By Brandon Moseley

Alabama Political Reporter

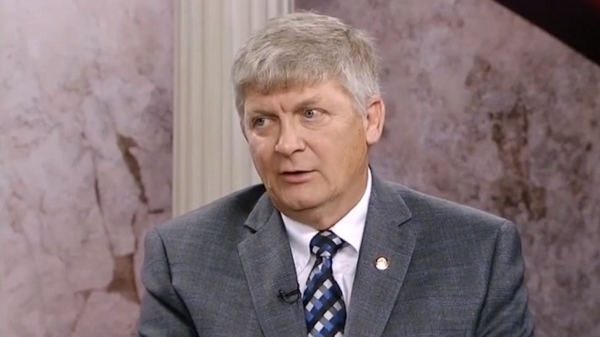

Wednesday, May 6, a public hearing was held in the Senate Banking and Insurance Committee on SB446. SB446 was sponsored by State Senator Tom Whatley (R-Auburn).

Sen. Whatley said that SB446 was needed to level the playing field for Alabama Pay Day Loan lenders who face competition from the internet. Whatley said that his bill takes the maximum limit for a payday loan from $500 to up to $1000. I can go online and borrow $1500 from online lenders. Our guys are limited to $500. “What this bill does is protect the Alabama free market society.” Whatley’s bill takes the limit from $500 to $1000.

Sen, Whatley said that the objections to his bill do not come from payday lending customers. The people with objections to his bill have a problem with aesthetics of brick and mortar payday lenders.

“That is just wrong”

Roy Hutchison said that Sen. Whatley did a great job of explaining the need for this bill. Online lenders are not regulated by Alabama or the US The payday loans cap was set in 1993 at $500. $750 is what $500 was then. The industry is serving the needs of the community.

Shay Farley, the Alabama Appleseed legal director said “I disagree with why this bill is needed. We already have the small loan act. Currently there are 1170 licensees under the small loan act. The difference between a payday loan and a small loan is the interest rate. 456 percent versus 120 percent.”

State banking laws allow consumers to declare any internet debt null and void that exceeds the $500 limit is unenforceable. She accused the bill of attempting to get around the database.

Sen. Whatley said we can take that out.

Lena Lester said, “I am here to speak for the poorer people this morning. I am on disability. When I borrow money payday loans are there for me. I don’t like to go to my son and my family to borrow money. I don’t like to go online. Payday loans are there for me. I don’t understand why anybody would take that away from the poor people. I prefer dealing with people from Alabama.”

Sen. Linda Coleman (D-Birmingham) said this does not do away with Payday Loans.

Lester: “I was very concerned about people in the payday loan office losing their jobs.”

Pete Session, a policy analyst for Alabama Arise, said that he opposed the bill. Said that the 456 percent interest rate on loans they can not pay back is his objection. “People all over the state care about this issue…There is not a risk of payday loan regulations driving people online.” Our goal should not be to try to legalize those practices. The federal government will deal with the out of state out of country online lenders. “We should have laws that reflect our values.”

Mack Wood said “I would like to say thank you for allowing me to speak on behalf of the industry and the consumers of Alabama. I have been in this business for 1995. Have a small store front. We believe by raising the cap you will level the playing field. There are big misconceptions about online lenders. They makes up 50 percent of the business. The number of storefronts have declined by 30 percent. Internet lenders have taken the business. Many people cannot get by on their $500, they need more money.”

Wood said that the argument that the state can declare loans null and void is inaccurate. They have had that option for 15 years and have done that twice.

Sen. Coleman asked Wood: “Are you willing to lower that to 30 percent, which is the rate on military loans.”

Wood: “I don’t know of a single payday lender that does military loans. I can’t make money at that rate.”

Sen. Bill Holtzclaw (R-Madison) said, “I have had conflicting reports on the interest rate and am seeking clarification.”

“Sen. Whatley suggested that the interest rates presented to us today are inaccurate. The small loan and the payday loan have different qualifications. They are not the same loan.”

Chairman Slade Blackwell (R-Mountain Brook) said, “I have a bill that I am working on as well.”

The bill was carried over.