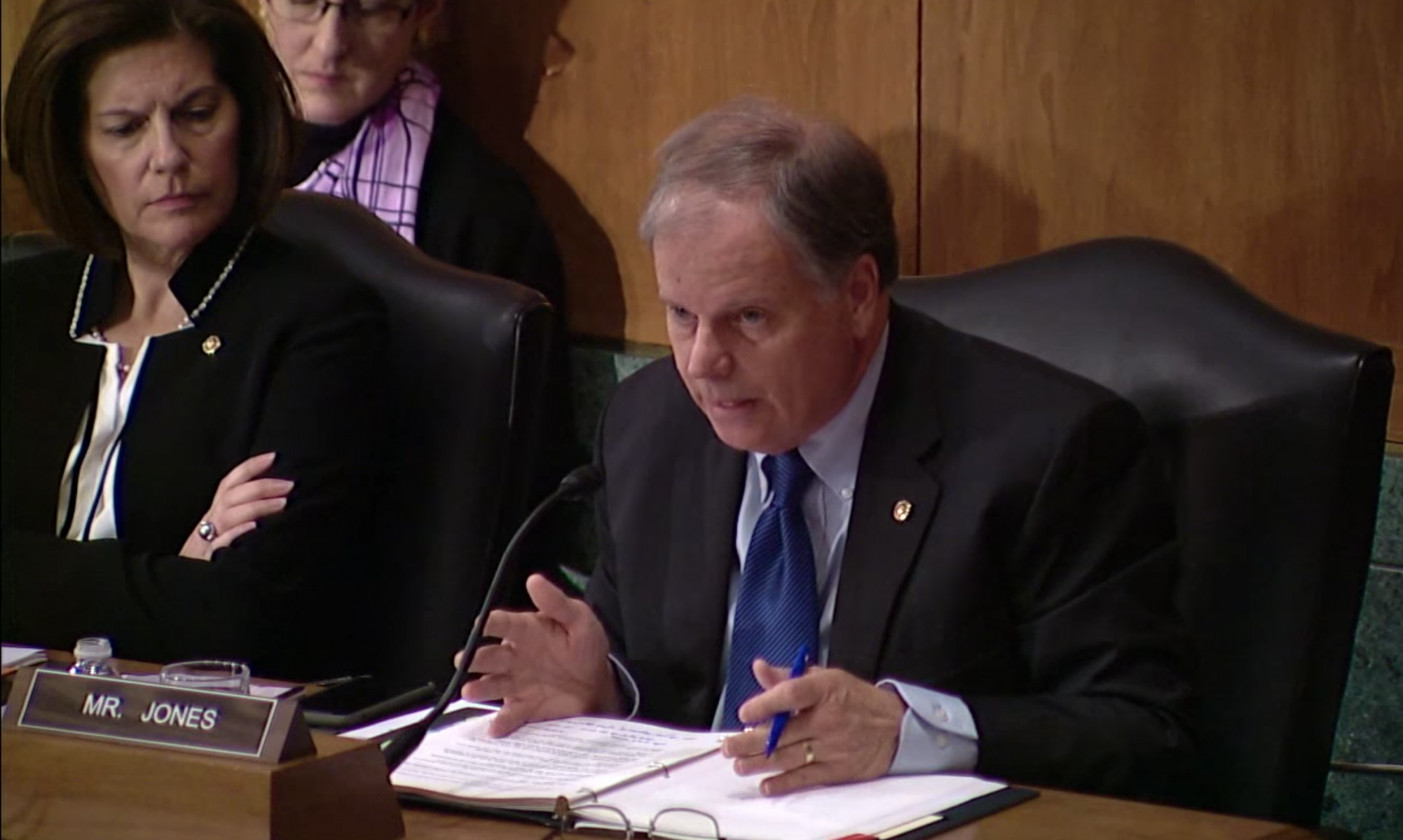

Thursday, U.S. Senator Doug Jones questioned the Acting Director of the controversial Consumer Financial Protection Bureau Mick Mulvaney.

Mulvaney is also the Director of the White House Office of Management and Budget.

Jones questioned Director Mulvaney about what he considered to be Mulvaney’s efforts to roll back consumer protections against payday lenders as well as data collection rules to ensure transparency for equal pay. Both issues which Jones claims directly impacts Alabama workers and consumers.

“[This] is such an important issue in my state… for every one person that takes out a payday loan, they end up taking an average of eight,” Jones said. “About a quarter of a million Alabamians in one year took out those loans and there ended up being over two million loans made that same year. I am struck – this is an important issue for state lawmakers [and] for civic leaders. To me, it seems bipartisan. It’s personal, as I watch the members of my community. It’s very important to the faith community in Alabama. In fact, my home church, Canterbury Methodist, took the lead [in] lobbying for some changes.”

Jones questioned Director Mulvaney’s Willingness to Hold Predatory Lenders Accountable:

“You made a comment that you’re not sure that ‘supervising’ means ‘regulating,’ and that troubled me a lot because I can watch my children and supervise them in a playground but unless I can regulate them and they have no consequences for bad behavior, I don’t know what the difference is,” Jones said. “So, I’d like to ask you just your basic philosophy about the payday lending industry and whether or not your organization will in fact commit to some pretty strong federal rules to make sure that they are not completely ripping off customers, which [creates] a spiral of debt.”

Mulvaney said that the best way to address the problem is to pass legislation. The Alabama legislature can, like my state did, pass legislation.

Jones said, “I am not sure that they have the political will to do it.”

Mulvaney answered, “It comes down to who you trust. I personally have a great deal of faith in my state legislature.”

Jones was also concerned about equal pay protections asking:

“Earlier on as OMB Director, you unilaterally withdrew things and rules in considering equal pay and collection of data,” Jones said. “This is an important issue for folks in Alabama. The Lilly Ledbetter Fair Pay Act was named after an Alabama native. You were asked about this in the House yesterday why you halted a rule that would have required large employers to collect and report aggregate pay data that was designed to help detect trends in unequal pay. Your conversation, I mean your answers, in all due respect, were a little bit flip to me that you just had not given it much thought. I can tell you, Mr. Director, that there are millions of women, there are millions of African-Americans that think about this issue every day.”

Mulvaney said that the data would be unlikely to be useful. “I am not sure how useful that data would actually be.” Mulvaney said that the data collected would have lumped two employees; a doctor and an accountant working for a firm together without making a distinction between the two.

More than two million payday loans were taken out by approximately 250,000 Alabamians between August 2015 and August 2016, with an average interest rate of 300 percent. High-cost lenders can charge up to 456 percent interest.

Jones’ office said that in Alabama, some progress has been made in the state legislature towards adopting new rules on payday lending. In the Alabama Senate, a bill recently passed that would raise the term minimum on payday loans from 15 to 30 days, which would effectively cut maximum interest rates in half.

Supporters of the payday loan industry argue that there is a demand for the service and argue that increased regulation would only force the borrowers, most of whom do not qualify for lines of credit at banks, to go to the underground economy, the internet or illegal loan sharks.

The Consumer Financial Protection Bureau remains a highly controversial agency many in Congress support the full repeal of the Dodd-Frank Act which created the CFPB in the first place.