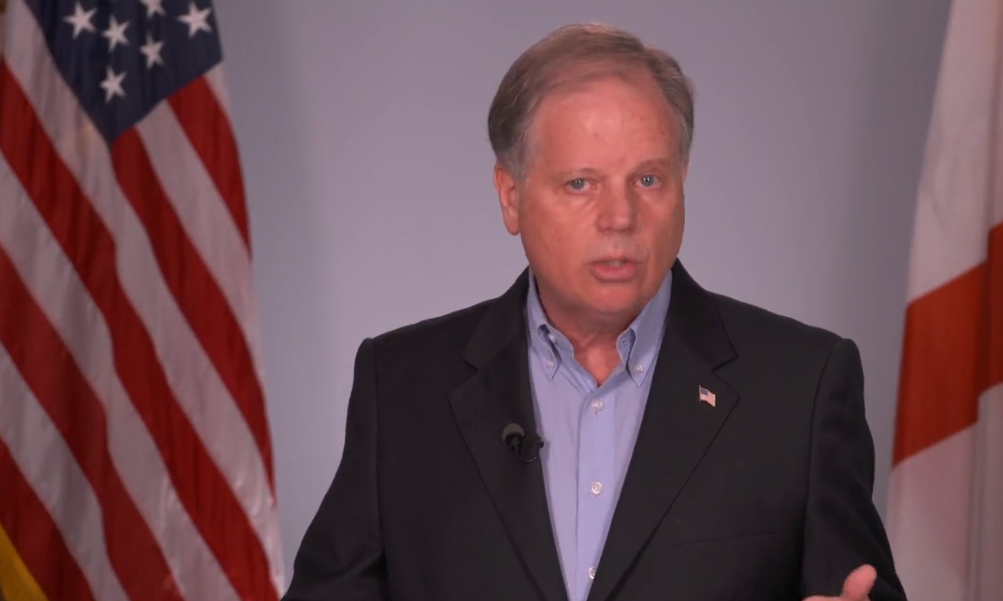

U.S. Sen. Doug Jones, D-Alabama, and Sen. Tim Scott, R-South Carolina, on Friday called for clarity on loan forgiveness for small businesses that received coronavirus-related grants through the Paycheck Protection Program.

“On Monday, April 27, the second round of funding began to help support our small businesses. However, the terms for forgiveness were and continue to be ambiguous,” Jones and Scott wrote in a letter Friday to Treasury Secretary Steven Mnuchin and Small Business Administration Administrator Jovita Carranza.

“As borrowers are responsible under the CARES Act for determining whether PPP proceeds were used as Congress intended, it is imperative that these regulations be laid out clearly so small businesses can make the right decisions on how to spend the funding,” the letter continues.

The senators wrote that there are many nuances that clear regulation could solve to make sure small businesses and their workers receive the most support from the program.

The first round of $349 billion in the Paycheck Protection Program loans ran out in just 13 days. At least $500 million of that money went to larger, publicly-held companies, but the federal government has been working to recoup much of that money in recent weeks.

In Alabama, 27,922 loans went out totaling $4.9 billion in the first round of loans before the money ran out, according to the U.S. Small Business Administration.

An additional $310 billion in loans were made available nationally in the second round.

Read the full letter below:

May 1, 2020

Dear Secretary Mnuchin and Administrator Carranza:

As you implement the Paycheck Protection Program and Health Care Enhancement Act (the “interim” COVID-19 act), which expands and replenishes the small business programs enacted in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, we are writing to request additional guidance on loan forgiveness. Further guidance is needed to ensure the small business recipients of federal funds can make payroll for their employees and remain afloat.

The interim COVID-19 act replenishes funding for key Small Business Administration (SBA) response programs, including $310 billion for the Paycheck Protection Program (PPP), $50 billion to leverage more than $350 billion for SBA’s Economic Injury Disaster Loan (EIDL) program, and $10 billion for SBA’s Emergency EIDL Grant program. It also includes important policy reforms to expand access to SBA assistance to more unbanked and underserved businesses, including minority-owned businesses, rural businesses, small mom-and-pop shops, and smaller nonprofits to ensure that they are not pushed to the back of the line.

On Monday April 27, the second round of funding began to help support our small businesses. However, the terms for forgiveness were and continue to be ambiguous. As borrowers are responsible under the CARES Act for determining whether PPP proceeds were used as Congress intended, it is imperative that these regulations be laid out clearly so small businesses can make the right decisions on how to spend the funding.

While releasing the banks from liability was a critical part of advancing the public policy of dispersing PPP funds quickly and effectively, small business owners have been asked to sign onto terms that read, “forgiveness may apply” or “all or part of the loan may be forgiven.” Owners have been given no contractual guarantee of loan forgiveness, or even guidance on how to comply with the rules or how to pursue it. Further, releasing guidance for lenders and small businesses is imperative to the success of this program and the SBA and Treasury Department should make it one of their priorities to clarify.

No concrete information has been given to either lenders or small business owners about how they should go about getting their loans forgiven. Some owners were told that to gain forgiveness, they would have to submit a request to their lenders. Others were told that they have to go straight to the SBA. Conflicting information at a time of uncertainty can be harmful to the significant and successful goal of the Paycheck Protection Program.

According to the CARES Act, 75 percent of the loan must be spent on retaining a borrower’s payroll, and the rest of the 25 percent can be spent on other overhead costs. We have heard from business owners that they need clarity around what full-time equivalent means– whether that constitutes rehiring the same staff or bringing on new hires, as well as details on wages paid especially for tipped and seasonal workers. There are many nuances that clear regulation could solve to make sure small businesses and their workers receive the most support from this program.

We appreciate your immediate attention to these critical issues and thank you for your continued work to mitigate the impact that this public health crisis is having on our economy.