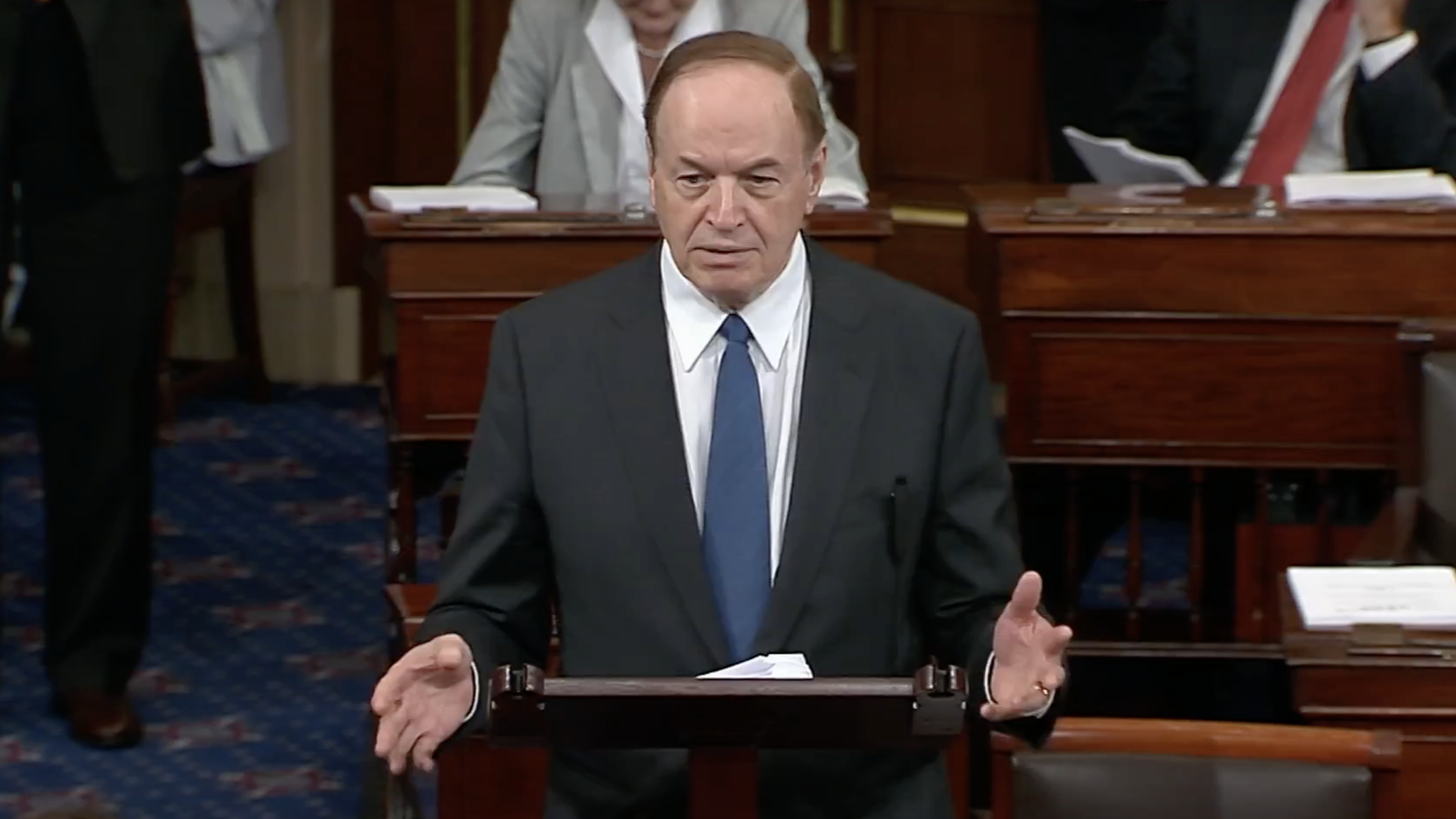

U.S. Sen. Richard Shelby, R-Alabama, has re-introduced legislation proposing a constitutional amendment that would require Congress to pass a balanced budget.

Shelby is concerned with our nation’s growing national debt, which has soared past $22 trillion. Shelby has introduced similar legislation each Congress since joining the Senate.

“While our national debt continues to climb, it is imperative that we stop spending without proper constraint,” Shelby said. “I have long believed that our Constitution lacks a requirement for the federal government to balance the budget – something that hardworking Americans are required to do every day. This legislation would implement a common-sense policy to improve our spending of taxpayer funds and help protect the future of the next generation.”

If passed by Congress and then ratified by three-fourths of the states, this amendment to the Constitution would require that the total amount of money spent by the United States during any fiscal year, except during times of war, not exceed the amount of revenue received by the U.S. during the same fiscal year, and not exceed 20 percent of the gross domestic product of the U.S. during the previous calendar year.

According to usdebtclock.org the current national debt is $22,270 billion. The deficit is $958 billion.

The largest budget items for the federal government are:

Medicaid and Medicare at $1,153 billion for this year (26.5 percent of federal spending)

Social Security which costs $1,016 billion (23.3 percent of the budget)

Defense/wars, including veterans benefits and pensions, $635 billion (14.6 percent)

The interest on the national debt $360 billion (8.3 percent)

income security programs, including SSI, earned income tax credits, unemployment compensation, supplemental nutritional assistance programs, foster care, and making work pay, $295 billion (6.8 percent)

federal pensions $284 billion (6.5 percent).

The rest of the government combined is only 14.8 percent of federal spending

The largest sources of federal income are: the individual income tax at $1,727 billion, the other payroll taxes including FICA at $1,208 billion, corporate taxes at $269 billion, and tariffs $61 billion.

The Trump economy is booming so the gross domestic product is $21,126 billion, which is up from $18,614 billion at this time three years ago. However the national debt is also up $2,719 billion from this date in 2016.

Richard Shelby has served the people of Alabama in the U.S. Senate since 1987, following four terms in the U.S. House of Representatives and two terms in the Alabama state Senate.