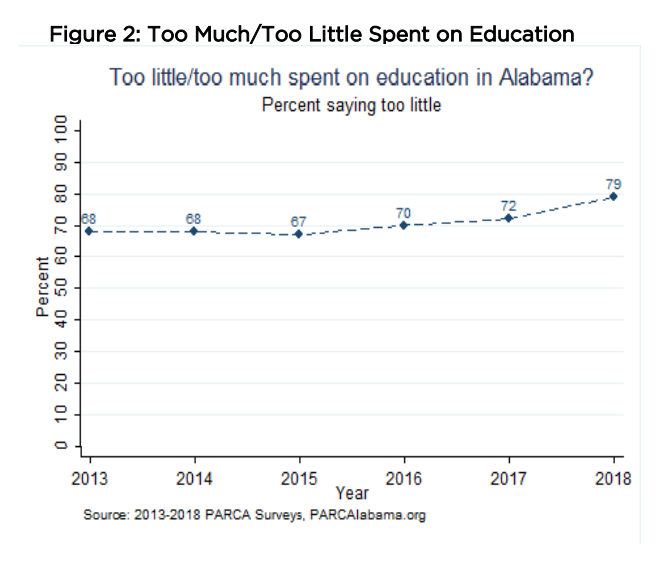

A new public opinion survey from the Public Affairs Research Council of Alabama found that 79 percent of Alabama citizens think the state spends too little on public education.

Those surveyed have increasingly said the state isn’t spending enough on education. Since 2013, the total percentage of those saying the state spends too little has increased more than 10 percentage points from 68 percent to 79 percent.

And, in a state that has historically been averse to raising taxes, respondents said they would be willing to pay more in taxes for various education priorities. Large majorities, ranging from 65 percent to 82 percent, said they would pay more for 13 different educational priorities. More than 70 percent said they would pay more taxes for classroom supplies, repair and construction of new buildings, hiring more teachers, technology infrastructure and school safety and security, among other proposals.

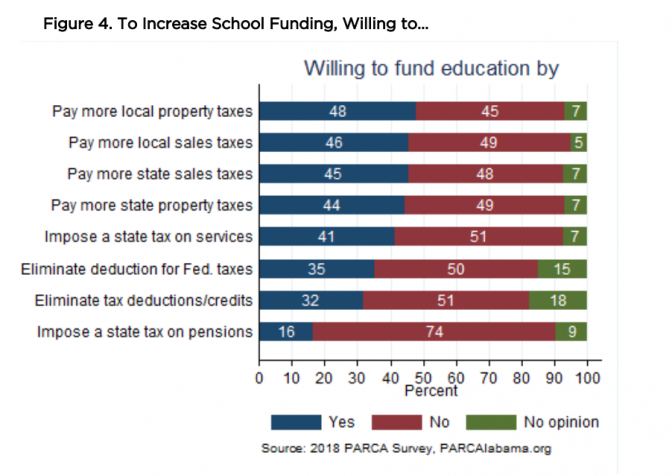

But when PARCA asked voters which taxes respondents would support raising, no single method of taxation received majority support, though one — local property taxes — received a plurality. Forty-eight percent said they would pay more local property taxes, compared to 45 percent who opposed raising local property taxes. Forty-six percent said they would pay more local sales taxes, while 49 percent said they would oppose paying more sales taxes.

When PARCA broke down how many tax mechanism each respondent supported, though, they saw something different. While 18 percent opposed any tax mechanism, 82 percent supported one or more. The respondents just didn’t agree on which mechanism to use.

“Alabamians say education is underfunded and are willing to pay more in taxes for a variety of education priorities,” PARCA’s survey report states. “A majority support three or more tax mechanisms. Still, none of the revenue mechanisms enjoys majority support. This situation poses a dilemma for state policy makers. The public perceives a problem (education underfunding) and is willing to participate in a solution (increasing revenue), but is unable to identify or agree on a way to do it.”

Passing education budgets in Alabama has generally been easier than passing general fund budgets, but lawmakers still routinely face problems. Even when lawmakers passed the largest education budget in state history last year, many Democratic lawmakers said the raises included for teachers and other education workers weren’t large enough.

The divided budget, which was enacted to keep separate tax pools earmarked for education, still receives majority support among those who responded to PARCA’s survey, but the number supporting the division of the budgets has declined over the last year. The number declined from 76 percent in 2017 to 70 percent in 2018, though that number is still higher than in 2016, when only 69 percent said the budgets should be kept separate.

About three-fifths, 62.7 percent, of those surveyed said Alabama schools are funded at levels lower than most other states, and 55 percent said Alabama public schools are worse than schools in most other states.

The survey found more highly educated respondents are more likely to say Alabama schools do worse than most, as are respondents from central and south Alabama. That number has grown from 46 percent in 2015 to 55 percent in 2018.

“It appears that the percentage saying Alabama public schools perform worse than schools in most states has been steadily, if gradually, increasing,” the survey found.

Seventy-six percent said the new state school report cards are a good idea, and about 55 percent said the accuracy of those report card grades is “about right.”

“Alabamians value public education, but believe it is underfunded and underperforming,” the survey’s conclusion found. “They express a willingness to pay additional taxes to shore up important educational priorities, although they disagree about what revenue mechanisms they might support to achieve those ends.”