By Bill Britt

Alabama Political Reporter

A recent article in The Economist found that nationally, the number of payday lenders is on the decline, which mirrors Alabama, where payday lending outlets have dropped significantly since the adoption of a statewide database designed to track loans and curtail abuses.

What doesn’t seem to have ebbed, is the need for the type of short-term loans provided by payday lenders.

In the last Legislative Session, Republican lawmakers aligned with left-leaning advocacy groups, but failed to cap small loan interest rates at 36 percent.

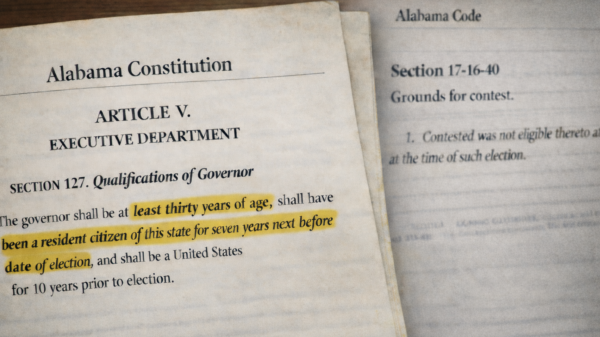

Citing religious convictions concerning biblical pronouncements on usury, several Legislators fell prey to misleading statements and resolutions that were not about payday lending interest rates but old Legislation regarding the small loan database, which was already in use under the State’s Banking Department.

As one Republican lawmaker lamented, “No Legislator in their right mind is going to fall in the SPLC and Arise’s trap again. It is clear that they were marching GOP lawmakers down the path to sponsor Legislation that was anti-free market. Then, in the end, these same lobbyists cut the legs out from under those same Legislators and killed the very reforms they were lobbying for all Session.”

The lawmaker, who remains friendly with representatives from the Southern Poverty Law Center and Arise, said he expressed his feeling to the group’s lobbyists and asked that his comments be used only as background.

During the most recent debates on payday lending, one Republican lawmaker said, “No Legislation is too harsh in fighting usury.”

Defining usury in the context of Religion rather than law is a complex issue, as there are wildly differing viewpoints.

A debate on Capitalism and Religion has as many reasoned answers as there are denominations.

Michael Novak, a Theologian emeritus in Religion, Philosophy, and Public policy at the American Enterprise Institute, writing for The New York Times said, “[C]apitalism is the most moral of a bad lot of economic systems known to humans.”

Also writing for The Times, the Reinhold Niebuhr Professor of Social Ethics at Union Theological Seminary and a professor of Religion at Columbia University, Gary Dorrien stated, “Capitalism thrives on selfish impulses that Christian moral teaching condemns, and neoclassical economic theory mythologizes a supposedly ‘natural’ free market that never existed anywhere.”

Using religious arguments to settle the issue of small loan interest rates is perhaps a debate better left in the church rather than the State House.

Free market forces are the engine that propels the State’s economy, so it’s important to understand what drives small lending under the cool light of data.

A study conducted by John P. Caskey at the Filene Research Institute located at Swarthmore College discovered, “people borrow from payday lenders because they believe that this is the best way to meet an immediate need for a cash advance of $100 to $500.”

The report also found, “Many payday loan customers apparently do not have access to lower cost credit from banks or credit unions because they have already reached the limit of the credit available from these sources.” While others can’t access lower cost loans, “because they have severely impaired credit histories.”

Conducted nearly 15 years ago, The Filene Research Institute study shows that those who use such loans and why they borrow from payday lenders have not changed. In its latest survey, the Center for Financial Services Innovation found 15 million Americans take out small-dollar loans due to limited access to traditional lines of credit. According to CFSI’s study, “about 1 in every 11 low and moderate-income Americans turns to small-dollar loans for quick access to cash despite fees or interest rates.”

Who uses these loans?

According to CFSI, there are four types of small loan borrowers:

Thirty-two percent are Unexpected Borrowers, who access small-dollar credit somewhat infrequently for relatively larger expenses related to unexpected or emergency events;

Thirty percent are categorized as Misaligned Cash Flow Borrowers, who frequently access smaller credit amounts for the periodic payment of bills due to a mistiming of income and expenses;

Thirty percent represent Exceeding Income Borrowers, who spend more than they make and are among the heaviest users of credit, accessing smaller loan amounts for everyday expenses;

Only nine percent are Planned Purchase Borrowers, which CFSI finds is a unique niche of users who make relatively large, planned purchases often related to a personal asset, such as a car, furniture, or household appliance.

Surveys on payday borrowers consistently find that minorities, single mothers, and families with lower wage earners are the primary users of short-term loan instruments.

Much of the argument during the 2017 payday lending debate revolved around protecting the poor from greedy money lenders.

A 2006 study by The Brookings Institute found that lower-income families pay a “poor tax,” in the form of higher prices on almost all consumer goods, including financial services. One of the many institutions that systematically penalize low-income families are banks.

But the State Legislature hasn’t moved to curb overdraft fees, debit card charges, or other fees referred to as the “poor tax.”

Writing in the Currency section of The New Yorker, Lisa J. Servon’s “The High Cost, For the Poor, of Using a Bank,” exposes the real-world reasons why low and moderate-income people turn away from banks to seek alternative financial resources.

Servon: “I had decided to work as a teller to understand why low-and-moderate-income people are choosing not to use banks if they’re really the best option. The answer was surprising: it turns out banks are often costlier for the poor than check cashers and other alternative services.” She also found that low-income borrowers have no other choices. “Banks have retreated from small-dollar credit, and many payday borrowers do not qualify anyway,” writes Servon. However, she does note that banks do “offer a de-facto, short-term, high-interest loan. It’s called an overdraft fee.” In Servon’s investigation she found, “An overdraft is essentially a short-term loan, and if it had a repayment period of seven days, the APR for a typical incident would be over five thousand percent.”

But here again, there is no outcry from the left or the right to curb these poor taxes.

Legislation spurred by emotion rather than data-formed discussion can lead to real world consequences for those who rely on short-term loans.

The number of payday lenders in the state is trending downward, still the demand from consumers is high. During the most recent debates on payday lending, one Republican lawmaker said, “No Legislation is too harsh in fighting usury.”