By Brandon Moseley

Alabama Political Reporter

Tuesday, the Tax Cuts and Jobs Act, HR1, passed the U.S. House of Representatives.

Congressman Bradley Byrne, R-Montrose, voted in favor of the bill, which represents the first major overhaul of our tax code since 1986. Byrne says the bill’s passage will result in lower taxes and a stronger American economy. Byrne said that the average family of four in Southwest Alabama will see their tax bill decrease by $2,187.

“Today, we are giving the American people a huge Christmas present: lower taxes, a stronger economy, and more money in their pockets. This historic vote will pave the way for more jobs and bigger paychecks for families in Southwest Alabama and across the United States,” Congressman Byrne said.

Congressman Gary Palmer, R-Hoover, also supported the bill.

“The Tax Cuts and Jobs Act will provide a much needed tax break for hardworking Americans for the first time in 31 years,” said Palmer. “Our tax plan not only puts more money in the pockets of the American people, but will also launch economic growth. Over the previous eight years our economy only grew at an anemic 1.8 percent per year because businesses were shackled by a complicated and burdensome tax code that was designed for a 1986 economy. The tax reform bill the House just passed removes the shackles and brings our tax code up to date with today’s economy and with American families and workers. I look forward to the Senate favorably voting on the tax bill so we can give the American people a Christmas gift that will keep on giving.”

Congressman Mo Brooks, R-Huntsville, voted in favor of the bill.

“I’m pleased my radical prostatectomy surgery went well enough for me to make a day trip to Washington to vote on tax reform. This tax reform is an historic opportunity to put more money into the pockets of working Alabamians at all income levels and spur much-needed economic growth that will both help with America’s deficit and debt crisis and improve struggling American family incomes,” Congressman Brooks said.

Congresswoman Martha Roby, R-Montgomery, also voted for HR1.

“The Tax Cuts and Jobs Act is a once-in-a-generation opportunity to reduce the tax burden on American families and grow our economy – and I’m glad we could deliver,” Rep. Roby said. “Under this legislation, a median income American family will get a tax cut of approximately $2,100 not just one year, but annually. It’s their money to begin with, and I believe families know how to spend it better than the government does. I look forward to the Senate swiftly passing this bill and the President signing it into law.”

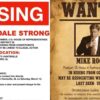

“The legislation will let Americans keep more of their hard-earned paychecks, will lower the corporate tax rate to make American businesses more competitive and will increase the Child Tax Credit. The bill also eliminates Obamacare’s individual mandate so that families can have more freedom in their health care decisions,” Congressman Mike Rogers, R-Saks, said.

“A lot of hard work and countless hours went into making today’s vote possible, and I appreciate all those who had a hand in this historic moment,” Rep. Byrne said. “Here in the People’s House, we will continue to pursue policies that ease the burden of the federal government and make life better for American families.”

“With this bill, the typical family of four earning the median family income of $73,000 will receive a tax cut of $2,059,” Rep. Brooks said. “That is a lot of money working families need to help pay their bills.”

Byrne said that in addition to the major tax reforms, the bill also includes a provision important to the Gulf Coast. The provision would increase the money Gulf states are able to receive through the Gulf of Mexico Energy Security Act. Congressman Byrne led a letter to House leaders last week urging them to include the provision in the final bill.

Critics argue that the bill disproportionately helps persons with high incomes and warn that cutting taxes could grow the $20 trillion national debt.

Congressman Brooks responded to those fears, “America faces a dangerous $20 trillion national debt and an unending string of $1 trillion/year deficits starting in just four years. Economic growth is critical to avoid a national debilitating insolvency and bankruptcy that could destroy an American economy it took our ancestors centuries to build. The Tax Cuts and Jobs Act cuts corporate and pass-through tax rates, allows full and immediate expensing of new equipment, and encourages companies to bring back overseas profits needed to spur investment in factories and jobs in America. Overall, these tax reforms make American job-creators more competitive in a cut-throat international marketplace, thereby protecting and creating even more jobs and bigger paychecks for struggling American families.”

The bill passed by a vote of 227 to 203.

Both the House of Representatives and the Senate have already passed competing versions of HR1. The bill was then sent to a conference committee that developed a compromise package. Today, the House passed the Tax Cuts and Jobs Act Conference Report. Late Tuesday night the Senate also passed HR1; but the Senate Parliamentarian demanded changes to the bill for it to pass the Senate through the budget reconciliation process so it can pass with a simple majority vote and avoid the Senate’s 60 vote filibuster rule. Since the bill has changed again, the House will have to vote on the altered bill again, presumably today. They are expected to pass it and President Donald J. Trump (R), who has been pushing for passage, is expected to sign it into law this week.