The U.S. Senate moved closer yesterday to finally ending the Military Widow’s Tax that taxes military widows and widowers’ survivor benefits.

The Senate voted unanimously on Wednesday to urge House-Senate National Defense Authorization Act (NDAA) conference committee members to include the Military Widow’s Tax Elimination Act of 2019 in the NDAA, which authorizes funding to equip, supply and train U.S. troops and support military families.

In a vote of 94-0, the Senate approved a Motion to Instruct measure in support of the bill being included in the annual defense bill. The House has already approved the widow’s tax provision in its version of the bill.

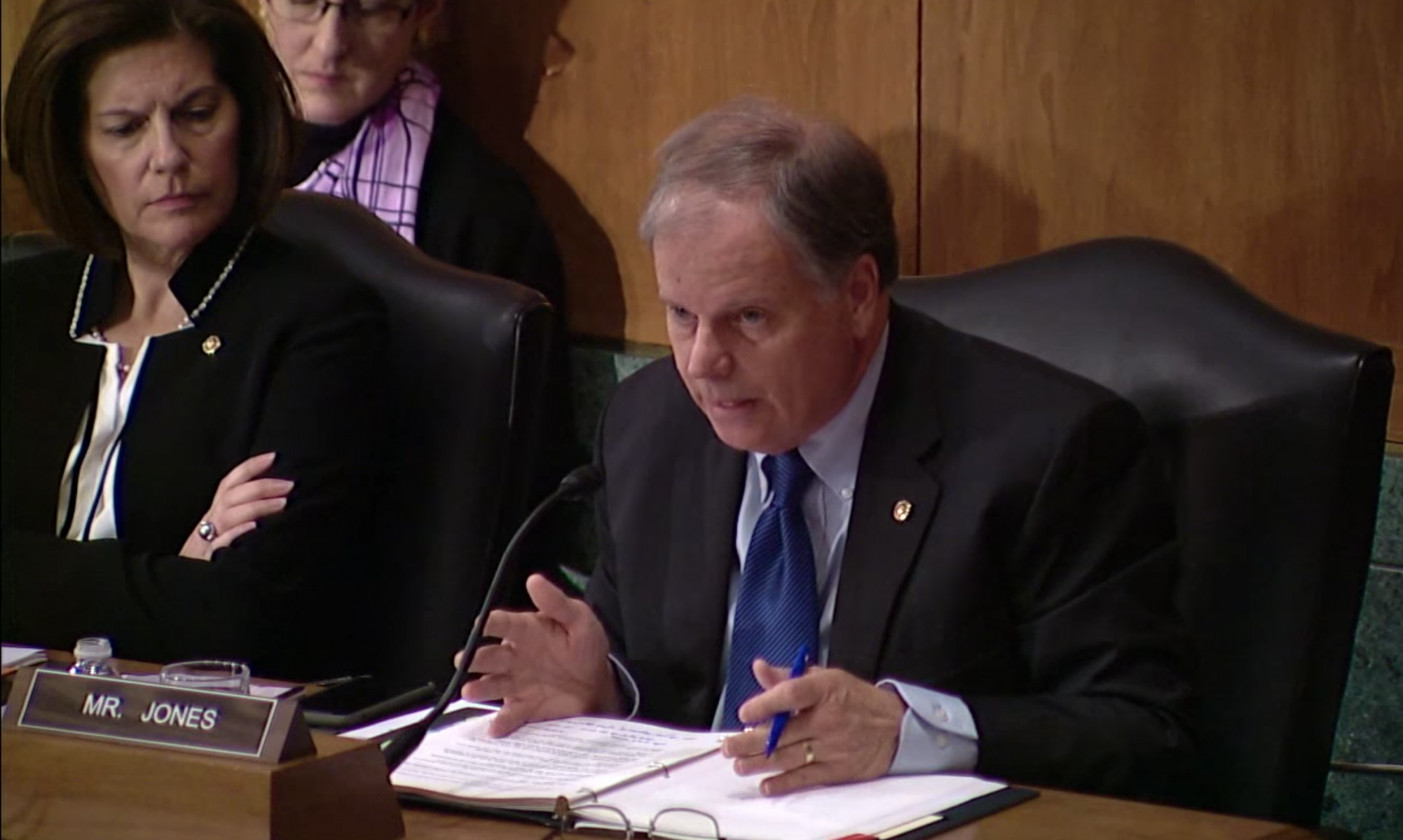

The bill, sponsored by Senator Doug Jones, D-AL, would repeal a law nicknamed The Widow’s Tax that prevents 67,000 surviving military spouses nationwide from receiving full survivor benefits from the Department of Defense and Veteran Affairs.

Currently, military widows and widowers who qualify for the VA’s Dependency and Indemnity Compensation are unable to collect their full Survivor Benefits Plan, instead having the amount received from DIC deducted from their plan.

“It has been a long battle for the military spouses who have fought to fix this decades-old injustice, but today the Senate took an important step toward finally putting an end to the widow’s tax,” Jones said in a statement. “With this vote, we sent an unambiguous message that ending the military widow’s tax is an urgent priority for this body. I am hopeful that the conference committee leaders will finally do the right thing for these families, who have given so much for our country.”

Legislation to repeal the widow’s tax has been repeatedly introduced in the Senate over the past 18 years, but the bill has recently gained heightened support, with a total of 77 cosponsors in the Senate.