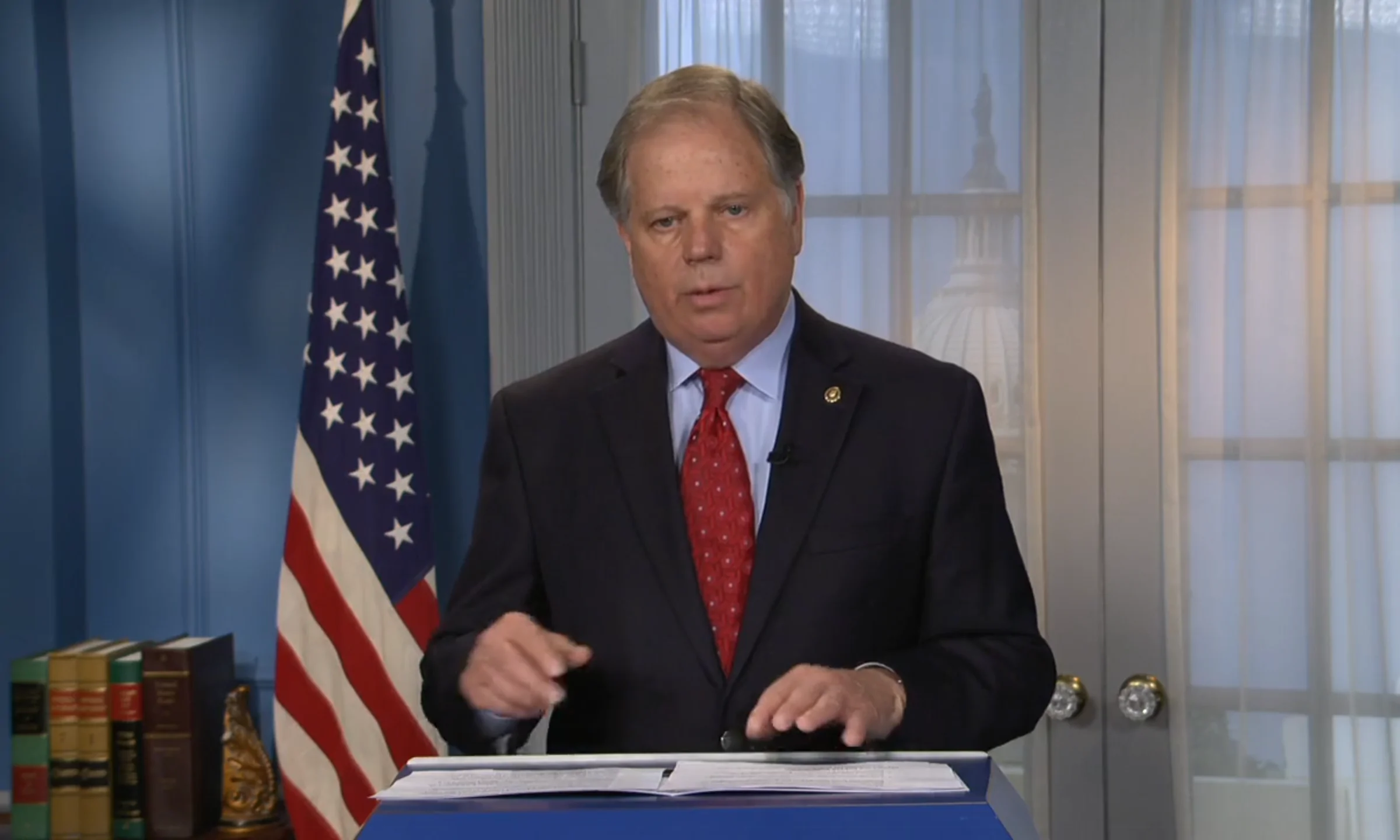

Alabama Sen. Doug Jones and two of his Democratic Senate colleagues — Nevada Sen. Jacky Rosen and New Hampshire Sen. Maggie Hassan — led 10 other senators in a letter asking Majority Leader Mitch McConnell of Kentucky to bring the Senate back into session and work through the weekend until Congress reaches a bipartisan deal to address the public health and economic crises caused by the COVID-19 pandemic.

“The ongoing COVID-19 pandemic in the U.S. has been relentless, bringing about a public health crisis and an economy teetering on the edge of catastrophe,” Jones and the other senators wrote. “Across the country, Americans are fearful and anxious as loved ones get sick, families go hungry, small businesses go under, and workers continue to go without pay. State and local coffers have run dry, tenants can’t afford the rent, state unemployment systems are overwhelmed, and over 150,000 Americans have died. Despite this, it has been over four months since the Senate passed a comprehensive relief package, and the relief we provided is running out.”

“In the circumstances we find ourselves, it is imperative that the Senate be in session through the remainder of this weekend and all of next week — working not on partisan nominations, but on bipartisan coronavirus relief for the American people,” the letter continues.

“With this in mind and with federal unemployment benefits having expired last night, we implore you to bring the Senate back into session this weekend and pass bipartisan legislation to help working Americans and families,” concluded the letter.

The House passed their Heroes Act in early May with little Republican input. Senate Republicans have proposed a $1 trillion coronavirus aid bill on top of the CARES Act and the other relief packages. Senate Democrats have criticized the Republican plan for not going far enough. Their proposal was for a $3 trillion aid bill.

Jones has been a vocal critic of McConnell’s delays in bringing a strong, bipartisan relief bill up for a vote. The original CARES Act had a costly provision that increased the amount of money that the unemployed could collect during the coronavirus economic shutdown. That bump up in benefits expired on Friday.

Millions of Americans, however, are still unemployed and are having to make mortgage and rent payments with dramatically less to spend. Senator Jones has called for a renewal of emergency unemployment benefits, as well as more relief for health care providers, small businesses and workers, schools, state departments of labor, and incentives for states to expand Medicaid.

He has also called for an extension of the federal eviction moratorium, and for the state of Alabama to renew its own eviction moratorium, which was lifted on June 1.

The federal government has enacted four pieces of legislation that provide relief to individuals, state and local governments and corporations that have been affected by the COVID-19 pandemic and the economic meltdown. These cost more than $2 trillion. To pay for all of this, the Treasury Department has ramped up borrowing.

According to a report by the Peter G. Peterson Foundation, since March 1, the United States Treasury has borrowed more than $3 trillion. Most of that increase has occurred since March 30, when the CARES Act was enacted.

Most of the new debt has been issued in the form of Treasury bills. T-bills mature in one year or less and account for 80 percent of the increase in debt since March 1. Treasury notes, which mature in 2 to 10 years, are 15 percent of the increase. Treasury bonds, which mature after more than 10 years, Treasury inflation-protected securities, and floating-rate notes, combine for the remaining five percent of the increase.

Fortunately, the government is paying very little interest on those new Treasury bills because interest rates dropped when the extent of the pandemic became clear and money fled risky investments like stocks and real estate trusts for security. For the 4-week bills that were issued on July 21, the government paid investors an interest rate of 0.11 percent. That is a considerable drop from the 1.60 percent interest rate that the government paid on the 4-week bills that were issued on Feb. 25 before the pandemic hit the U.S.

Treasury projects that they will borrow $677 billion in the third quarter.

The U.S. national debt is nearly $26.6 trillion — an all-time high — and the budget deficit is $3.8 trillion. Interest on the debt is costing taxpayers $337 billion annually, the fourth costliest federal program trailing Medicare and Medicaid at $1.3 trillion, Social Security at $1.08 trillion and national defense at $695 billion.

Jones is in a difficult re-election race with former Auburn head football coach Tommy Tuberville.