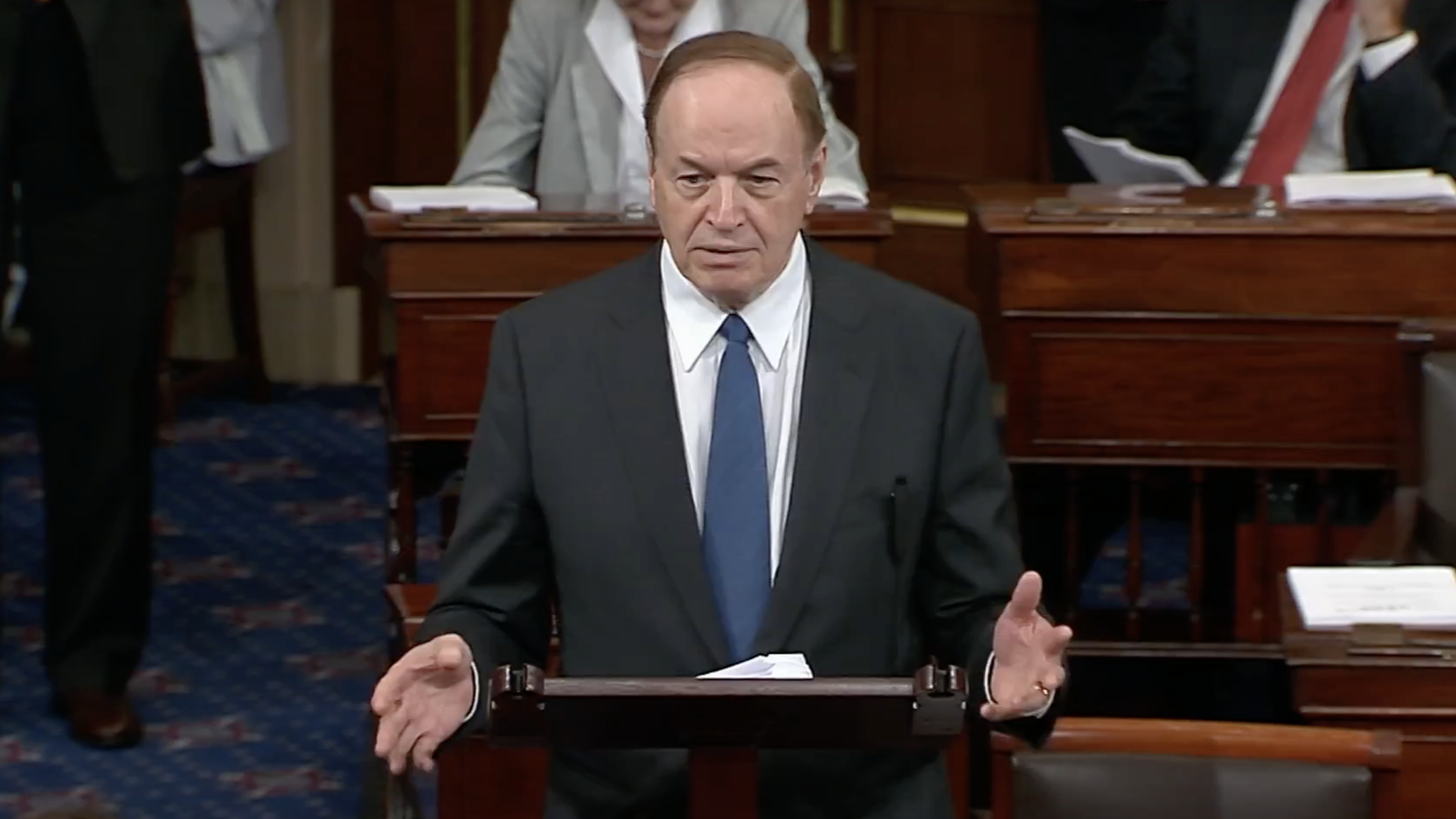

Alabama Sen. Richard Shelby on Monday re-introduced legislation known as the “Simplified, Manageable, and Responsible Tax (SMART) Act,” which would establish a flat tax on all income. Shelby has advocated for the flat tax since he was first elected to the Senate in 1986. He has introduced legislation to support it during each Congress since the 100th Congress.

“Our nation’s current tax code is complex, unclear, and costly to hardworking Americans. Every year on Tax Day, we are reminded of this unfortunate reality,” said Shelby. “If my legislation, the SMART Act, was in place instead of current law, taxpayers would file a simple, self-explanatory return that’s the size of a postcard. Should Congress pass my bill, every American would be taxed equally and at the same rate.

“The recent success of the Tax Cuts and Jobs Act have helped improve our tax code, but I believe the SMART Act would go a step further, resulting in an immediate tax cut for nearly all taxpayers and reducing the size, scope, and complexity of the IRS – rather than broadening and expanding it as our sitting President would prefer. I urge my colleagues to consider and support this legislation for the good of our nation,” Shelby said.

The SMART Act establishes a flat income tax of 17 percent on all income. The only exception would be personal exemptions of:

- $14,590 for a single person;

- $18,630 for a head of a household;

- $29,190 for a married couple filing jointly; and

- $6,290 for each dependent.

These allowances would also be adjusted to the consumer price index in order to prevent inflation from raising our tax burden. To prevent the double-taxation of income, earnings from savings would not be included as taxable income, resulting in an immediate tax cut for virtually all hardworking taxpayers.

By closing loopholes for individuals and businesses, the SMART Act would create broad-based, lower tax rates that would give American individuals and businesses a competitive edge, create and retain jobs in the United States, and curb offshoring.