Here’s an annual reminder for you as you decompress from filing your tax returns: Alabama’s state and local governments are collecting less in state and local taxes than any other state in the United States.

Good right? Maybe. Maybe not.

As Tax Day — and an extended deadline caused by web portal outages — pass, 2018 may mark another year when Alabama pulls in less money per capita to operate its state services than any other place in America.

Even less than Mississippi.

Alabama has been behind in tax collection since the early 1990s, according to the Public Affairs Research Council of Alabama, which has produced an analysis of Alabama’s tax revenues since 1988.

The low taxes are often the largest catalyst for perpetual budget crises in Montgomery and the biggest bump in the road as lawmakers try to balance the two state budgets, a constitutionally mandated requirement.

Budgeting over the last two years in Alabama has been a lot smoother because the state has had billions on hand from a settlement with BP Oil over the 2011 Deepwater Horizon oil spill, but as we head into 2019, Alabama is expected to face another dramatic budget shortfall.

The last major shortfall in 2015 led to an increase of some taxes, including the cigarette tax and taxes on nursing home beds — but property and income taxes haven’t moved much in years.

While Alabamians are some of the most averse to taxes, the meager tax collections provide a strained pool of money not just for the finance of often unpopular government programs but also popular public services like schools, roads, courts, health care and public safety.

PARCA conducted the analysis of Alabama’s tax revenues by relying on the U.S. Census Bureau and its annual survey of state and local governments across the country.

State and local spending are considered together because vary in how they decide to divide up the taxation and collection responsibilities for funding public services and government.

Alabama has the lowest property taxes, both state and local, in the country, ranking 50th of the states. Alabama’s property taxes fund education, state and county general funds and county road and bridge funds.

Alabama and its local governments have developed a reliance on the sales tax and already has some of the highest sales tax rates in the country. And unlike other states, our sales tax applies to groceries and medications.

Sales taxes are often considered regressive because they more heavily affect low-income individuals than high-income individuals.

Despite those high sales tax rates and their effect on the cost of groceries and medication, Alabama’s per capita state and local sales tax collections rank 30th among the 50 states because Alabama’s sales taxes are not as productive.

That, according to PARCA, is because of the smaller tax base of economic activity and because Alabama’s sales tax is narrow compared to most states.

Alabama sales tax applies to almost all sales of goods, but it does not apply the tax to most kinds of business, professional, computer, personal or repair services. And in recent years, the economy has moved more toward the consumption of those services, lessening the effectiveness of Alabama’s sales tax.

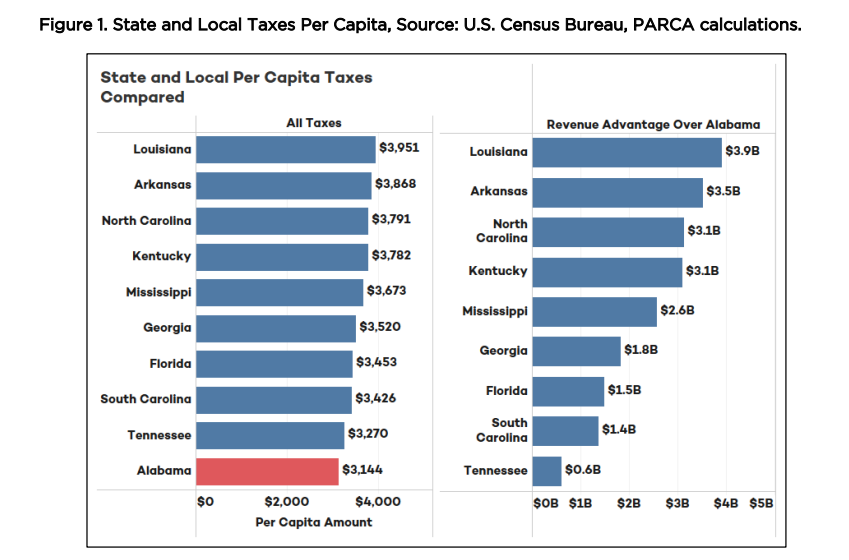

In 2015, the last year PARCA performed its analysis, state and local governments collected a total of $15 billion in taxes or $3,144 per resident. Across the U.S., the media per capita value for state and local taxes was more than $1,230 higher at $4,379.

If Alabama collected taxes at a per capita rate equivalent to the national median, the state would have $6 billion more to spend on public services like building and maintaining roads, providing police and fire protection and operating civil and criminal courts — not to mention schools, colleges, libraries and parks, according to PARCA.

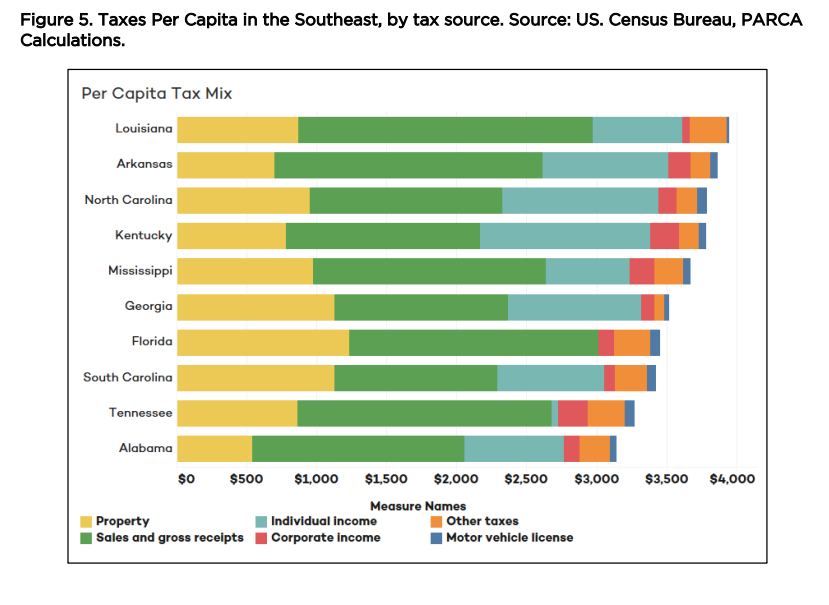

Even if national comparisons aren’t inviting, Alabama even stands out among other states in the South when it comes to revenue.

South Carolina, Tennessee, Georgia, Florida, Mississippi and Louisiana all collected significantly more, per capita, than Alabama. If Alabama collected taxes at the same rate as Georgia, for example, the state would have about $1.8 billion more in tax revenue. If it collected the same amount of revenue as Louisiana, it would have $3.9 billion more.

(via Public Affairs Research Council of Alabama)

Alabama has lower tax revenue than other states primarily because of lower tax rates, but a lower-than-average base of wealth also puts the state behind, PARCA said.

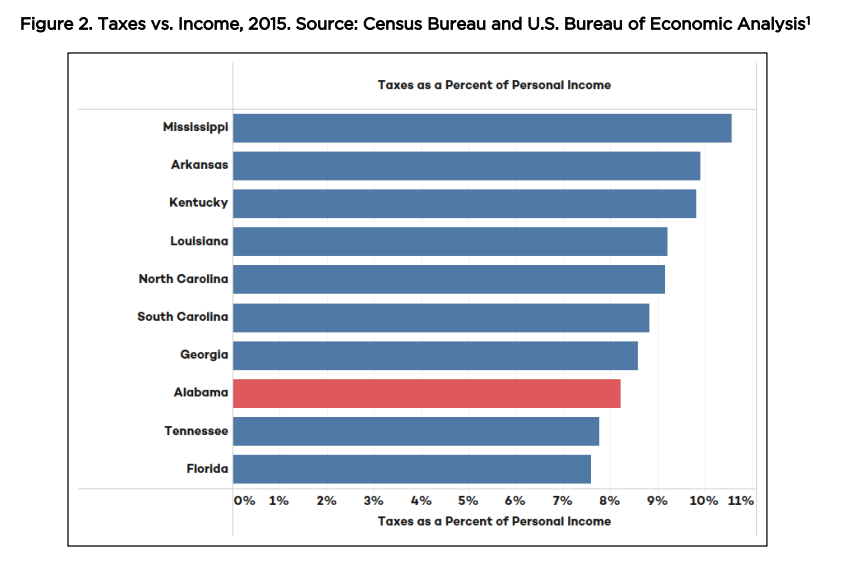

(via Public Affairs Research Council of Alabama)

Tennessee and Florida collected less taxes as a percent of personal income — largely because those states don’t collect income taxes — than Alabama. But their higher base of wealth puts them at an advantage, and the states pursue other funding sources — like higher property taxes — to make up for lower income tax revenues.

Alabama’s collections amount to about 8.2 percent of total personal income of state residents. In Mississippi, total personal income is lower than Alabama, but that state’s collections amounted to 10.6 percent of total personal income.

(via Public Affairs Research Council of Alabama)

Because of their greater effort at tax collection, the states have more money to spend per capita than Alabama.

A full analysis of Alabama’s tax system can be found here.