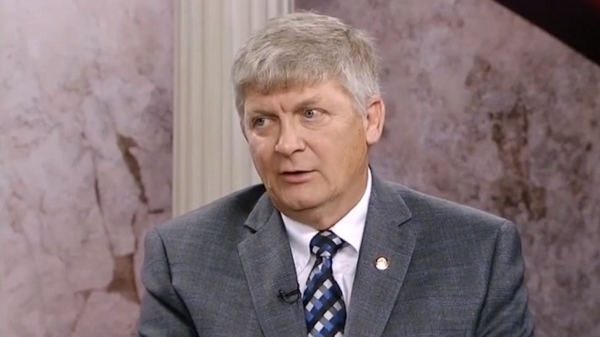

by Katherine Green Robertson

Special session No. 1 wound down in essentially the same posture as the regular session did. The governor still wants tax increases. House members tried to raise taxes, while senators opted to cut their way to the $200 million needed to close the General Fund shortfall.

It’s clear that what has been offered so far does not satisfy the majority. To gain a consensus in the second special session, the Legislature needs a plan that is tolerable to more of the State House’s warring factions and that can better bring the House and Senate together.

That plan may be one that was quietly filed early in the regular session by Sen. Paul Sanford, R-Huntsville. The proposal would nearly close the General Fund shortfall without raising taxes by sharing growth revenue between the state’s two main funds. At the end of each month, this new fund would distribute recurring revenues at a proportion of 78 percent to 22 percent between the Education Trust Fund and the General Fund.

At first glance, it may almost seem simplistic, but the proposal is good policy and achieves much of what legislators claim they want to see in a budget solution.

The General Fund needs around $200 million to balance the budget. Increasing costs of Medicaid and prisons, coupled with the flat or decreasing sources of revenue assigned to this fund, ensure that it will struggle year after year. In fact, in the short time since the regular session concluded, General Fund revenues are already projected to be $17 million less than expected.

The Sanford proposal would ensure that, from now on, the General Fund receives a slightly larger share of all recurring revenues. This seems fair in light of the public’s reaction to House-proposed Medicaid cuts and Senate-proposed cuts to courts and law enforcement.

According to the Legislative Fiscal Office, the 78/22 proposal would send roughly $150 million to the General Fund for FY2016. That means that $50 million in cuts would need to be found, rather than $200 million, significantly reducing the negative impact to General Fund agencies.

The proposal tackles the underlying distribution problems that impair the General Fund, but will still require the Legislature to stay focused on controlling the costs of Medicaid and prisons. The plan is part of a long-term solution, but not the cure-all.

The same public education proponents who shut down the use tax transfer will probably react similarly to this proposal, but it is worth their consideration for two reasons. First, the 78/22 split proposal is estimated to take roughly $75 million less from the ETF than the proposed $225 million use tax transfer.

The Legislative Fiscal Office estimates that the ETF’s recurring revenue for FY2016 would go from $6.249 billion to $6.096–a decrease of only 2.44%. This decrease does not take into account a few revenue measures that were adopted during the special session to benefit the ETF. Further, the proposal would not disrupt the ETF budget that was enacted in June.

Second, for many legislators, the current shortfall has underscored the validity of consolidating the state’s two budgets. For education interests concerned about consolidation, the 78/22 proposal is far less risky, as it specifies the percentage of revenues that the ETF should receive.

The state’s receipts would not become a free-for-all, as is feared with consolidation, and education would remain the state’s top priority by a large margin. The bill also preserves the conservative Rolling Reserve Act, with the cap for FY16 reduced by the amount distributed to the General Fund.

Alabamians would surely applaud a sensible solution to the General Fund problem after being threatened with $500 million in tax increases, closed state parks or a collapsed Medicaid system. While taxpayers certainly recognize the importance of funding public education, they are also interested in adequately funding law enforcement, the courts and the district attorneys’ offices.

Given that there are plenty of appropriations from each fund for non-essential services, it is reasonable to expect the Legislature to find a way to provide these essential services without more of the taxpayers’ hard-earned money.

Sen. Sanford’s proposal is a sensible solution to the current situation. Pushing this proposal would require some courage, but it will be far easier to defend than most of the alternatives we’ve seen thus far.

Katherine Robertson is vice president for the Alabama Policy Institute. API is an independent non-partisan, non-profit research and education organization dedicated to the preservation of free markets, limited government and strong families.