Wednesday, U.S. Senator Doug Jones (D-Alabama) sent a letter calling for Federal Reserve Board Inspector General Mark Bialek to open an investigation into the Consumer Financial Protection Bureau’s (CFPB) repeal of the Payday, Vehicle Title, and Certain High-Cost Installment Loans Rule (Payday Rule).

Senator Jones was joined in the letter by Senators Sherrod Brown (D-Ohio), Chris Van Hollen (D-Maryland.), Elizabeth Warren (D-Massachusetts), and Catherine Cortez Masto (D-Nevada).

“Recent press reports detail a CFPB rulemaking process that, if true, flagrantly violates the Administrative Procedure Act’s (APA) requirements—in which political appointees exerted improper influence, manipulated or misinterpreted economic research, and overruled career staff to support a predetermined outcome,” wrote Senator Jones and his colleagues.

“In light of these disturbing allegations, we ask that you investigate to determine whether the Bureau’s process for reconsidering and repealing the 2017 Payday Rule violated the Administrative Procedures Act or other federal laws and regulations,” Jones wrote.

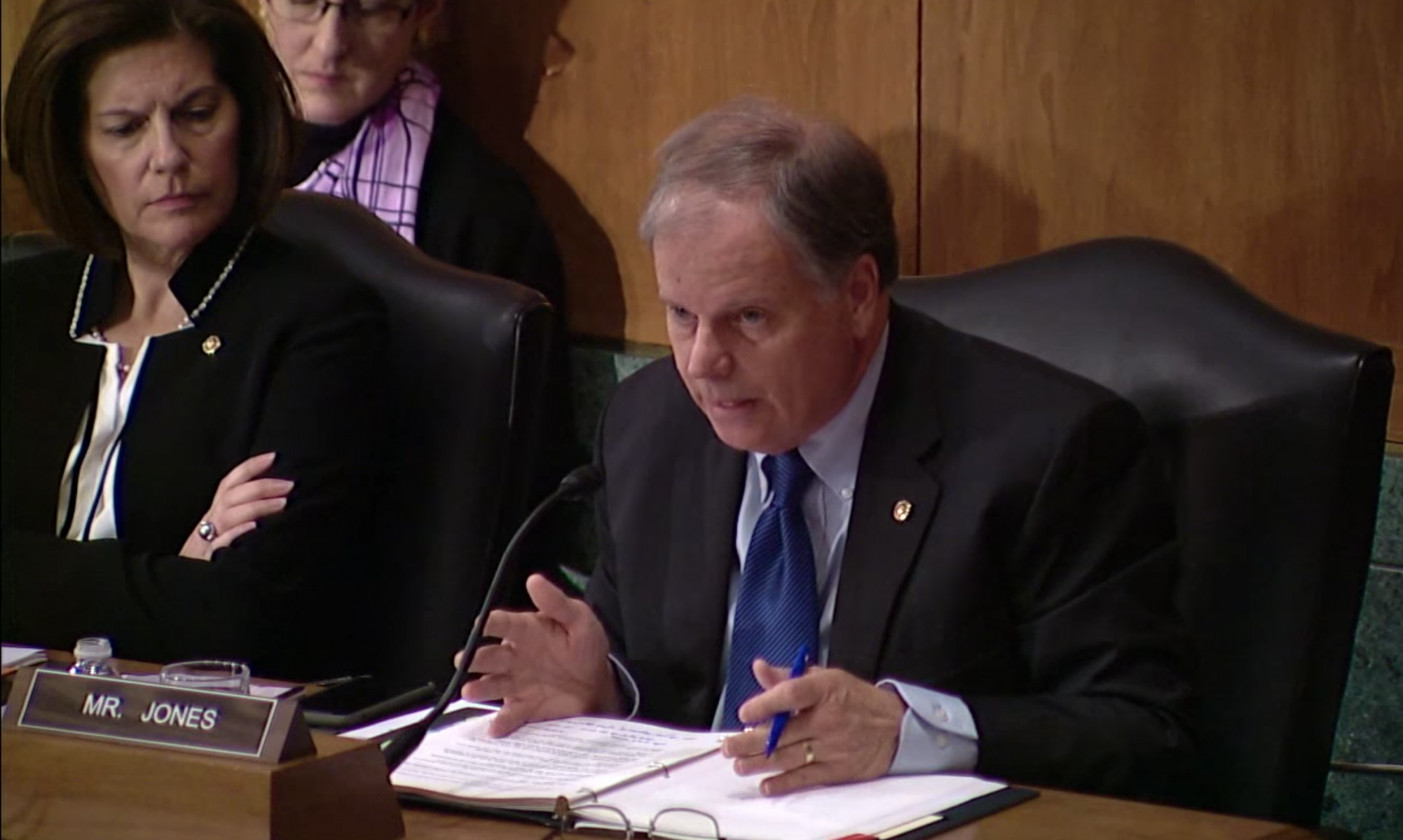

Senator Jones has been a strong advocate for payday lending protections. In February 2019, the Senator released a statement regarding his disapproval of CFPB’s decision to weaken payday lending protections. In 2018 when the CFPB initially indicated that it wanted to reverse the 2017 payday lending rule, Senator Jones called for the dismissal of this action. Senator Jones also has repeatedly addressed the importance of maintaining a strong payday lending rule with both former CFPB Acting Director Mick Mulvaney and current CFPB Director Kathleen Kraninger during Senate Banking Committee hearings.

Opponents of payday lending argue that poor people are preyed upon by payday lenders, who charge exorbitant interest rates. Supporters argue that poor people lack credit because they: don’t have assets, a good credit history, and are inherently a high credit risk. They argue that without payday lenders millions of the working poor could not be able to get credit at all from banks and that niche market would be filled by loan sharks, offshore over the internet lenders, and other illegal lenders. As many as 12 million Americans use payday loans each year.

Senator Jones is a member of the Senate Banking Committee. Jones faces re-election later this year. Jeff Sessions and Tommy Tuberville are running in the July Republican Party primary runoff.