By Brandon Moseley

Alabama Political Reporter

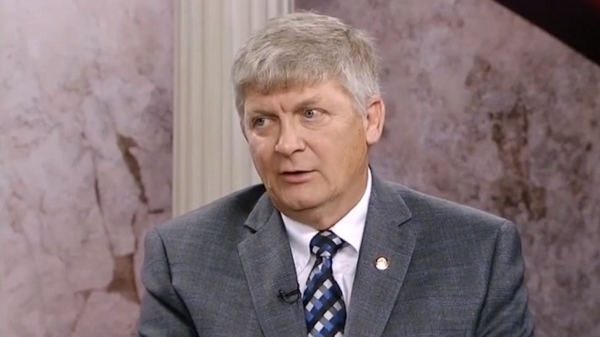

Congressman Mo Brooks (R-Huntsville) says that the American people no longer trust the IRS, and that he supports reform efforts.

US Representative Brooks wrote on Facebook, “American taxpayer trust in the IRS is at an all-time low. Who can blame them? On National TaxDay, the House passed eight bills to rein in IRS abuse, protect taxpayers, and hold agency employees accountable for misconduct. Today’s bills help protect American taxpayers from an incomprehensible tax code that costs billions of hours and billions of dollars merely to navigate. I yearn for the day American families are freed from the IRS’s invasion of their economic privacy. I yearn for the day when April 15 is just another beautiful Spring day.”

US Speaker of the House John Boehner (R-Ohio) said of the reform bills that passed the House, “This isn’t just about passing common-sense reforms. We do that every day. This is about stamping out a culture of arrogance at the IRS. It is a culture in which bureaucrats have willfully targeted citizens for their political beliefs, seized assets from law-abiding small business owners, and routinely wasted taxpayer dollars. All the while, the Obama administration has tried to stonewall the problem away. We owe it to every taxpayer to make sure the abuses of power at the IRS are neither tolerated nor repeated. These reforms will move us closer to achieving both goals, and I applaud Chairman Roskam for his leadership. Let’s keep at it so we can look back on this Tax Day as Reckoning Day for the IRS.”

The IRS reforms passed by the House today include:

•H.R. 1058, Taxpayer Bill of Rights Act, Rep. Peter Roskam (R-IL)

•H.R. 709, Prevent Targeting at the IRS Act, Rep. Jim Renacci (R-OH)

•H.R. 1026, Taxpayer Knowledge of IRS Investigations Act, Rep. Mike Kelly (R-PA)

•H.R. 1314, Ensuring Tax Exempt Organizations the Right to Appeal Act, Rep. Pat Meehan (R-PA)

•H.R. 1152, IRS Email Transparency Act, Rep. Kenny Marchant (R-TX)

•H.R. 1295, IRS Bureaucracy Reduction and Judicial Review Act, Rep. George Holding (R-NC)

•H.R. 1104, Fair Treatment For All Gifts Act, Rep. Peter Roskam (R-IL)

Congressman Brooks would go even farther and abolish the IRS as it is presently configured and replace the income tax with the Fair Tax.

Rep. Brooks wrote, “During TaxWeek I wanted to take some time to emphasize the detrimental effects America’s complicated tax code has on our economy and the burden it creates for taxpayers and business owners alike. Did you know Americans spend approximately 7.6 billion hours each year complying with the multitude of IRS requirements? That’s why I’m a proud cosponsor of the FairTax and was pleased to join Rep. Rob Woodall in sending a letter to Ways and Means Chairman Paul Ryan, urging him to bring this legislation through the committee and to the House floor for a vote.”

Congressman Gary Palmer (R-Hoover) also signed on as a cosponsor for the Fair Tax legislation.

Fair Tax Act of 2015 repeals the income tax, employment tax, and estate and gift tax. Redesignates the Internal Revenue Code of 1986 as the Internal Revenue Code of 2015.

The legislation would imposes a National sales tax on the use or consumption in the United States of taxable property or services at 23 percent in 2017, with adjustments to the rate in subsequent years. It allows exemptions from the tax for property or services purchased for business, export, or investment purposes, and for State government functions.

The act also sets forth rules relating to both the collection and remittance of the sales tax, and credits and refunds. There would be a monthly sales tax rebate for families meeting certain size and income requirements. The primary authority for the collection of sales tax revenues and the remittance of such revenues to the Treasury would fall on the states.

Congressman Mo Brooks represents Alabama’s Fifth Congressional District.