U.S. Senators Doug Jones (D-Ala.), Tom Cotton (R-Ark.), and Jeff Merkley (D-Ore.) have reintroduced bipartisan legislation—the Unsolicited Loan Act —that would halt the predatory practice of mailing high-interest loans to consumers in the form of “live” checks.

Often times, when consumers receive these checks in the mail they believe them to be from their bank or another trusted financial institution and are unaware the check is a high-interest loan. Under the Unsolicited Loan Act, this practice would be prohibited and would ensure consumers can only access loans for which they proactively applied. This legislation echoes Congress’ ban on the mailing of live credit cards.

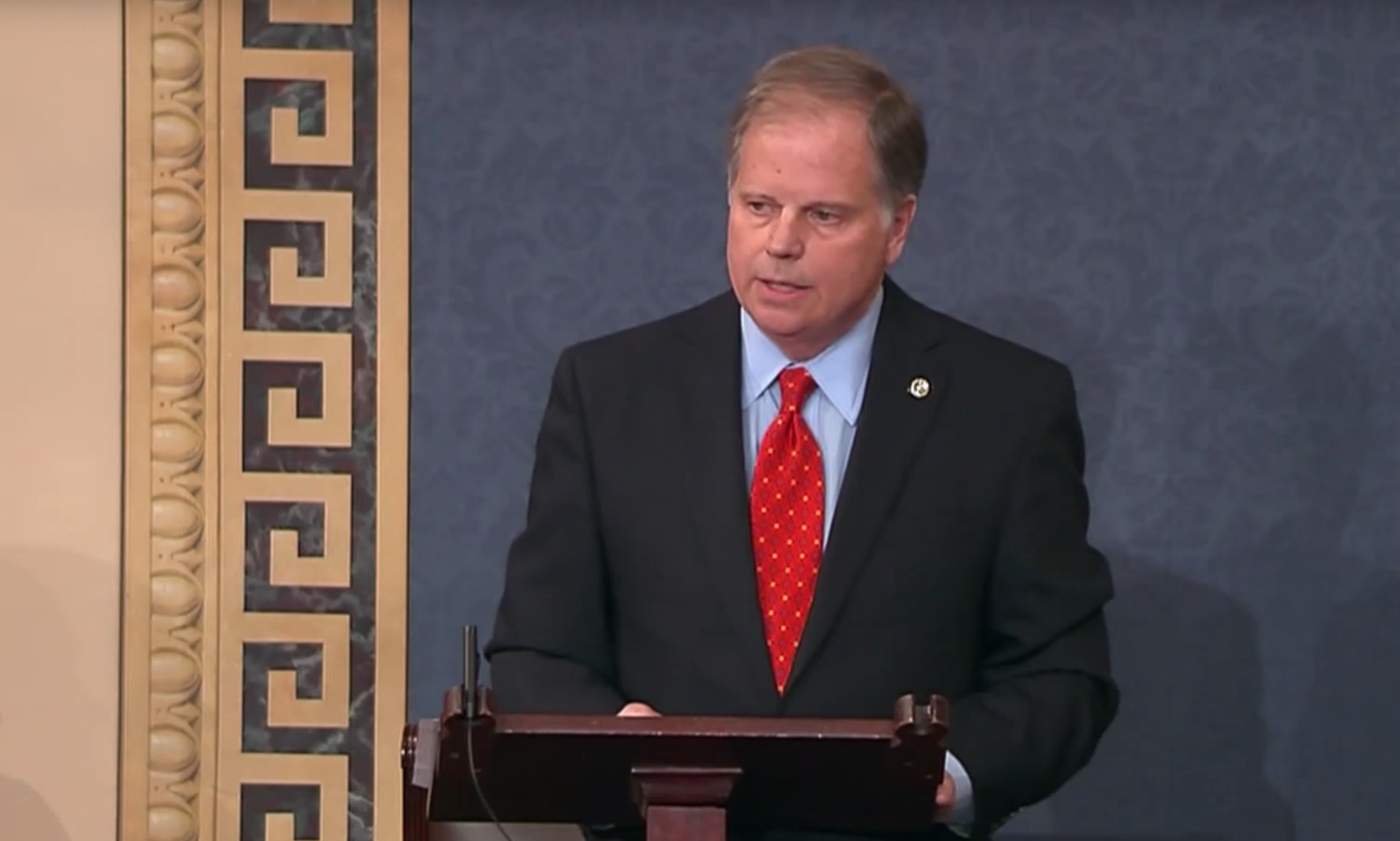

“We need to continue to take a stand for hard-working families and make sure we have protections in place to prevent these predatory tactics,” said Senator Jones, a member of the Senate Banking, Housing and Urban Affairs Committee. “Many honest folks are not aware that by depositing these checks they are actually taking on a high-interest loan. Congress must act now and pass this common-sense legislation to protect consumers from this predatory scam.”

“People should understand exactly what they’re getting into when taking on debt. But many individuals don’t understand that ‘live’ checks mailed directly to consumers are just high-interest loans in disguise. Congress put an end to ‘live’ credit cards decades ago, it’s time to do the same with ‘live’ checks,” said Senator Cotton.

“Families across the country have fallen victim to scams where they think they’re getting a lucky windfall or refund from their bank, and instead are being lured into a high-interest loan they never asked for,” said Senator Merkley. “It should be illegal to trick unsuspecting customers into loans they don’t want, and that’s why I’m urging my colleagues to take a stand for consumer fairness and transparency by passing the Unsolicited Loan Act.”

Congress has long recognized consumer loans should require an application by a customer and nearly 50 years ago the practice of mailing live credit cards was banned. In modern lending, formal loan applications are often quick to fill out and this legislation would not prohibit the direct mailing or marketing of a loan application. This legislation would allow for common-sense consumer protections to be put in place—without limiting access to credit—for consumers who willingly apply and seek lending products.

The Unsolicited Loan Act would also ensure that companies cannot shift from the mailing of live checks to other forms of transfer, such as a gift card or an “e-check.” Additionally, customers would not be held liable for debt incurred from illegal, unsolicited live check loans.

This legislation has been endorsed by The National Consumer Law Center on behalf of its low-income clients.