By Beth Marietta Lyon

Alabama Political Reporter

The Alabama Legislature convened for day 15 of the annual Regular Session on Tuesday, February 27 with 31 committee meetings held throughout the week to consider legislation. Both Houses then convened on Thursday, March 1 for Day 16. The Session reached the halfway point on Tuesday.

There have been 842 bills introduced to date.

The Legislature will return to Montgomery on Tuesday, March 6 for day 17 of the Session with the House convening at 1:00 p.m. and the Senate at 2:00 p.m. Fourteen committees have scheduled meetings as of the time of this report.

Significant Introductions This Week

A third version of legislation relating to the Simplified Sellers Use Tax Remittance Program (SSUT) was introduced in the House. The bill would allow an out-of-state vendor participating in the SSUT to continue to participate in the Program if a physical presence in the state is established through the acquisition of an in-state company, provide that the transaction is subject to sales tax if completed at a retail establishment, provide that the eligible seller also includes sales through a marketplace facilitator, and authorize an additional 1% to be collected and distributed to municipalities according to population. The bill is pending in the House Ways and Means General Fund Committee [HB470 by Representative Rod Scott].

A bill was introduced in the Senate that would exempt prescription drugs from business license taxes based on gross receipts. The bill is pending in the Senate County and Municipal Government Committee [SB349 by Senator Billy Beasley].

A bill was introduced in both Houses that would increase the amount a licensed manufacturer of liquor may sell at retail for off-premises consumption from 750 milliliters per day to 4.5 liters per day [HB464 by Representative Chris Blackshear and SB352 by Senator Jimmy Holley].

A bill was introduced in both Houses that would make receiving, retaining, or disposing of a stolen firearm a felony regardless of the value of the firearm. The bill is pending in the House Judiciary Committee [HB465 by Representative Merika Coleman].

A bill was introduced in the Senate that would authorize an income tax credit to businesses that lose employees to a business currently receiving any economic tax incentive from state government. The bill is pending in the Senate Finance and Taxation Education Committee [SB356 by Senator Paul Sanford].

A bill was introduced in both Houses that would repeal the law that authorized the establishment of Regional Care Organizations and the Regional Care Organization System for providing Medicaid services throughout the state [HB475 by Representative Arnold Mooney and SB362 by Senator Paul Sanford].

A bill was introduced in the House that would prohibit the possession, sale, or transfer of assault weapons and large-capacity ammunition within the state. The bill is pending in the House Public Safety and Homeland Security Committee [HB472 by Representative Mary Moore].

A bill was introduced in the House that would authorize the City of Montgomery and the Montgomery Airport Authority to join the Employees’ Retirement System of Alabama and transfer assets and liabilities of the existing Employees’ Retirement System of the City of Montgomery to the Employees’ Retirement System of Alabama. The bill is pending in the House Montgomery County Legislation Committee [HB471 by Representative John Knight].

A bill was introduced in the House that would provide that a party desiring to redeem property sold to the state for unpaid taxes would pay interest only on the taxes dues at the time of default. The bill is pending in the House Fiscal Responsibility Committee [HB468 by Representative Becky Nordgren].

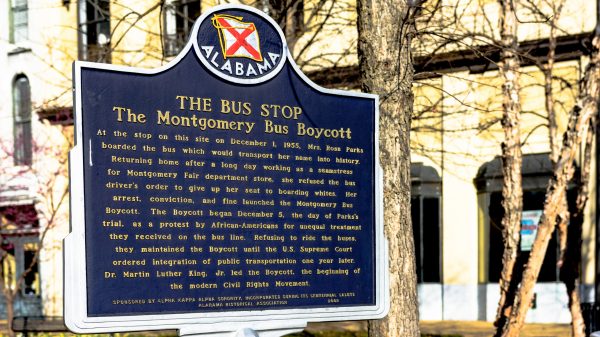

A bill was introduced in the House that would designate the first day of December of each year as Mrs. Rosa L. Parks Day. The bill is pending in the House State Government Committee [HB474 by Representative Laura Hall].

A proposed Constitutional Amendment was introduced in the Senate that would authorize an additional five mill annual state ad valorem tax with the net proceeds to be distributed to the State General Fund for Medicaid purposes. The bill is pending in the Senate Finance and Taxation General Fund Committee [SB353 by Senator Vivian Figures].

A bill was introduced in both Houses that would further provide auditing procedures for pharmacy records and would limit recoupment for certain errors by a pharmacy [HB457 by Representative Elaine Beech and SB348 by Senator Billy Beasley].

A bill was introduced in the Senate that would create the Alabama Rural Hospital Resource Center with the University of Alabama at Birmingham to facilitate access to high quality care and improve the health of rural Alabamians by increasing the viability and capabilities of eligible hospitals at no or minimal cost to those hospitals. The bill is pending in the Senate Health and Human Services Committee [SB351 by Senator Greg Reed].

Significant Committee Action This Week:

The House Boards, Agencies and Commissions Committee substituted and gave a favorable report to a Senate bill that would increase the membership of the State Pilotage Commission from 3 to 4 with the 4th member to be advisory only and appointed by the Chair of the Alabama State Port Authority Board. The bill now goes to the full House [SB222 by Senator Trip Pittman].

The Senate Governmental Affairs Committee gave a favorable report to a House bill that would create an exception that would allow the surviving spouse of a law enforcement officer, firefighter, rescue squad member, or certain volunteer firefighters, killed in the line of duty to continue to receive benefits after remarriage, and extend the benefits for minor children. The bill now goes to the full Senate [HB192 by Representative Matt Fridy].

The Senate Tourism and Marketing Committee gave a favorable report to a bill that would exempt fantasy sports contests from the prohibition against gambling and provide for regulation and registration of operators. The bill now goes to the full Senate [SB325 by Senator Paul Sanford].

The Senate Tourism and Marketing Committee gave a favorable report to a proposed Constitutional Amendment that would allow the state to participate in multi-state lottery games. The bill now goes to the full Senate [SB326 by Senator Paul Sanford].

The Senate Finance and Taxation Education Committee gave a favorable report to a House bill that would clarify that an agricultural trade or business that purchases and installs irrigation equipment or a reservoir may claim one tax credit during tax years 2011 through 2017 and one tax credit during tax years 2018 through 2022. The bill now goes to the full Senate [HB260 by Representative Donnie Chesteen].

The Senate Banking and Insurance Committee gave a favorable report to a House bill that would remove the requirement for homeowners to submit copies of construction records in order to receive an insurance premium discount for meeting certain construction standards making a home resistant to strong winds if the property is certified by the Institute for Business and Home Safety (IBHS) and evidence of that certification is submitted. The bill now goes to the full Senate [HB279 by Representative Randy Davis].

The Senate County and Municipal Government Committee gave a favorable report to a House bill that would provide that a business license is not required for a person traveling through a municipality on business if the person is not operating a branch office or doing business in the municipality. The bill now goes to the full Senate [HB107 by Representative Paul Lee].

The Senate Agriculture, Conservation and Forestry Committee gave a House bill that would provide for the regulation of tagging of oysters and require an annual oyster aquaculture license . The bill now goes to the full Senate [HB302 by Representative David Sessions].

The Senate Fiscal Responsibility and Economic Development Committee gave a favorable report to a bill that would add a manufacturers license that conducts tastings or samplings to the types of alcoholic beverage licenses in an area where a municipality seeks to establish an entertainment district. The bill now goes to the full Senate [SB339 by Senator Rodger Smitherman].

The Senate Agriculture, Conservation and Forestry Committee gave a favorable report to a House bill that would allow the taking of whitetail deer or feral swine by means of bait with a baiting privilege license from the Department of conservation and Natural Resources. The bill now goes to the full Senate [HB21 by Representative Jack (JW) Williams].

The Senate Fiscal Responsibility and Economic Development Committee held a public hearing and gave a favorable report to a bill that would provide for a wine direct shipper license to allow for shipment of limited quantities of wine directly to Alabama residents for personal use. The bill now goes to the full Senate [SB243 by Senator Bill Holtzclaw].

Significant Floor Action This Week

The Senate passed a local House bill that would authorize the governing body of any municipality within Mobile County, or the County Commission in any unincorporated areas of the county, to establish “on premises” sale and consumption of alcoholic beverages on Sunday commencing at 10:00 a.m. The bill now goes to the Governor [HB267 by Representative James Buskey].

The Senate passed a local House bill that would authorize Class 2 municipalities to provide for the abatement and removal of inoperable motor vehicles as public nuisances from private property. The bill returned to the House for action on a Senate amendment which was approved. The bill now goes to the Governor [HB127 by Representative Adline Clarke].

The House voted against a proposed Constitutional Amendment that would have required the Forever Wild Land Trust to annually reimburse the amount of al valorem tax revenue lost as a result of property previously subject to ad valorem tax being acquired by the Forever Wild Land Trust [HB362 by Representative Mark Tuggle].

The Senate amended and passed a bill that would authorize a 3% cost-of-living increase for state employees. The bill is now pending in the House Ways and Means General Fund Committee [SB185 by Senator Clyde Chambliss].

The Senate substituted and passed a bill that would allow certain retirees under the Employees’ Retirement System to receive a funded one-time lump-sum addition to their retirement allowances. The bill is now pending in the House Ways and Means General Fund Committee [SB215 by Senator Gerald Dial].

The Senate substituted and passed a bill that would allow certain retirees and beneficiaries under the Teachers’ Retirement System to receive a funded one-time lump-sum addition to their retirement allowances. The bill is now pending in the House Ways and Means Education Committee [SB21 by Senator Gerald Dial].

The Senate substituted and passed a bill that would make a $30 million supplemental appropriation for the Department of Corrections. The bill is now pending in the House Ways and Means General Fund [SB175 by Senator Trip Pittman].

The Senate amended and passed a House bill that would require the Commissioner of the Department of Revenue to convene the first meeting of the Alabama Land Bank Authority Board and allow the Board to obtain the state’s interest in real property acquired as a result of its sale for delinquent state taxes and retained in the state’s inventory for a period of five or more years. The bill returned to the House which concurred in the Senate amendment. The bill now goes to the Governor [HB54 by Representative Ron Johnson].

The House substituted and passed a bill that would require the Department of Public Health to establish a form for an Order for Pediatric Palliative and End of Life Care to be used by medical professionals outlining medical care provided to a minor with a terminal illness. The bill now goes to the Senate [HB194 by Representative April Weaver].

The House amended and passed a Senate bill that would provide procedures for the disposal of abandoned or derelict vessels. The bill returned to the Senate which concurred in the House amendment. The bill now goes to the Governor [SB50 by Senator Trip Pittman].

The House amended and passed a bill that would require a person seeking public office through a write-in candidacy to file a statement with voting officials in order for the write-in votes to be counted. The bill now goes to the Senate [HB241 by Representative Ron Johnson].

The House amended and passed a Senate bill that would provide for procedures for handling claims relating to potentially or proven dangerous dogs and provide for felony penalties for violations. The bill returned to the Senate which concurred in the House amendments. The bill now goes to the Governor [SB232 by Senator Steve Livingston].

The Senate passed a proposed Constitutional Amendment that would allow displays of the Ten Commandments or other religious displays on state property including public schools. The bill now goes to the House [SB181 by Senator Gerald Dial].

The Senate substituted and passed a bill that would require certain entities to provide notice to certain persons upon a breach of security that results in the unauthorized acquisition of sensitive personally identifying information. The bill is now pending in the House Technology and Research Committee [SB318 by Senator Arthur Orr].

The House passed a bill that would prohibit the possession or sale of sky lanterns. The bill now goes to the Senate [HB325 by Representative Ron Johnson].

Budgets

- The Education Trust Fund Budget, sponsored by Rep. Poole, has passed the House and is pending in the Senate Finance and Taxation Education Committee.

- The General Fund Budget, sponsored by Sen. Pittman, has passed the Senate and is pending in the House Ways and Means General Fund Committee.

Major Legislation Enacted

- HB 190 by Rep. Faulkner: To prohibit municipalities from regulating transportation network companies (Uber, Lyft) and provide for permitting and licensing by the Public Service Commission.

- HB131 by Rep. Pringle: To substantially revise the provisions governing the operation of the Department of Examiners of Public Accounts.

Summary

- Bills Introduced: 842

- Bills which have passed house of origin: 303

- Bills which have passed both houses: 99

- Bills that are pending the governor’s signature: 50

- Bills which have been vetoed: 0

- Constitutional Amendment Bills pending referendum: 8

- Bills Enacted: 41