewer systems for high-need projects eligible for the Environmental Protection Agency’s Clean Water State Revolving Fund or the Drinking Water State Revolving Fund;

Up to $200,000,000 to be provided as matching grants to public water and sewer systems for infrastructure projects;

Up to $5,000,000 may be delegated through a memorandum of agreement with the Department of Public Health to provide grants for wastewater improvements through the engineered septic system program in the Alabama Black Belt areas of low population density, rural property, and/or soils with poor perc characteristics;

Up to $55,000,000 to be used for eligible programs or services in response to the negative economic impacts of the public health emergency. The programs and services eligible for funding in this category include:

Food assistance through food banks;

Programs that provide services to child-welfare involved families;

Programs that provide services to victims of domestic violence;

Programs that provide services for senior citizens;

Programs that provide services for mental health disorders and behavioral analysis;

Programs that support long-term housing security;

Programs that provide summer learning opportunities or athletic programs or services to school-aged children.

Up to $5,000,000 to be used for response and mitigation expenses related to the coronavirus pandemic, which shall be used to reimburse the Alabama Department of Labor for the expense of conducting hearings related to the receipt and use of coronavirus unemployment benefits;

Up to $1,0060797.72 to be used to reimburse costs for the administration, auditing, and reporting requirements of the state fiscal recovery funds.

Other bills being considered in the Special Session are:

HB2 by Rep. Reynolds and SB1 by Sen. Albritton which would make a supplemental appropriation from the State General Fund to the Alabama Trust Fund in the amount of $59,997,172;

HB3 by Rep. Wood and SB2 by Sen. Gudger which would require health care facilities to adopt certain visitation policies.

NOTABLE INTRODUCTIONS IN THE REGULAR SESSION

HOUSE

HB1 by Rep. Simpson: To provide for mandatory terms of imprisonment for a person who engages in the unlawful sale, manufacture, delivery, or possession of one or more grams of Fentanyl.

HB4 by Rep. Chestnut: To make it unlawful for employers and certain other individuals from requiring another individual to be implanted with a microchip.

HB7 by Rep. Oliver: To prohibit certain public entities, including state agencies, local boards of education, and public institutions of higher education, from promoting or endorsing, or requiring affirmation of, certain divisive concepts relating to race, sex, or religion.

HB9 by Rep. Bedsole: To reduce the amount of correctional incentive time a prisoner receives and to provide for additional circumstances in which a prisoner may be required to forfeit his or her correctional incentive time.

HB12 by Rep. England: To provide that failure by a person to inform a law enforcement officer that her or she is in possession of a concealed pistol or firearm upon request is a Class A misdemeanor.

HB14 by Rep. England: To require a unanimous vote of a jury to impose a death sentence in a capital murder case.

HB15 by Rep. England: To authorize the governing body of a municipality to reduce or eliminate the local sales and use tax rate on food.

HB20 by Rep. Brown: To provide for permits for living shoreline restoration from the State Lands Division of the Department of Conservation and Natural Resources and the Department of Environmental Management and for the use of source sediment by riparian property owners.

HB22 by Rep. Brown: To authorize any municipality or governmental entity subject to a countywide civil service system to elect by a majority vote of the governing body to opt out of the countywide civil service system.

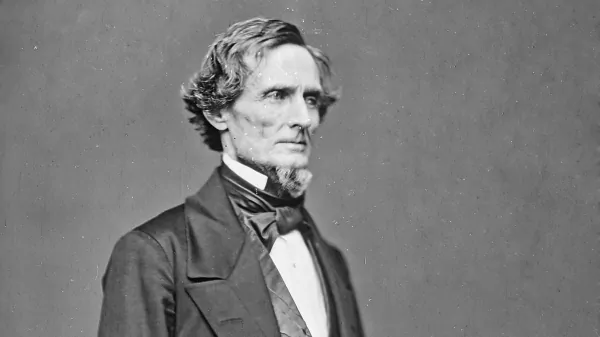

HB27 by Rep. England: To remove Jefferson Davis’ birthday and add State Employee Appreciation Day as a state holiday.

HB28 by Rep. England: To further provide for the unlawful possession of a firearm on the premises of a public school by removing the exemption for persons with lawful pistol permits.

HB34 by Rep. Estes: To provide that it is unlawful to discharge a firearm on school property.

HB35 by Rep. Estes: To require a local board of education to provide certain school resources to students to facilitate student-led prayer.

HB36 by Rep. Collins: To define “advanced recycling” as a manufacturing process to convert post-use materials into recycled products and to specify that advanced recycling would not be considered solid waste disposal or incineration under the solid waste act.

HB50 by Rep. Estes: To expand the definition of a dependent to include a taxpayer, or spouse of a taxpayer, in their third trimester of pregnancy during the tax year.

HB51 by Rep. Ellis: To increase the threshold dollar amount for which competitive bidding is generally required for certain state and local public awarding authorities, with exceptions.

HB52 by Rep. Drummond: To require that at least one residential transition center established by the Board or Pardons and Paroles be a women’s facility.

HB53 by Rep. Mooney: To require any approved electronic vote counting system used in an election to require the use of paper ballots.

HB54 by Rep. Mooney: To prohibit the use of electronic vote counting systems that are capable of connection to the internet or cell phone networks or that possess modem technology.

HB65 by Rep. Collins: To increase the minimum amount for contracts of city and county boards of education subject to competitive bid from $15,000 to $25,000.

HB83 by Rep. Pringle: To establish the State Transportation Commission composed of five members appointed by the Governor from the five regions of the Department of Transportation and provide for the appointment of the Director of the Department of Transportation by the commission.

HB84 by Rep. Pringle: To extended the qualifying deadline for municipal elections in a Class 2 municipality (Mobile).

HB88 by Rep. Sells: To authorize a licensed manufacturer or importer of alcoholic beverages to donate a limited amount of alcoholic beverages to a licensed nonprofit special event.

HB94 by Rep. Jackson: To require each county to provide at least one early voting center to be open during the week immediately preceding election day to allow registered voters to vote prior to election day.

HB95 by Rep. Jackson: To authorize absentee voting without an excuse.

HB100 by Rep. Clarke: To allow a disabled voter to designate an individual to deliver the voter’s application for an absentee ballot to the absentee election manager and to allow a disabled voter to designate an individual to deliver the voter’s absentee ballot to the absentee election manager.

HB106 by Rep. Almond: To provide that a county, municipality, or political subdivision of a county or municipality may satisfy a notice requirement by publishing the notice on a website maintained by the state, county or municipal governing body.

SENATE

SB1 by Sen. Weaver: To reduce the amount of correctional incentive time a prisoner receives and to provide for additional circumstances in which a prisoner may be required to forfeit his or her correctional incentive time.

SB6 by Sen. Coleman-Madison: To provide for the creation of multi-jurisdictional local land bank authorities.

SB9 by Sen. Chambliss: To require any approved electronic vote counting system used in an election to require the use of paper ballots.

SB10 by Sen. Chambliss: To prohibit the use of electronic vote counting systems that are capable of connection to the internet or cell phone networks or that possess modem technology.

SB17 by Sen. Butler: To include the United State Space Force in all collective references to the United States Armed Forces.

SB24 by Sen. Albritton: To provide regulations for indemnification agreements in certain construction contracts.

SB26 by Sen. Coleman: To repeal the existing law authorizing a citizen’s arrest.

SB36 by Sen. Elliott: To increase the minimum amount for contracts of city and county boards of education subject to competitive bid from $15,000 to $25,000.

SB47 by Sen. Orr: To eliminate the 2 percent tax rate on the first $500 of taxable income for single persons, heads of households, and married persons filing separate returns and to eliminate the 2 percent tax rate on the first $1,000 of taxable income for married persons filing jointly.

At the conclusion of the Special Session, the House and Senate will reconvene for continuation of the Regular Session. They have currently adopted Tuesday, March 21 as the day when the Legislature will reconvene in Regular Session.