By Brandon Moseley

Alabama Political Reporter

Wednesday, the U.S. House of Representatives passed the final version of HR1, the Tax Cuts and Jobs Act.

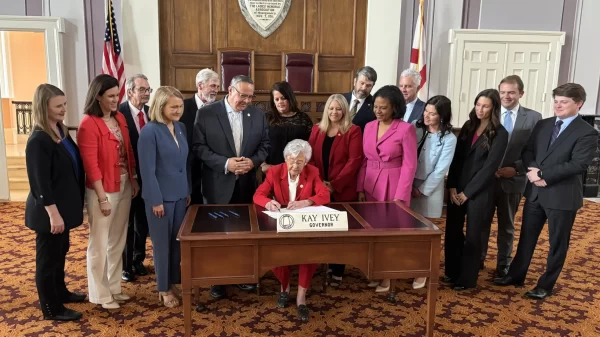

Following passage, Alabama Gov. Kay Ivey released a statement supporting the passage of “Tax Cuts and Jobs Act.”

“American families know best how to spend their hard-earned dollars, not politicians in Washington,” Ivey said. “I am thankful both the U.S. House and U.S. Senate have passed historic tax reform legislation, and I look forward to President Trump signing it into law. Simplifying the tax code while cutting taxes will bring much needed relief to Alabama families, will help our businesses grow and will prove to be a boon for our economy.”

“Today, Congress approved a once-in-a-generation tax reform bill. This is the end of a long journey to deliver major tax relief to the American people. Now, this historic legislation will be sent to the president’s desk so we can start 2018 with a new tax code,” Speaker of the House Paul Ryan, R-Wisconsin, said in a statement.

“It’s finally happening. Today, Congress is sending our historic tax reform plan to the President’s desk. This is a once-in-a-generation opportunity to reduce the tax burden on American families and grow our economy – and I’m glad we could deliver,” Congresswoman Martha Roby, R-Montgomery, said in a statement.

“Republicans succeeded despite a narrow Senate majority, no help from Democrats, and the near-universal hostility of the Beltway press. They also had to overcome the Keynesian bias embedded in such institutions as the Congressional Budget Office and Tax Policy Center that are treated as policy oracles when they merely offer guesses about policy outcomes that are often wrong,” The Wall-Street Journal editorial board wrote.

“The tax bill also includes a provision very important to Gulf Coast states like Alabama. The provision would help make up for shortfalls in the projected amount of revenue from offshore oil and gas leases. It would increase the revenue sharing cap from $500 million to $650 million for two years (2020 and 2021). This is a BIG win for our coastal communities,” Congressman Bradley Byrne, R-Montrose, said on social media.

“Under the Tax Cuts and Jobs Act, a typical, median income American family will get a tax cut of about $2,100,” Roby said. “And that’s not just one year, but annually. For moms and dads working to make ends meet, an extra couple thousand dollars in the budget can make a big difference. It’s their money to begin with, and I believe families know how to spend it better than the government does.”

“Another important aspect of our tax reform plan is lowering business taxes,” Roby said. “A lot of people don’t realize that our effective tax rate for businesses is among the highest in the world. All that does is send jobs overseas and make it harder for small businesses to be successful. By lowering business taxes to a globally-competitive 21 percent, we can boost our economy and spur job growth here in the United States.”

“Our legislation also preserves a lot of the popular tax deductions people count on, including the student loan interest deduction, the deduction for teachers’ expenses, the medical expense deduction, and the mortgage interest deduction,” Roby said. “It doubles the Child Tax Credit to help working families and eliminates the Obamacare individual mandate tax penalty.”

All of the Democrats in both chambers of Congress opposed the bill.

“I have offered amendments to the GOP tax bill, I have called for hearings, I have asked for expert witnesses, and I have supported alternative legislative principles for tax reform that should be bipartisan,” Congresswoman Terri A. Sewell, D-Selma, said. “But today Republicans leaders are bringing a hastily-written bill to the floor that is bad for working families with zero input from the public. Here’s my promise: I will not give up fighting for a better bill for Alabama because families in my district deserve better.”

“A misinformation campaign from the other side had generated a lot of confusion about this bill – what it actually does and doesn’t do,” Roby said. “But, I believe the results will speak for themselves. Americans will know who was telling the truth when they see more money in their pockets and a growing economy thanks to our historic tax reform plan.”

The President and Chief Executive Officer of Boeing Dennis Muilenburg released a statement praising the tax bill passed by Congress that’s about to be signed into law as a critical driver of business, economic growth and innovation for the United States and for Boeing.

“On behalf of all of our stakeholders, we applaud and thank Congress and the administration for their leadership in seizing this opportunity to unleash economic energy in the United States,” Muilenburg said. “It’s the single-most important thing we can do to drive innovation, support quality jobs and accelerate capital investment in our country.”

The House passed HR1 by a vote of 224 to 201.

The bill now is on the president’s desk, and he is expected to sign it.

Among many other things, the bill formally repeals the widely despised mandate that Americans have to buy health insurance.

“When the individual mandate is being repealed that means Obamacare is being repealed. We have essentially repealed Obamacare and we will come up with something much better,” President Donald Trump said in comments at a cabinet meeting.