By Brandon Moseley

Alabama Political Reporter

Efforts in the legislature to increase State taxes collected on every gallon of fuel failed this week, due to a lack of support among members of the Legislature.

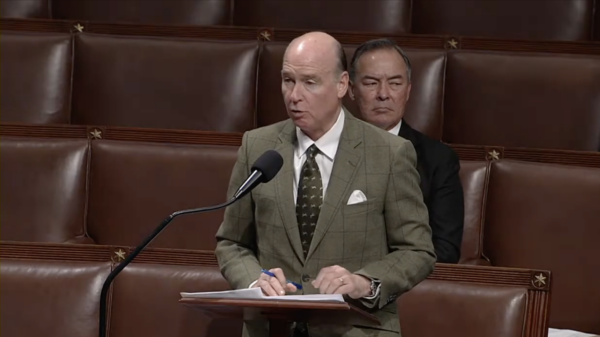

The sponsor of House Bill 394, Mac McCutcheon (R-Capshaw) told the Montgomery Advertiser’s Brian Lyman, that he did not bring the gas tax bill to the floor this session, “For the simple reason that we could not get cooperation from the Senate.”

Senator Bill Holtzclaw (R-Madison) responded on social media, “Didn’t realize that many House members supported the gas tax; was told House didn’t have support #blamesomeoneelse?”

Rep. McCutcheon responded to that: “Bill we had the house support but I had the list of Senator’s who were going to filibuster and kill the gas tax bill. I could not ask the house members to vote for the tax and then see a tough vote go nowhere. I wish we could have gotten something passed. We need a joint effort to fix our transportation infrastructure. Will continue to work for a solution!!”

Rep. McCutcheon, who chairs the powerful House Rules Committee, never brought it to the floor for consideration.

The Executive Director of the County Commissioners Association Sonny Brasfield said in a statement, “It is clear at this point that there is not enough time for the gas tax to complete the legislative process before final adjournment next week. The impact of counties’ efforts to pass the road and bridge revenue measure cannot be overstated. The Association staff would like to express its appreciation to county officials and employees for the numerous efforts to meet, call, email, and tweet their legislators about the urgent need for additional road and bridge dollars.

As a result, SB180 – the bill creating unprecedented accountability and transparency in the distribution of transportation infrastructure dollars – passed this session and is expected to be signed by the Governor before the end of the week. This legislation will set the path for any future road and bridge revenue that the Legislature might consider. Its passage is a great accomplishment.”

Brasfield claimed, “Efforts were made over the weekend to combine the BP settlement (HB569 by Rep. Clouse) and gas tax (HB394 by Rep. McCutcheon) bills into a package deal that would have paid off a significant portion of the Rainy Day Fund debt, provided $50 million to Medicaid, and generated the infrastructure dollars set out in HB394. This was done with the goal of securing additional support for the bills, as well as giving both bills a better opportunity to be considered for final passage before the Legislature adjourned for the session. These bills needed to be considered by the House of Representatives no later than tomorrow in order to receive a final vote before the last meeting day. Unfortunately, our efforts stalled today, in large part, because of the small window of time left to properly explain the function of both bills to undecided legislators.”

Many Republican legislators who were re-elected in 2014 on a platform of no new taxes, and downsizing government, were reluctant to raise taxes, even though the road builders and their government and business allies were pushing hard for the tax increase which would have raised fuel taxes by at least six cents a gallon now and set up automatic future tax increases if other southern states raised their state fuel taxes. McCutcheon’s bill also created a new tax on alternative fuel vehicles.