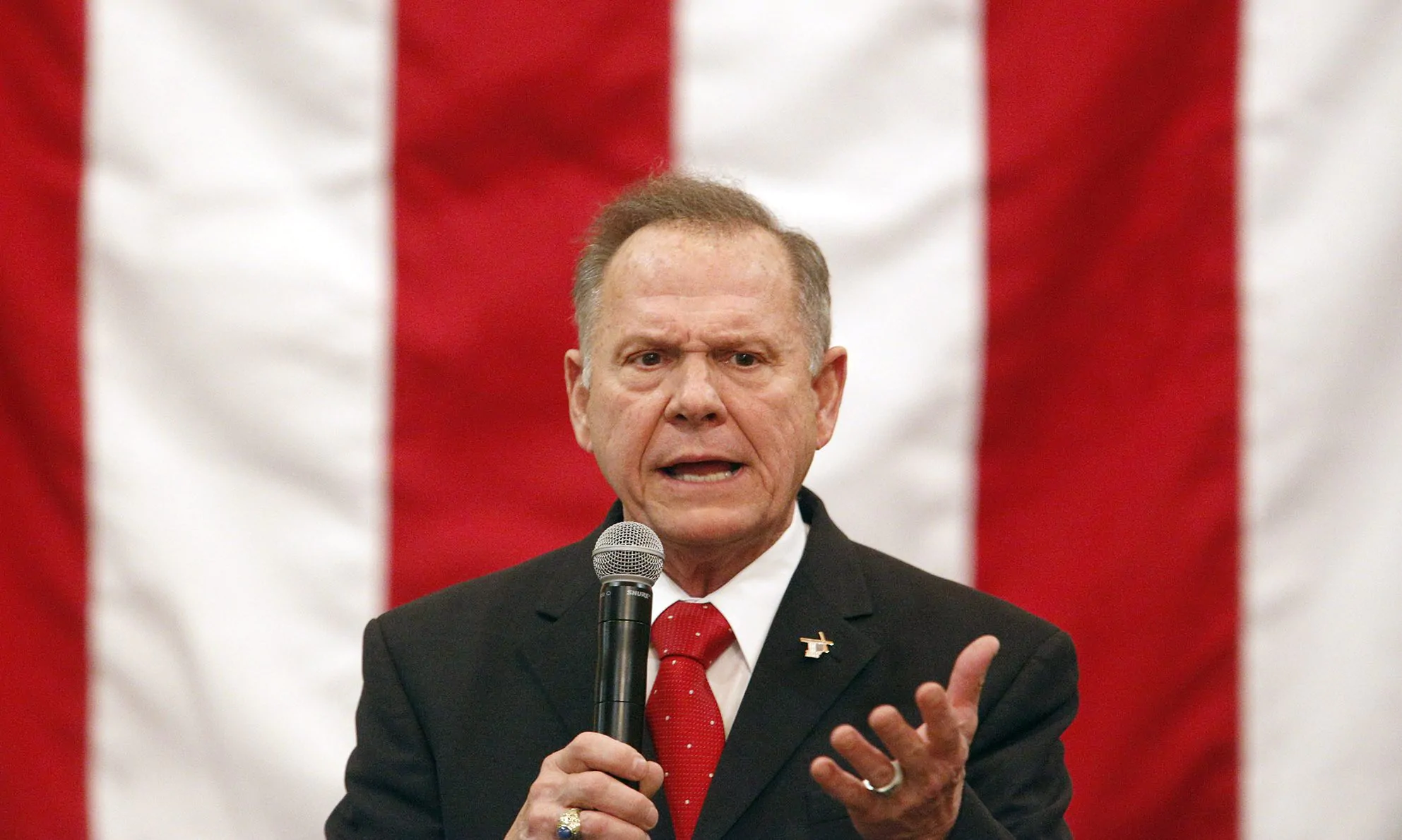

Tuesday, Senate candidate former Chief Justice Roy Moore (R) criticized the tax plans of major Democratic Party candidates for President of the United States. Judge Moore said that the Democratic contenders were “pandering to their socialist supporters.”

The major Democratic candidates for President of the United States have all promised to undo the Tax Cuts and Jobs Act of 2017 and are promising income tax increases on top of that. Some have even proposed massive wealth confiscation schemes to fund an expansion of federal social spending.

“It is clear that the democrat candidates for President are merely pandering to their socialist constituents,” Judge Moore told the Alabama Political Reporter. “I have and will continue to support a “flat” tax or even better a “fair” tax which would tax people on what they spend for “new” goods and services. The fair tax would actually reward merchants who would collect the tax and distribute the tax burden to those who could actually afford it, and that is “fair.””

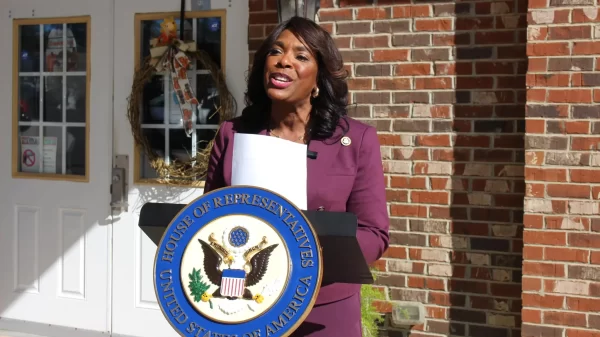

Judge Moore is running for the U.S. Senate seat currently held by Doug Jones (D).

In 2016 billionaire hotel developer Donald J. Trump (R) ran for President promising to lower personal income taxes, simplify the tax cut, and slash corporate tax rates. Former Secretary of State Hillary R. Clinton (D) was promising to increase tax revenues by $1.4 trillion for the next ten years. Trump defeated Clinton and the GOP majority than passed the Tax Cuts and Jobs Act of 2017.

Former Vice President Joe Biden (D) and South Bend, Indiana Mayor Pete Buttigieg are the most moderate of the four major Democratic candidates in regards to taxation; but according to Americans for Tax Fairness even their proposals are substantially higher than the tax increases proposed by Hillary Clinton four years ago.

Both Biden and Buttigieg have offered up plans raising taxes on the rich and corporations by around $3.4 trillion, although both have suggested that their final proposals could potentially be much higher.

Senators Bernie Sanders (Vermont) and Elizabeth Warren (Massachusetts) are proposing far more expensive proposals.

Warren is proposing raising $28.4 trillion in tax increases in the next decade, with $17.9 trillion of that going into her healthcare plan.

Sanders is proposing over $22 trillion in tax increases in the next decade, with over $12 trillion of that going to his healthcare plan.

Biden’s plan would cost $3.4 trillion; while Buttigieg’s would cost $3.5 trillion.

Republicans argue that their plan has grown the economy and resulted in the lowest unemployment in over fifty years. Democrats point out that GOP tax policy has led to $trillion a year national deficits, even in a robust economy.

Sen. Cory Booker (New Jersey) dropped out of the race yesterday ahead of the pending Iowa Caucuses.

To see the full Americans for Tax Fairness report: Here.

The Republican primary will be on March 3.

Moore was twice elected Chief Justice of the Alabama Supreme Court and was the Republican Senate nominee in 2017.