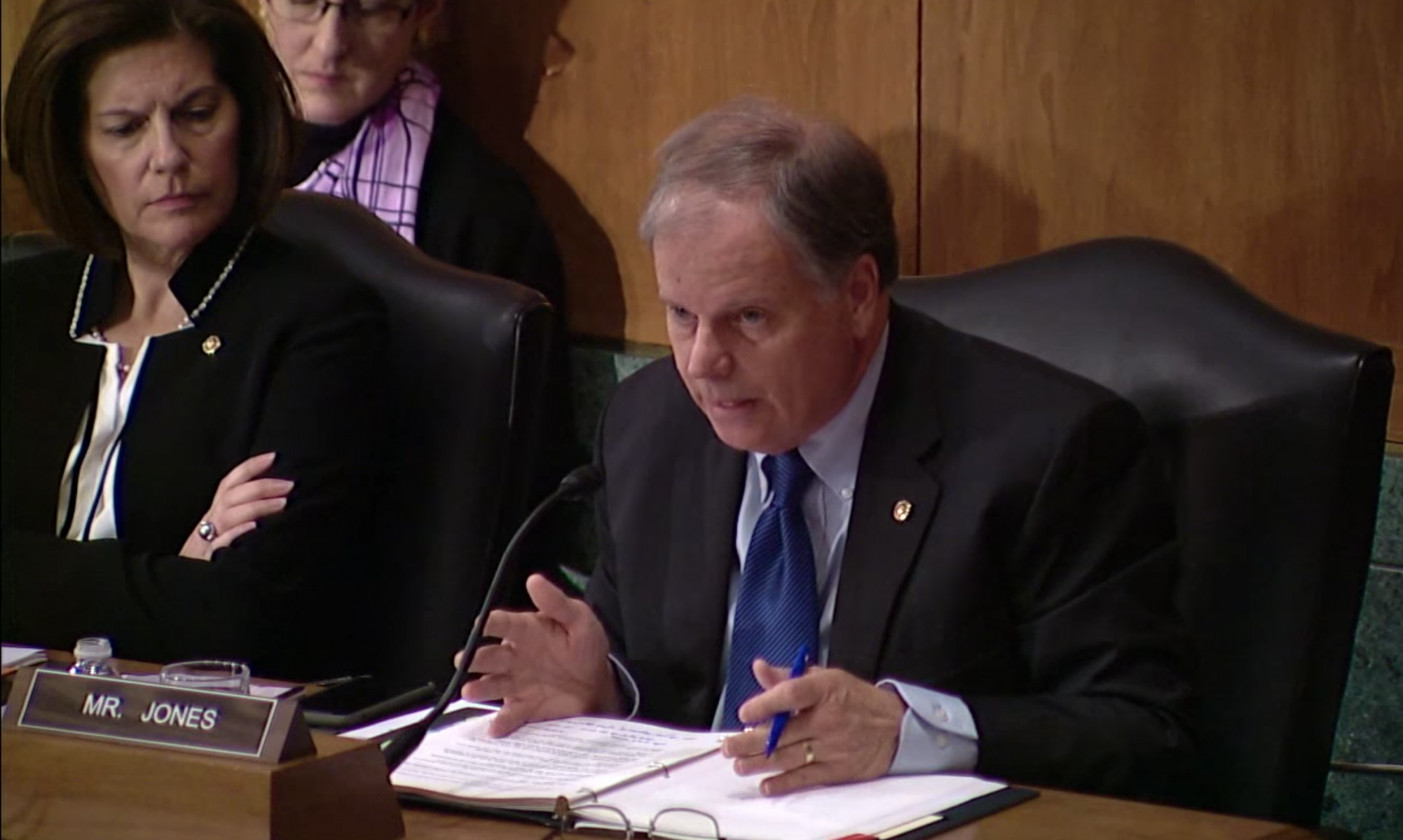

U.S. Sen. Doug Jones is calling for a formal review of a backlog among tariff exemption applications.

Jones joined with Sen. Pat Toomey, a Republican from Pennsylvania, and Tom Carper, a Democrat from Delaware, to write a letter to Comptroller General Gene Dodaro in the government accountability office requesting a formal review of the exclusion process administered by the Department of Commerce.

Jones’ office said the exclusion process for the 25 percent steel and 10 percent aluminum tariffs implemented by President Donald Trump’s administration has generated a large backlog of petitions, placing a significant burden on American businesses who have applied for the exemptions but haven’t had their applications processed.

Trump’s administration has justified a unilateral increase on steel and aluminum tariffs by using Section 232 of the U.S. Code, which states the president can implement tariffs on goods that could “pose a threat to national security.”

“As a result of the section 232 actions, U.S. trading partners have levied retaliatory tariffs on billions of dollars of American exports,” the senators’ letter reads. “In addition, several countries, including U.S. allies like Canada, Mexico, and the European Union (EU), have filed disputes against the United States using the World Trade Organization (WTO) dispute mechanism.”

At the end of October, the Commerce Department had received nearly 50,000 applications for exemptions. Only 16,567 had received decisions.

In the letter, Jones and the other two senators call for the accountability office to investigate questions about the process including the pace of review, costs to taxpayers, support provided to petitioners and how approvals are determined.

“Members of Congress and U.S. businesses have repeatedly raised concerns about the pace, transparency, and fairness of the section 232 steel and aluminum exclusion process,” the letter reads. “For example, the Senate Finance Committee and industry groups have called on Commerce to clarify the criteria it uses to determine whether to grant an exclusion from the tariffs. In July 2018, at a House Ways and Means subcommittee hearing, businesses vocalized concerns about the backlog of exclusion applications and the challenges small businesses have faced in accessing adequate resources to navigate the exclusion process.”