Two months.

That’s how long it took for Alabama politicians to break all of those oh-so-sincere promises to you about the gas tax.

Two months ago, when the Legislature was debating this 10-cent gas tax increase — the one that can be increased another penny for years to come — there was one often-repeated promise that you heard from everyone at the State House.

“These funds will only be used to repair designated roads and bridges.”

No pet projects. No slush fund.

Nope. Only roads and bridges.

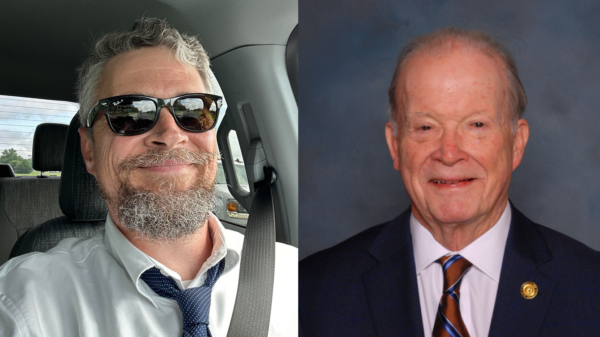

“If we do this, every dollar gets to where it needs to go,” said Rep. Bill Poole, the bill’s sponsor. “There is transparency, clarity, and accountability.”

Gov. Kay Ivey said, that “every penny will be scrutinized,” and that it will be “for infrastructure only, period.”

Senate President Del Marsh said a committee would review all expenditures, guaranteeing that the money would be used only road and bridge repair.

House Speaker Mac McCutcheon echoed those guarantees.

And yet, two months later, here is SB268.

A bill filed by Sen. Arthur Orr and co-sponsored by 11 other senators, both Democrats and Republicans, that will divert annually $10 million from the proceeds of the gas tax to fund repairs and construction at inland ports all around the state.

It has already passed out of the Senate, 30-0.

Now, I have spent most of my life on Alabama rivers and our family business shipped quite a few containers from freshwater ports over the years, so I know a fair amount about the various ports around the state.

Here’s the biggest thing I know: They are not roads or bridges.

But see, they are ports. And when you give away millions to dredge and fix one port — as happened with the Port of Mobile in the original gas tax bill — then you should probably expect others to show up with their hands out. Which is exactly what’s happened.

And which is exactly what everyone expected out of this whole thing — that the gas tax-funded projects would inevitably end up being the pet projects for pals of lawmakers.

And if you’re in a city, like, say, Decatur, where riverfront development and port improvements could bring in a few more dollars, guess what you do?

You convince your lawmaker pal to sponsor a bill that would bring in some of those gas tax dollars, just like Mobile got, because how can that not be fair?

And on and on it will go.

If the ports got it, why can’t train stations? Or bus terminals? What about large distribution centers?

And if you want to know just how crazy the cash grabs will become, look no further than the very first — Orr’s bill. Because buried down in this bill is loopiest of all loopholes.

After listing all of the ways the money for inland ports can’t be spent, Orr’s bill takes some time to tell everyone how it can be spent — on capital projects related to an inland port or dredging in the “immediate vicinity” of an inland port, or on inter-modal infrastructure development.

Or, and pay special attention to the craftiness of this rather large exception: The money can also be spent on projects OUTSIDE the normal operating budget of a port, inter-modal facility or “river-related community.”

To put that another way: You can use this money for literally anything.

This is why we can’t have nice things in Alabama.