By Bill Britt

Alabama Political Reporter

MONTGOMERY— During the 2015 Legislative Session, the State Legislature created the Joint Committee on Alabama Public Pensions with the expressed purpose of reforming the State Pension plan.

Republicans have repeatedly expressed a desire to overhaul the Retirement Systems of Alabama (RSA), in an effort to control cost.

Ideas like reform, transparency, efficiency, and ending corruption in Montgomery, have been among the most often intoned catch-phases of the Republican supermajority.

This has led to unfunded prison reform, costly education reform, and creating an enormous policing bureaucracy in ALEA. It has also led to the Speaker of the House being indicted on 23 felony counts of public corruption, and the State’s Legislative website being resigned in such a manner, that it seldom works.

The latest iteration of reform, known as the Joint Committee on Alabama Public Pensions, which just completed its second formal meeting, is comprised of 16 legislators tasked with meeting once a month until next legislative session. Then, submitting a list of suggestions on how to best reform the system.

Among the reforms volleyed about during the second gathering was lowering the interest rate assumption, and making it easier for millennials, the generation which came into adulthood around 2000, to fully vest into the RSA.

These ideas would not lower the cost of operating the RSA, but would vastly increase it liability, according to Dr. David Bronner, the system’s long-time Chief Executive.

“At the beginning of the discussion where the legislators were talking amongst themselves about what is wrong with the Retirement System… the suggestion was made to lower interest rate assumption,” said Bronner. “They read in the newspaper that a few states were lowering their interest rate assumption. Alabama has an 8 percent assumption which is normal…They saw California is going to 7 1/2 percent. So, they start talking about lowering the rate. What they don’t understand is that if you lower our rate, (and remember, we were at 11 percent, the last 5 years)…the costs go up, not the reverse,” said Bronner.

During the session, group members discussed how the current plan was unfair to millennials.

Under the current structure there is a 10 year vesting period, “So we should knock that down, so the millennials see something that they want?” said Bronner. “Of course, if you go lower to 5 year vesting, or 1 year, or immediate vesting, what happens to your cost? It costs more,” he said.

Bronner is quick to point out that historically, these so-called reform efforts have led to more folly than financial stability.

Bronner recalls a time when the legislature was tasked with reforming the system during the Gov. Fob James administration, only to find that it needed to do more for retirees, not less. “By the time we finished combing the dog so many times, the only thing that jumped out was, as a State, we were so far behind in providing death benefits, that we had to raise them,” said Bronner.

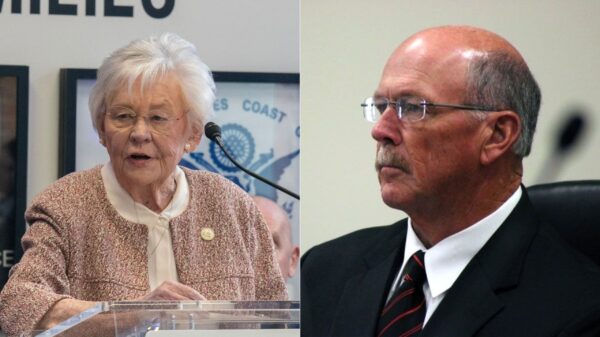

Another issue raised at the committee meeting was a concern over the System’s funding ratio, which Bronner says is typically around 70 percent. Committee co-chair, State Sen. Arthur Orr (R-Decatur) said he would like to see it at 90 or 100 percent. “I’ve always said 80 percent funding is plenty. When you get close to 100 then you have people crying for more benefits,” said Bronner.

Bronner says, it is feasible to achieve 100 percent funding “but the legislature has to stop giving unfunded cost of living increases.” Orr, has admitted that legislatively imposed, unfunded cost of living increases have caused some of the problems, but says it is only a small percent. Brenner, takes exception to that characterization. “That’s the main thing that got us in trouble…that just shows the naiveté of the politicians.”

Bronner points out that the system was 103 percent funded in 2000. He noted, that with a private company, 100 percent funding can work because they can out-of-business and declare bankruptcy…The State cannot go out of business or file bankruptcy.”

Bronner also said, “The only way you get unfunded recurring liability is when you give a benefit to people and you didn’t fund it, and that’s usually called the Cost of Living.”

The RSA supplied the following figures to show the current state of the plan:

March 31, 2015

Employee contribution for teachers: $241 million

Employer contribution: $376 million

Investment earnings: $1.3 billion

March 31, 2015

Employee contribution for employees: $115 million

Employer contribution: $210 million

Investment earnings: $592 million

The words, reform, transparency, efficiency, and ending corruption are often bantered about in Montgomery. Lately, the cures offered have only lead to more disease.