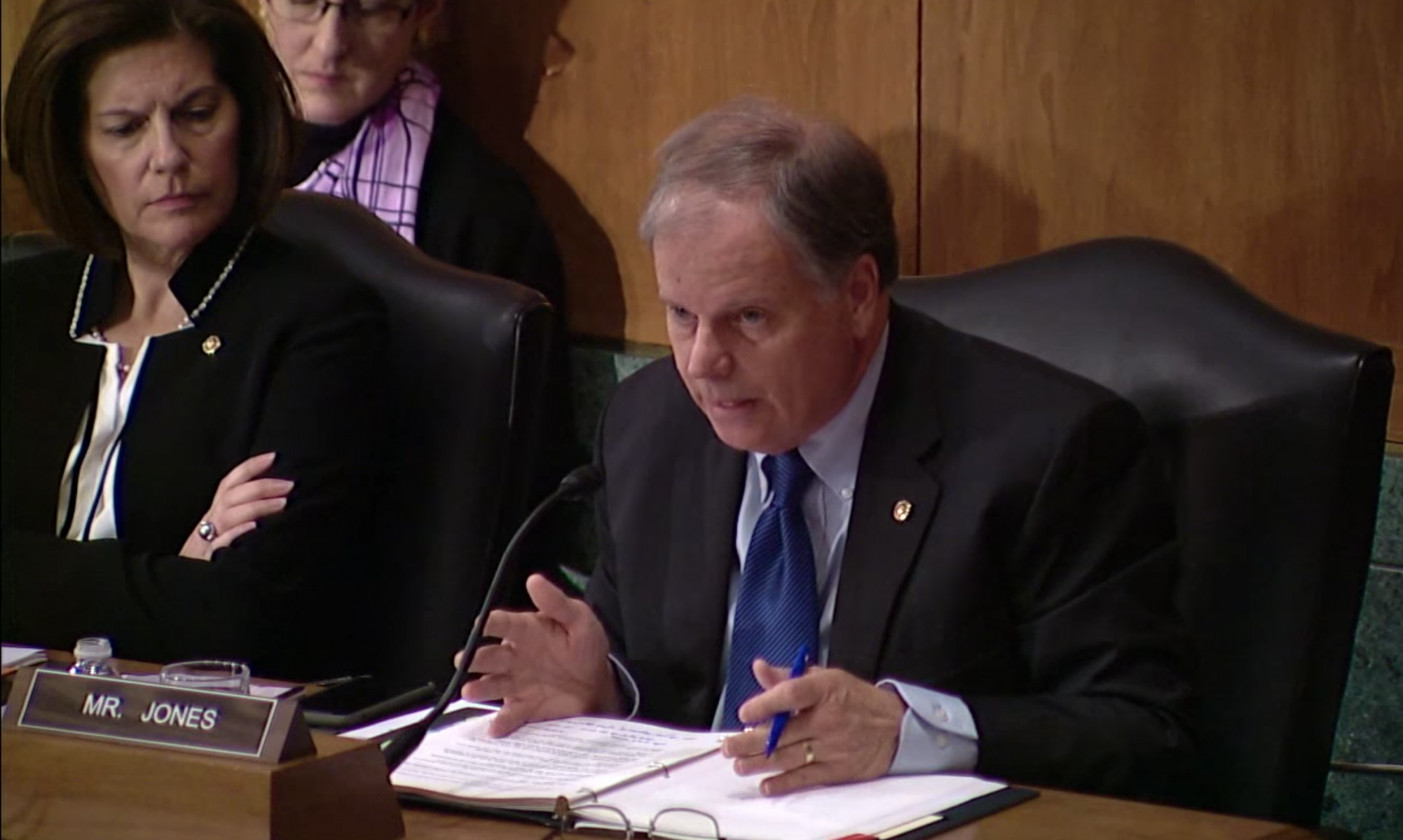

Sen. Doug Jones, D-Alabama, and colleague Susan Collins, R-Maine, sent a bipartisan letter to ranking members of the House and Senate Armed Services Committees on Monday urging them to include the Military Widow’s Tax Elimination Act of 2019 in the final version of the National Defense Authorization Act.

“We have an obligation to make sure that we are taking care of our military families who have sacrificed so much,” Jones and Collins wrote. “This problem goes back decades, but this year we can finally solve it once and for all. It is our time to do our duty not only to support the brave men and women of our military, but also to support their families.”

If made law, the legislation would repeal a law nicknamed The Widow’s Tax that prevents 67,000 surviving military spouses from collecting full survivor benefits from the Department of Defense and Veteran Affairs.

Under the current law, military widows and widowers who qualify for the VA’s Dependency and Indemnity Compensation are unable to collect their full Survivor Benefits Plan, instead having the amount received from DIC deducted from their plan.

“As a result of the widow’s tax, tens of thousands of surviving spouses are prevented from collecting the full insurance benefits from the Department of Defense for which their military retiree spouses paid because those benefits are offset by the DIC payments they receive from the Department of Veterans Affairs,” Jones and Collins wrote. “On average, this offset means that surviving spouses are denied more than $11,000 per year in SBP benefits. In response to this unfairness, thousands of military widows have become grassroots advocates, working in many cases for more than 30 years to right this wrong for their own families and the entire military family community.”

The letter was co-signed by 64 of their Senate colleagues.

“There has never before been more bipartisan support in Congress for repealing the SBP-DIC offset,” Jones and Collins wrote. “Currently, there are 75 co-sponsors of legislation to repeal the widow’s tax in the Senate and 371 co-sponsors in the House. Numerous military and veterans advocacy groups have joined us in this effort.”

This issue has been introduced in the Senate several times over the past 18 years, but recently gained heightened support. The bill’s 75 cosponsors has broken records for past support of repealing the tax.