By Susan Britt

Alabama Political Reporter

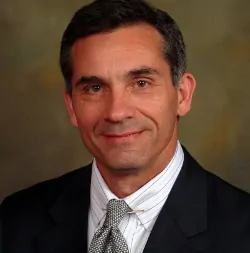

MONTGOMERY—Tuesday, Senate President Pro Tem Del Marsh (R-Anniston) proposed a bill that would allow the Alabama voters to decide whether they want Class III gaming and a lottery.

Marsh’s bill, if passed, would require favorable referendum votes to become an amendment to the Alabama Constitution.

However, on Tuesday, a plan, strongly supported by Speaker Mike Hubbard (R-Auburn), received a favorable vote in the House Republican Caucus opposing much of Marsh’s bill. The House proposal instead would raise taxes, negotiate an exclusive gaming compact with the Poarch Creek Indians (PCI), and not include a lottery or new jobs.

The House plan would include a one-time payment from PCI of $250 million to shore up the 2016 General Fund shortfall, but not include any future revenue from PCI. All future revenue would be generated by new taxes.

Marsh says his plan will generate $400 million in new State revenue and provide more than 11,000 people with new jobs. He estimates the overall impact on the State would be $1.28 billion, according to a study he released last Monday, conducted by the Institute for Accountability and Government Efficiency at Auburn University of Montgomery (AUM).

Marsh said, “I say, let the people of Alabama vote. The choice is clear to me: do you want to raise taxes by $700 million or do want a lottery and casino gaming that will generate $400 million and create 11,000 new jobs without having to raise taxes? The people of Alabama should decide this question for themselves, and nobody else.”

The Marsh amendment is a three-step plan:

—Create the Alabama Lottery Corporation

—Allow slot machines and Class III gaming tables at the existing racetracks in Mobile, Macon County, Greene County and Birmingham

—Authorize the Governor to negotiate a compact for gaming with the Poarch Creek Indians to expand to Class III table gaming

Marsh said, “Hundreds of millions of Alabama dollars are going to Mississippi, Florida, Tennessee and Georgia to play in their lotteries, their casinos…This is creating new jobs for their people, new investments for their towns and cities, new hotels, restaurants, entertainment facilities, new tourism dollars. It is time that Alabama dollars stayed right here in Alabama, creating new jobs for our workers, creating new investments for our businesses, and expanding tourism and opportunities for our towns and cities.”

“We can achieve all that without raising taxes,” Marsh said. “Five years ago we came to Montgomery on the simple promise to streamline State government, cut waste, and bring efficiency and a business-like approach to funding essential State services.”

According to the Marsh amendment, other key parts include:

—to levy a State gross receipts tax and a local gross receipts tax on gaming revenue of the racetracks

—to levy a tax on vendors of gaming equipment

—to provide for the disposition of lottery proceeds and State gaming tax proceeds

—to create the Alabama Lottery and Gaming Commission to implement, regulate, and administer gaming and regulate and supervise the Alabama Lottery and Alabama Lottery Corporation

—to require the Legislature to pass general laws to implement the amendment

Should the amendment pass the legislature, the referendum would likely be held on September 15, 2015. If the amendment is passed by the voters, the Legislature would be required to hold a special session within 30 days to pass laws implementing the amendment.

The AUM study estimated that a lottery would generate $332 million annually, casino gaming that includes Class III table gaming and slot machines would add another $74 million.

House Democrats already have bills in place contingent on the establishment of the Alabama Lottery Corporation.

Those bills include:

—distribution of funds for Medicaid Agency (HB471-Ford-D)

—hiring School Resource Officers (HB426-Coleman-Evans-D)

—distribution of funds for college scholarships (HB472-Ford-D)

Macon and Greene Counties already have a constitutional amendment to permit electronic bingo.

Last Thursday and Monday, House members filed bills raising multiple taxes to be included in the House Caucus plan.

The House plan would:

—raise cigarette taxes by 25 cents per pack estimated to raise $60 million (HB572-Todd-D)

—raise business privilege tax estimated at $39 million (HB581-Beech-D)

—raise taxes on large corporation while reducing taxes on small business (no bill found yet)

—raise taxes on rental vehicles, $6 million (HB267-Clouse-R)

—raise fees on insurance brokers and adjustors, 4.5 million (HB591-Martin-R)

—limit State employees paid holidays and ask them to take two holidays as furlough, $3.2 million(HB588-Greer-R)

—stop longevity pay for State workers for 2016, $5.2 million (HB590-Mooney-R)

—raise the automobile title fee, $14 million (HB578-Sells-R)

In addition to raising taxes and the State employee proposals, the plan would also authorize the Governor to enter into a compact with PCI allegedly giving them exclusive gaming privileges in Alabama.

The competing plans will be making their way through the process over the next few weeks.