By Brandon Moseley

Alabama Political Reporter

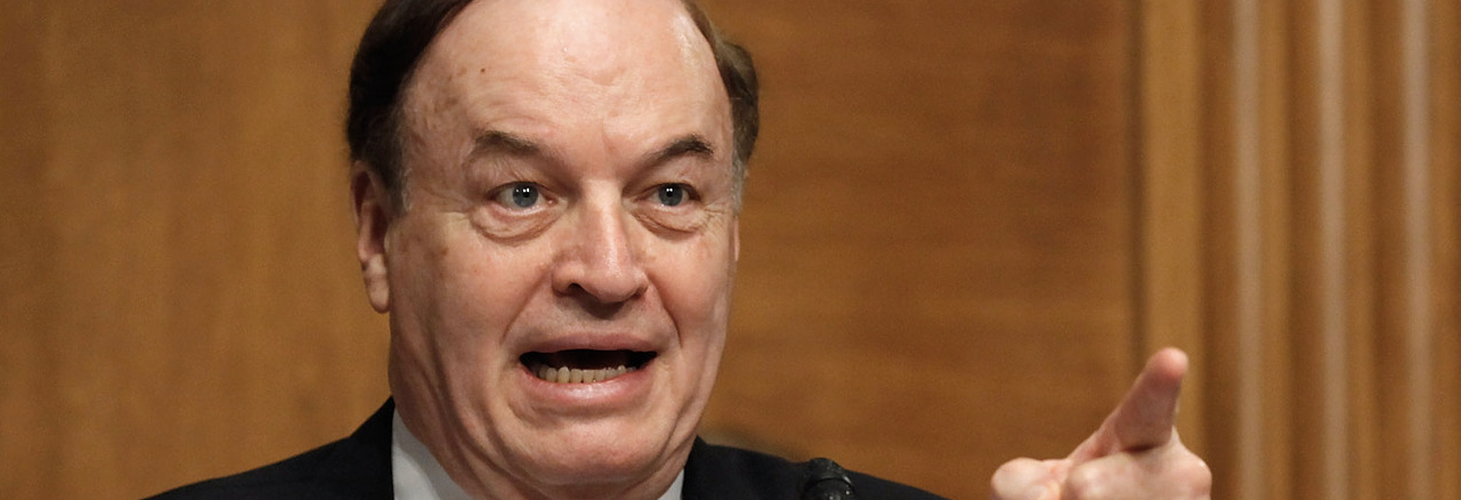

Tuesday, October 11, 2016, a US Court of Appeals for the District of Columbia Circuit ruled that the structure of the Consumer Financial Protection Bureau (CFPB) is unconstitutional. US Senator Richard Shelby (R-Alabama), who has been a longtime critic of the CFPB and it’s unique structure, commented on the ruling.

“For years I have argued that supporters of Dodd-Frank sacrificed our Constitution in the name of bureaucratic independence,” Shelby stated. “While the court’s ruling today is a victory for accountability, it is meaningless without a President who is willing to rein in the unmatched authority of the CFPB’s Director.”

Sen. Shelby concluded, “That is why it is critical for the Bureau to be subject to the congressional appropriations process and governed by a board of directors. Only then will Congress have the ability to conduct meaningful oversight to ensure that the CFPB is truly accountable.”

Senator Shelby has been a staunch critic of the vast powers and autonomy from Congressional oversight that the Dodd Frank financial regulation bill gave to its creation: the CFPB. Dodd-Frank was passed in 2010 when Democrats still had overwhelming majorities in both Houses of Congress to pass the Obama agenda.

The three judge panel of the US Court of Appeals for the District of Columbia unanimously ruled that the CPFB had violated, “bedrock due process principles.” The suit was brought by PHH, a mortgage lender in New Jersey who was accused of taking kickback from mortgage insurers. A federal administrative judge ruled against PHH and fined the company $6.9 million. The CFPB disagreed with the judgement and fined PHH $109 million.

Other federal agency budgets are set by Congress. Dodd-Frank set up the CFPB so that it is funded directly by the Federal Reserve, with no need to make budget requests of Congress and with Congress having little ability to direct or oversee its actions.

Since its creation, the CFPB has written over ten thousand new pages of federal regulations, which affect virtually anyone who borrows or lends money. Critics, such as Shelby, have argued that the CFPB is too powerful. The Obama Administration maintains, however, that the CFPB is necessary to prevent another financial collapse, like the one that occurred in 2008.

Some critics argue that the weight of the growing federal regulatory burden, including the CFPB, is slowing economic growth.

CFPB backer, Sen. Elizabeth Warren (D-Massachusetts), predicted that the ruling would be appealed and overturned.

Original reporting by the Wall-Street Journal contributed to this report