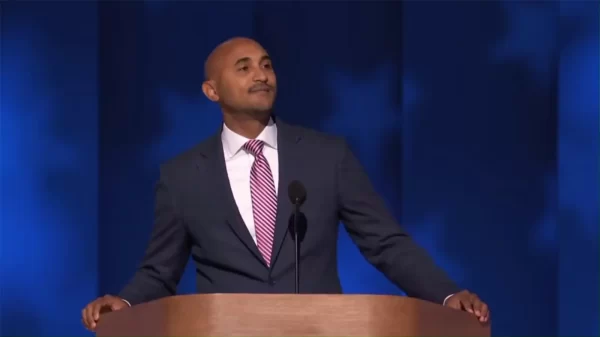

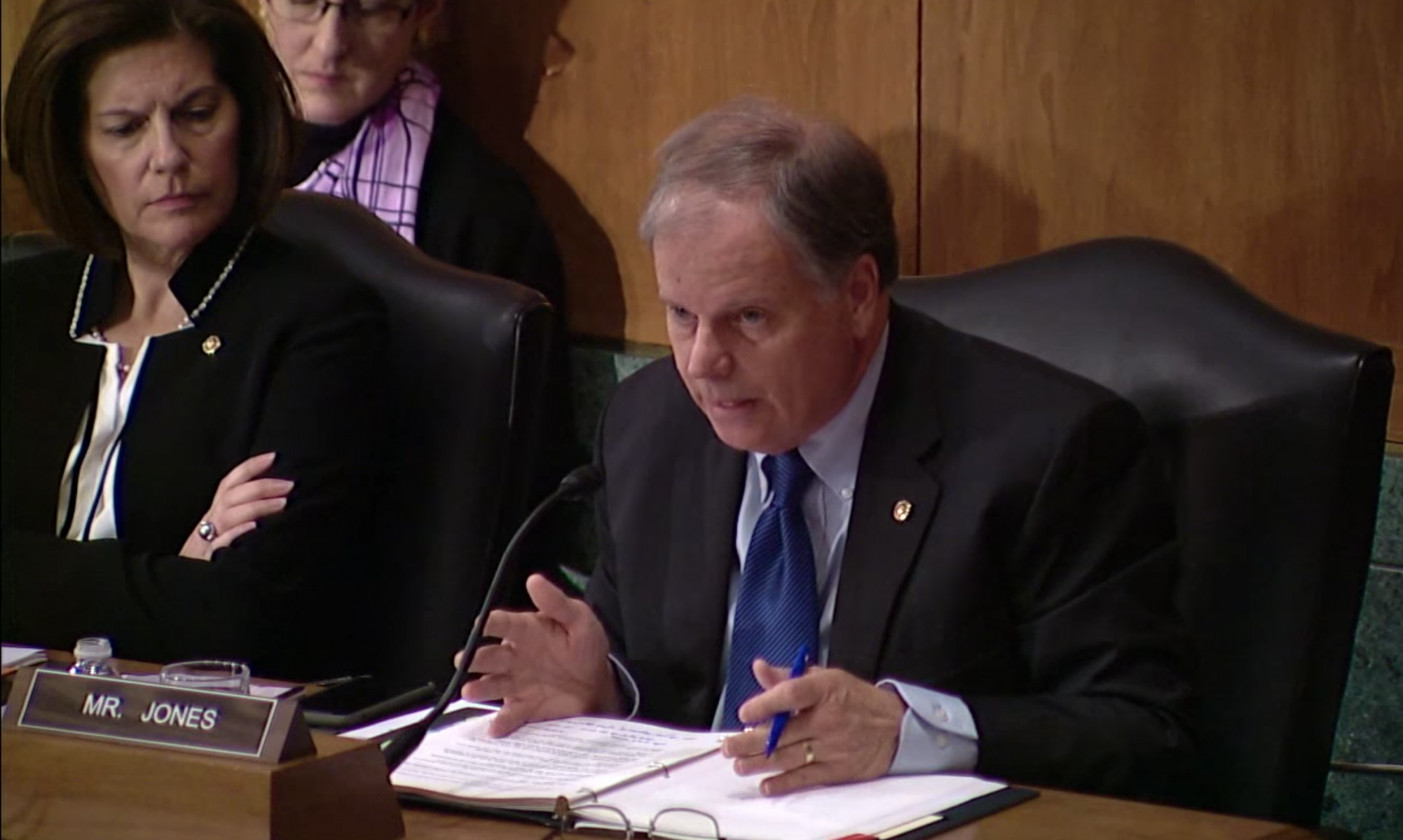

Monday U.S. Senator Doug Jones (D-Alabama) joined Senators Tom Cotton (R-Arkansas), and Jeff Merkley (D-Oregon) in introduced legislation that would end the practice of mailing high-interest loans to consumers in the form of “live” checks.

When consumers receive these loan checks, many unknowingly believe they have received money from their bank or financial institution, not realizing that the check is often a high-interest loan.

The Unsolicited Loan Act of 2018 would prohibit this practice and ensure that consumers access loans only when they proactively apply for them. This legislation mirrors the decades-old prohibition on the mailing of live credit cards.

“As working Americans look to make ends meet, lenders will often target cash-strapped families with these mailings,” Senator Jones said. “It is unconscionable that someone would take advantage of another person’s dire financial situation to make a quick buck for themselves. We need to end this predatory lending tactic and pass this legislation to protect consumers and their pocketbooks.”

“People should understand clearly when they are taking on debt,” Senator Cotton said. “But because ‘live’ checks mailed directly to consumers don’t require an application or any previous relationship with the consumer, many individuals don’t realize that these checks are actually high-interest loans until it’s too late. Just like Congress ended the practice of mailing ‘live’ credit cards nearly 50 years ago, Congress should pass our bill now to stop this underhanded practice.”

“When you receive a check in the mail, it’s natural to assume that depositing it will help—not hurt—your bottom line,” Sen. Merkley said. “But these checks don’t pad consumers’ pocketbooks; instead, they send them into a vortex of debt. The practice of mailing high-interest loans disguised as checks is unconscionable and clearly predatory. Today, we’re sending a bipartisan message that this unacceptable practice must end.”

The sponsors said that it has been long recognized by Congress that consumer loans should require an application by a customer. In fact, Congress banned the mailing of unsolicited live credit cards nearly 50 years ago. In modern lending, a formal loan application can often take just minutes. The bill does not prohibit the direct marketing or mailing of a loan application. The sponsors say that this legislation would provide common-sense consumer protections without limiting access to credit for consumers who willingly apply and seek lending products.

The bill would also ensure that companies cannot shift from the mailing of live checks to other forms of transfer, such as a gift card or an “e-check.” In addition, it would ensure that customers are not liable for debt incurred from an illegal, unsolicited live check loan. The National Consumer Law Center has endorsed this legislation on behalf of its low-income clients.

According to usdebtclock.org the average American is carrying $58,849 in debt. American families owe over $19,371,000,000. Almost $15,374,000,000 of this is mortgage debt; but Americans also carry nearly $1,580,000,000 in student loan debt and almost $1,050,000,000 in credit card debt. According to the American Bankruptcy Institute, through November 703,130 Americans have already filed for bankruptcy in 2018, including 24,676 in Alabama.

Senator Jones was elected a year ago in a special election for the seat vacated by Senator Jeff Sessions (R) when he accepted President Donald J. Trump’s (R) nomination to be U.S. Attorney General. Jones is the only Democratic candidate to win a statewide election in Alabama since 2008.