By Chip Brownlee

Alabama Political Reporter

Ahead of what is expected to be a quiet and relatively non-controversial Legislative Session, Senate Republicans released a four-pronged agenda highlighting priorities that include an income tax break and a push for broadband in rural communities.

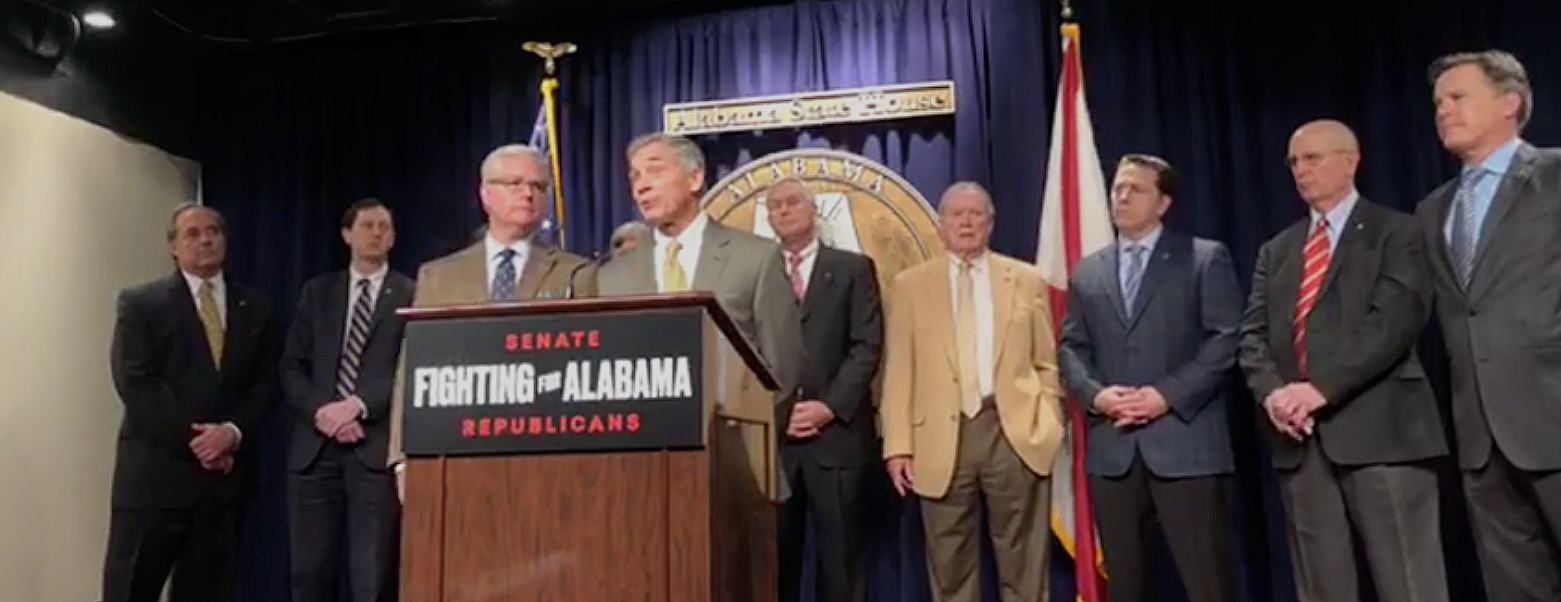

Republican senators announced the agenda — notably less partisan and low key than previous years — before heading into the second day of this year’s session on Tuesday.

“It’s not a real long agenda,” said Senate President Del Marsh, R-Anniston. “We’re more concerned, myself and my colleagues, about quality not necessarily quantity.”

While the income tax deduction and broadband expansion incentives are sure to attract a lot of attention, Republicans also say they will prioritize making sex trafficking a capital offense in Alabama and streamlining Medicaid resource recovery procedures in order to save money on the state’s biggest budget item.

“I think it’s a real aggressive thing and addresses a lot of the problems we have in this state,” said Sen. Gerald Dial, R-Lineville. “It will give us an opportunity to look forward and goals to look to.”

The Income Tax Break

Senators said Tuesday that the proposed income tax break, filed as Senate Bill 76 sponsored by Marsh, would include an expansion of the adjusted gross income range for the maximum standard deduction, meaning families would have to pay taxes on less of their income.

“If you look at this income tax break, it really affects working-class Alabamians. The high-income folks don’t get anything on this one,” Marsh said. “It’s the working class and lower income.”

Alabama’s standard income tax deduction is different for individuals depending on their filing status and income, and it decreases the tax burden for low-income filers, as a portion of income, to a larger degree than those of higher incomes. Above a certain income level, the deduction falls steadily until it hits either a $4,000 minimum for those who file joint tax returns or $2,000 for those who file individually.

“The bottom line is this is not a tax break for the rich, it’s a tax break for working-class Alabamians,” Marsh said.

Current tax law allows those making up to $20,499 and filing jointly to deduct $7,500 off their taxable income. The new bill would expand the maximum income that allows for the largest deduction from $20,499 to $23,000, allowing a larger segment of the population to utilize the largest deduction. The standard deduction then decreases by $175 for every $500 of additional income until the minimum standard deduction of $4,000 is reached.

The bill also expands the income range for those filing individually.

The proposed income tax deduction is one of several proposals made possible this year by an improving financial footing for the state. The Education Trust Fund, the main recipient of state income and sales taxes, saw a large increase in revenue this year after strong economic growth.

“The men and women in the Legislature have passed pro-business legislation, and it’s finally put us in a position to have a 3.5 percent unemployment rate and great opportunities looking forward,” Marsh said. “It’s a time we can justify a small tax break for the working class in Alabama.”

Marsh indicated Thursday that the financial footprint of the tax break, while not neutral, would be small. He estimated their bill would only reduce budget revenues by $4 million to $6 million, a small portion of this year’s estimated $6.6 billion education budget. In addition to floating pay raises for teachers, the governor’s proposed education budget this year is $216 million larger than last year — a little more than 3.3 percent — and allows for $23 million in new appropriations for the state pre-K program along with $50 million for higher education.

Dial said he believes pay raises for educators will amount to somewhere between 2.5–3 percent along with a bonus for retired teachers.

“They’ve been ignored for the past 10 or 12 years, so we’re going to address that issue,” Dial said. “We’re going to continue to expand the pre-K program. That is phenomenal, so I’m excited about this education budget as well.”

Democrats have been supportive of spending more on education and signaled they would support the Republican budget, at least in theory, but Sen. Bobby Singleton, D-Greensboro, said he would need to know more about the income tax deduction plan before signing on.

“It’ll be interesting to see how they’re going to do that because income taxes are a large part of our budgeting as we come in,” Singleton said. “I’d like to see how they’re going to carve that out.”

Balancing an income tax break with a heftier education budget won’t be difficult, Dial said, as the continue continues to expand.

“When you lower unemployment by 1 percent, you create about $250 million in new revenue,” Dial said. “It’s self-growth. Get jobs, jobs create the money, and the money goes to education. So we’re going to grow our way through this without raising taxes.”

Expanding High-speed Broadband in Rural Alabama

Republicans will push a bipartisan bill this session, the Alabama Rural Broadband Act, that would offer incentives to telecommunications and cable companies for expanding broadband infrastructure into rural areas.

Marsh said the bill would spur private investment into infrastructure by providing tax credits and incentives to companies that invest in network facilities in rural areas. Among the incentives are income tax credits, property tax exemptions, and sales and use tax exemptions on equipment used to operate networks.

“If we want Alabama’s economy to grow and Alabama to be all we want her to be, we’re going to have to have economic growth not only just in the cities and along the interstates but also in rural areas in our community,” said Senate Majority Leader Greg Reed, R-Jasper. “That’s going to require that broadband access be something that’s important.”

Singleton and other Democrats, including Minority Leader Billy Beasley, D-Clayton, are listed as co-sponsors on the broadband bill currently filed. Singleton said he is supportive of efforts to bring better connection to rural areas.

“We definitely need to give our children and schools access and the ability to move forward,” Singleton said.

Sex Trafficking as a Capital Offense and Streamlining Medicaid

Sen. Cam Ward, R-Alabaster, chair of the Senate Judiciary Committee, said Alabama currently said the Republican agenda item of making child sex trafficking a capital offense is badly needed.

“We’ve found several loopholes in our sex trafficking laws, and you’re seeing young kids being trafficked from all over the world and them getting nothing more than a slap on the wrist,” Ward said. “You’re an adult preying on a small child, a young child, who has their whole life in front of them. It’s wrong. It should be penalized and deterred in any way we can.

Human trafficking in Alabama is currently a Class A felony.

Other states, including Utah, have pursued making human trafficking a capital offense punishable by the death penalty if a victim dies, though the law has not yet been passed.

Capital offenses in Alabama include murders in the process of other crimes including rape, kidnapping, robbery and burglary.

The last portion of the Republican agenda would create a streamlined recovery process for when state Medicaid Agency officials need to recover agency resources from deceased beneficiaries and their estates, which is required under federal law. The streamlining will save the state money, Republicans say, on it’s largest budget item.

The Senate adjourned Thursday afternoon and will return for its second week of session on Tuesday, Jan. 16, at 2 p.m.