By Brandon Moseley

Alabama Political Reporter

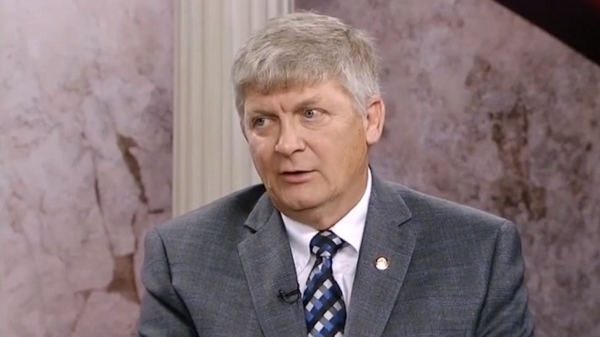

Congress is on the verge of passing the largest tax reform package since 1986, slashing corporate and individual tax rates for most Americans. Congressman Bradley Byrne, R-Montrose, said that the reform package will grow the economy and create more jobs if passed.

“We are on the cusp of something truly historic: tax cuts and tax reform for the first time since 1986. Under the Tax Cuts and Jobs Act, Americans will get to keep more of their hard-earned money in their pockets instead of having to hand it over to the federal government. Our tax reform plan will also grow the economy, resulting in more jobs and higher wages,” Rep. Byrne said in a statement.

Speaker of the House Paul Ryan, R-Wis., said on Monday, “Tomorrow is the day. The House will vote on the most sweeping, pro-growth tax reform since Reagan. So what does it mean for you and your family? Most importantly, the Tax Cuts and Jobs Act will give typical families of four earning $73,000 per year a $2,059 tax cut next year.”

“That is a really big deal,” Speaker Ryan said. “That’s $2,059 to help cover that dream vacation, invest in your children’s college education, or save up for that new car. This tax cut is the result of three major reforms: Increasing the standard deduction so more of what you earn—$12,700 for individuals and $24,000 for joint filers—is completely tax free. Doubling the Child Tax Credit to $2,000 per child so parents have some extra cash to raise their families. Lowering rates across the board so Americans at every single income level get a well-deserved and long-overdue tax cut.”

“The long story short is that relief for middle-income Americans and families living paycheck-to-paycheck is finally on the way,” Ryan said. “When we get this done, people across the country can celebrate the holidays knowing they will wake up with a simpler and fairer tax code on New Year’s Day.”

“When government loosens its grip, there is no summit we cannot reach,” President Donald J. Trump (R) said on Wednesday. “Our tax cuts will break down, and they’ll break it down fast — all forms of government, and all forms of government barriers — and breathe new life into the American economy. They will unleash the American worker; they will tear down the restraints on discovery, innovation, and creation; and they will restore the hopes and dreams of the American family.”

The Tax Cut and Jobs Act also faces a critical vote in the closely divided U.S. Senate as early as today. Even though Doug Jones was narrowly elected by the voters a week ago in the special election for Senate, he will not be sworn in until next month. Appointed Sen. Luther Strange remains in the Senate through the Christmas break.

“I’m calling on Senator McConnell to wait on the tax bill until our state has two ELECTED senators in office. For one of the most consequential votes this Senate is likely to take, our state deserves to have its duly elected Senator at the table,” Congresswoman Terri Sewell, D-Selma, said on social media.