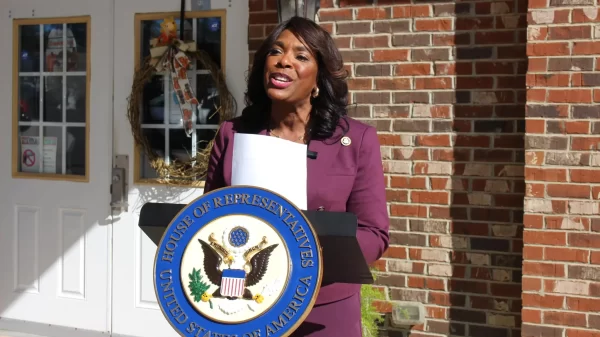

Congresswoman Terri Sewell, D-Alabama, this week voted in favor of the latest coronavirus relief and stimulus legislation and government funding package, which is aimed at providing hospitals, workers and families relief from the pandemic and will, if signed, ensure the government is funded through this fiscal year.

“It’s been more than eight months since Republicans have met Democrats at the negotiating table to provide our families, small businesses, frontline health care workers, and schools with the resources they need to weather the COVID-19 pandemic,” Sewell said. “While this bipartisan agreement is a compromise on many issues, this emergency funding cannot come soon enough to those struggling in Alabama and across the country from the devastating fallout of this virus. This bill is far from perfect, but Alabamians cannot wait any longer for relief. Once President-Elect Joe Biden is sworn in, Congress must consider a further relief package that includes more support for families, as well as essential resources for state and local governments struggling to support frontline employees, including our firefighters and police, and provide vital community resources.”

[visual-link-preview encoded=”eyJ0eXBlIjoiaW50ZXJuYWwiLCJwb3N0IjoxMDQ4ODAsInBvc3RfbGFiZWwiOiJQb3N0IDEwNDg4MCAtIFdoYXQncyBpbiB0aGUgJDkwMCBiaWxsaW9uIENPVklEIGFpZCBwYWNrYWdlPyIsInVybCI6IiIsImltYWdlX2lkIjo3NTY5MiwiaW1hZ2VfdXJsIjoiaHR0cHM6Ly93d3cuYWxyZXBvcnRlci5jb20vd3AtY29udGVudC91cGxvYWRzLzIwMTkvMTAvQWRvYmVTdG9ja18xMTgyMTAwNzQtZTE1NzA5NzI3Njc5MDEtMTAwMHg2MDAuanBlZyIsInRpdGxlIjoiV2hhdCdzIGluIHRoZSAkOTAwIGJpbGxpb24gQ09WSUQgYWlkIHBhY2thZ2U/Iiwic3VtbWFyeSI6IkNvbmdyZXNzIGFwcHJvdmVkIGNvcm9uYXZpcnVzIHJlbGllZiBsZWdpc2xhdGlvbiBmb3IgdGhlIGZpcnN0IHRpbWUgaW4gbW9udGhzLiBIZXJl4oCZcyB3aGF04oCZcyBpbnNpZGUuIiwidGVtcGxhdGUiOiJ1c2VfZGVmYXVsdF9mcm9tX3NldHRpbmdzIn0=”]

“I am also glad that the House passed the bipartisan FY2021 Omnibus Spending bill to fund the government for next year,” Sewell continued. “In these uncertain times, it is more important than ever to keep the government funded and open. This legislation includes additional funding for issues important to the 7th Congressional District, including health care, wastewater infrastructure, civil rights historic preservation, and our HBCUs.”

The package, H.R. 133, will provide $166 billion for economic impact payments, providing $600 stimulus direct payments per adult and child. These payments will be given to individuals making up to $75,000 a year and couples making up to $150,000 a year. This means a family of four would receive a payment of $2,400. President Donald Trump is urging Congress to raise the direct payment amount to $2,000.

It would also:

- Extend the eviction moratorium through Jan. 31, 2021, and provides $25 billion for emergency rental assistance.

- Extend Unemployment Assistance through March 14, 2021, including a supplemental $300 per week payment.

- Provide $13 billion for increased SNAP food assistance, child nutrition benefits and support for food banks.

The omnibus funding bill includes five pieces of legislation that Sewell has sponsored to improve health care delivery in rural and underserved areas and bring economic opportunity to Alabama’s 7th Congressional District:

These include:

- H.R. 1052, the Physician Assistant Direct Payment Act, allows physician assistants to be directly compensated by Medicare in order to expand their role as medical providers in underserved communities. Not only will this increase access to health care in underserved communities, but it also saves money.

- H.R. 8892, the Rural-Urban Physician Workforce Act of 2020, helps rural and urban hospitals partner to help produce the next generation of doctors and meet our community’s health care needs.

- H.R. 1763, the Resident Physician Shortage Reduction Act, is partially included in the bill. The bill will add 1,000 new medical residency slots in 2021, increasing the number of trained doctors to meet growing demand. It will also help provide hospitals and health centers the tools they need to increase access, lower wait times for patients and create a pipeline of qualified medical professionals to serve Americans’ health needs. This is the first addition of residency slots since 1997.

Other legislation sponsored by Sewell included in the package:

- Sewell’s H.R. 1680, the New Markets Tax Credit Extension Act, to extend the New Markets Tax Credit for five years, at an allocation level of $5 billion. The NMTC spurs private investment in low-income rural communities and urban neighborhoods by providing tax credits for private investments made in underserved communities.

- H.R. 5156, the Carbon Capture and Sequestration Extension Act, expands incentives for businesses across a range of industries to invest in state-of-the-art technologies to lower carbon emissions from existing power plants by extending the 45Q tax credit for carbon capture.

The package includes the following health care provisions:

- $20 billion for the procurement of COVID vaccines and therapeutics.

- $9 billion to the Center for Disease Control and States for vaccine distribution.

- $3 billion to improve the strategic national stockpile.

- $22 billion to the states for COVID testing, tracing, and mitigation programs. This includes $2.5 billion for grants targeted to underserved, minority, and rural communities.

- $9 billion to support healthcare providers.

- $1 billion for the National Institutes of Health COVID research.

- $4.5 billion for mental healthcare.

The package also includes support for business:

- $284 billion for the Small Business Administration for first and second forgivable PPP loans for small businesses.

- The bill also expands PPP eligibility for nonprofits and modifies the PPP program to better serve the smallest businesses and independent restaurants.

- $9 billion in emergency capital investments in Community Development Financial Institutions and Minority Depository Institutions to support lending in low-income and persistent poverty counties.

- An additional $3 billion to the Community Development Financial Institution Fund to alleviate the economic impact on underserved low-income and minority communities.

- $13 billion to support struggling farmers, ranchers, and fisheries.

Other provisions:

- $45 billion for public transit, buses, airports, and airlines.

- An extension of student loan forbearance through April 1, 2021.

- Expansion of Pell Grants to 500,000 new recipients.

- $82 billion for education funding, including $54.3 billion dedicated to the Elementary and Secondary School Emergency Relief Fund.

- $22.7 billion dedicated to the Higher Education Relief Fund, and $4.05 billion for the Governor’s Fund. This includes $1.7 billion for HBCUs, tribal colleges, and minority-serving institutions.

- $10 billion to support childcare providers through the CCDBG program.

- $20 million for the Head Start program.

- Extension of the CARES Act Coronavirus Relief Fund until Dec 31, 2021, to give states and localities more flexibility to allocate emergency resources.

- $7 billion for broadband, including $3.2 billion to help low-income families afford broadband connectivity.

- $250 million for telehealth.

- $21.125 million to preserve the sites and stories of the Civil Rights Movement.

- $10 million to HBCUs for historic preservation.

- $9.24 billion for the EPA, including $1.21 billion for the EPA Superfund and $12.5 million for Environment Justice Activities.

In healthcare:

- Ending surprise billing by ensuring patients are only responsible for their in-network cost-sharing amounts when patients cannot choose an in-network provider.

- Also prohibits certain providers from balance billing patients, and creates a new framework that protects patients and allows providers and insurers to resolve payment disputes without involving the patients.

- Extension of key Medicare programs, including funding for low-income Medicare beneficiary outreach, enrollment, and education activities, the Independence at Home demonstration, Medicare patient IVIG access demonstration project, and transitional coverage and retroactive Medicare Part D coverage for certain low-income beneficiaries.

- Increases the use of real-time benefit tools to lower Medicare beneficiary costs and requires Part D plan sponsors to implement real-time benefit tools (RTBT) that are capable of integrating with provider electronic prescribing (e-prescribing) and electronic health record (EHR) systems.

- Simplifies Medicare beneficiary enrollment and eliminates coverage gaps in Medicare by requiring that Part B insurance coverage begin the first of the month following an individual’s enrollment and provides for a Part A and Part B Special Enrollment Period for “exceptional circumstances” to mirror authority in Medicare Advantage and Medicare Part D.

- Extends the Rural Community Hospital Demonstration (RCHD) by five years. The demonstration tests the feasibility and advisability of establishing “rural community hospitals” to furnish covered inpatient hospital services to Medicare beneficiaries in states with low population densities. Participating hospitals are mostly paid using reasonable cost-based methodology instead of the inpatient prospective payment system.

- Ensures that state Medicaid programs cover non-emergency medical transportation to necessary services.

- Eliminates Medicaid Disproportionate Share Hospital cuts.

- Creation of new voluntary Medicare payment designation that provides more flexibility to rural hospitals to access funding.

In the areas of tax and trade:

- A five-year extension of the New Markets Tax Credit.

- Earned Income Tax Credit and Child Tax Credit special provision to allow taxpayers to refer to earned income in 2019.

- Reforms Tax Extender process to provide certainty for small businesses.

- A fix to USMCA Merchandise Processing Fee to support automakers.

- Re-established NADBank status to promote environmental clean-up and conservation efforts in North America.

Worker and family support:

- Extension of the Temporary Assistance for Needy Families program through FY2021 and includes the Supporting Foster Youth and Families through the Pandemic Act.

Support for the agriculture industry and rural areas:

- $1.45 billion for rural water and wastewater program loans.

- $620 million in water and wastewater grants.

- $730 million in broadband expansion for rural education and healthcare services.

- $635 million for the ReConnect rural broadband program.

- $1.4 billion for rental assistance for affordable housing for elderly and low-income families in rural communities.

- $6 billion for the WIC nutrition program.

- $114 billion for the SNAP food program.

- $1.824 billion for farm programs, including $5 million to heirs property farmland issues.

- $180 million for the Appalachian Regional Commission to promote economic development and critical infrastructure.

Commerce, justice, and science:

- $346 million for the Economic Development Administration, including $2 million for STEM apprenticeships.

- $48 million for the Minority Business Development Agency to support minority businesses around the country.

- $13.5 million for the Emmitt Till Unsolved Civil Rights Crimes Reauthorization Act.

- The creation of a new Task Force on Law Enforcement Oversight to be composed of representatives from the DoJ, law enforcement, labor, and community-based organizations to address alleged law enforcement misconduct.

- $3.385 billion for grants to state and local law enforcement, including $484 million for Byrne JAG, and $386 million for the Community Oriented Policing Services program.

- $513 million for Violence Against Women Act programs.

- $23 billion for NASA.

Defense:

- A 3 percent military pay raise for service members.

- $335.5 million for the Department and Services’ Sexual Assault Prevention and Response program.

Financial services:

- $270 million for Community Development Financial Institutions fund.

- $17 million for the Election Assistance Commission to increase support to state efforts to ensure security and accessibility of Federal elections.

- $33 million to the FCC to improve broadband mapping data.

- $778.9 million for the Small Business Administration.

Homeland Security:

- $2 billion for the Cybersecurity and Infrastructure Security Agency.

- $21.67 billion for FEMA, including $17 billion for disaster response and recovery efforts.

Labor, research and education:

- $185 million for Registered Apprenticeships.

- $2.8 billion for Workforce Innovation and Opportunity Act grants.

- $42.9 billion for the National Institutes of Health, including $80 million for research centers in minority institutions.

- $25 million for research on firearm violence prevention.

- $7.5 billion for the Health Resources and Services Administration, including $2.4 billion for the Ryan White HIV/AIDS program.

- $5.9 billion for the Child Care and Development Block Grant.

- $10.7 billion for the Head Start Program.

- $3.8 billion for the Low Income Home Energy Assistance Program.

- $62 million for the Office of Minority Health.

- $35 million for the Office of Women’s Health.

- $5 million for public-private partnerships to accelerate and improve the diagnosis and treatment of kidney disease.

- $40.6 billion for K-12 education programs.

- An increase in the maximum Pell Grant to $6,495.

- $338 million for Historically Black Colleges and Universities, including $2 million for the Center of Education Excellence.

- $1.1 billion for the TRIO Program.

Veterans Affairs:

- $90 billion for VA medical care, including $10.3 billion for mental healthcare, of which $313 million is for suicide prevention efforts and $3.18 billion to address the VA disability claims processing backlog.

In the areas of Transportation, Housing and Urban Development:

- $1 billion for TIGER/BUILD grants and allows for cost-share waivers for grants in rural and persistent poverty areas.

- $49.6 billion for the Department of Housing and Urban Development, including $200 million for the Choice Neighborhoods Initiative.

- $3.5 billion for Community Development Block Grants.

President Donald Trump is demanding that the package contain an increase in the individual stimulus checks to $2,000 per person from $600 per person and cutting off a number of provisions mainly in the area of foreign aid that he called “wasteful spending.”

Congressional Democrats support the president’s call for higher individual stimulus checks. Republicans, however, do not, though they have been generally supportive of his calls for cutting the so-called wasteful provisions.

Without the president’s signature to the bill, the override of a presidential veto, or another continuing resolution to keep the government funded, there will be a government shutdown Monday at midnight.

President-elect Joe Biden has said that he will ask for an additional COVID aid package once sworn into office that will include more individual stimulus checks.