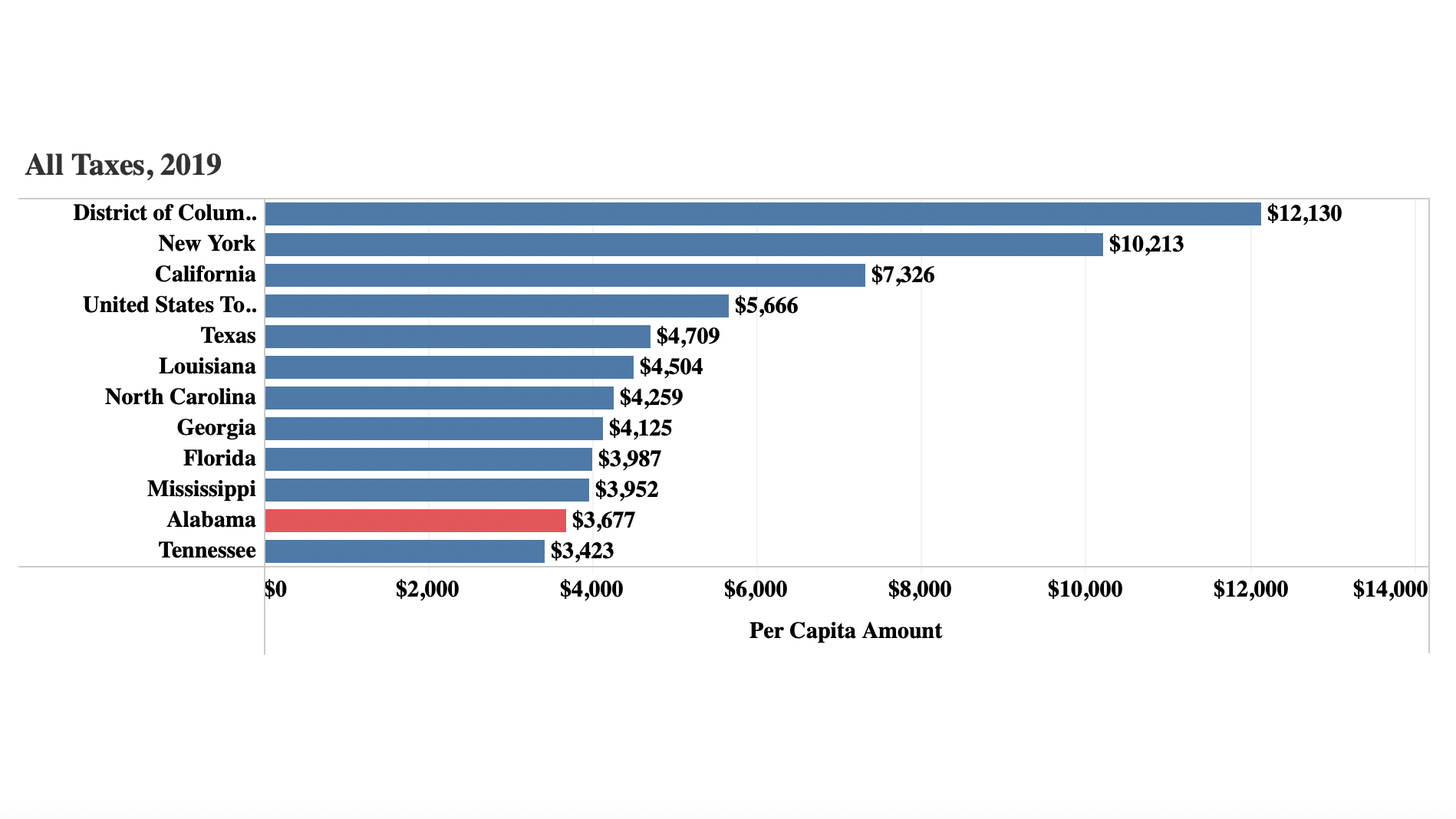

Alabama had the nation’s second-lowest tax collections per capita in 2019, according to a new report from the Public Affairs Research Council of Alabama. Only Tennessee had lower state and local tax revenue per resident than Alabama.

Some of the key findings in the analysis show that

- Alabama has the lowest per capita property tax collections in the nation.

- Alabama has among the highest sales tax rates in the U.S.

- Alabama’s income tax is essentially flat, with tahe top rate of 5% applied to an individual’s taxable income over $3,000.

The analysis shows that in 2019, Alabama brought in $3,677 per resident. In neighboring states, Mississippi collected $3,952, Florida $3,987, and Georgia $4,125.

The highest tax collection per capita in the country is the District of Columbia by far, with $12,130 per resident. The next highest is New York with $10,213.

The higher tax collections add up for other states’ revenues.

For instance, Louisiana has a $827 per capita advantage over Alabama according to the analysis, leading to $4.1 billion in extra revenue for the state. Georgia has a $2.2 billion revenue advantage over Alabama and Florida a $1.5 billion more.

This means governments in Alabama have less money than governments in other states to provide a competitive level of service.

State and local tax collections are based on two fundamental factors: tax rates and the value of the tax base to which the rate is applied. Alabama combines low tax rates with a less valuable base of economic activity, yielding less in taxes per capita and less revenue for state and local government to provide services.

Property tax

Alabama has the lowest per capita property tax collections in the nation.

Low property taxes benefit homeowners and owners of agricultural and timberland but present a challenge to local governments and schools needing to pay for adequate services. Across the country, property taxes provide a greater share of revenue and tend to provide a more stable source of revenue.

Income tax

Alabama requires families in poverty to pay income taxes. No other state sets a lower threshold for paying income taxes than Alabama. That threshold hasn’t been adjusted since 2006.

In most states, the income tax is used to provide some balance for the regressive effects of other taxes, providing credits to low-income households to offset sales taxes, for instance. Not in Alabama.

On the other hand, Alabama will soon be the only state that allows taxpayers to completely deduct federal income taxes when calculating state taxes, a tax break that disproportionately benefits upper-income earners.4

Federal deductibility also means that when federal taxes go up, state taxes go down and vice versa. When federal tax deductions and credits are raised, the state automatically takes back some of the benefit the federal tax change is intended to provide.

Taxes as a Percentage of Personal Income

Comparing total personal income to the total of state and local taxes collected, Alabama ranks No. 45 in the country, with state and local tax collections amounting to 8.3% of state residents’ total personal income. Only five states—New Hampshire, Alaska, South Dakota, Florida, and Tennessee—collect less in taxes as a percentage of personal income.

Each of those states has a higher personal income per capita than Alabama, so despite collecting less as a percentage of total personal income, all those states, except Tennessee, raise more revenue per capita than Alabama. They can produce high tax revenues with less tax effort.

Mississippi’s total personal income is lower than Alabama’s, but its state and local government tax collections equaled 10% of Mississippi’s total personal income for 2019. Because of that greater tax effort, Mississippi state and local governments have more to spend on a per capita basis than those in Alabama.