By Brandon Moseley

Alabama Political Reporter

Alabama Governor Robert Bentley (R) has demanded that the legislature increase revenue for the state’s beleaguered general fund budget. On Thursday, April 2 the Alabama House of Representatives did pass a fee increase that will increase revenues by an estimated $9 million per year, $4.5 million of that will go to the general fund. House Bill 92 sponsored by Representative Mike Hill (R from Columbiana) would increase fees that the Department of Insurance already collects on insurance agents and insurance companies that operate in the state of Alabama.

State Representative Hill said on Thursday on floor of the Alabama House, “It has been 15 or 20 years since these fees have been raised, and it will be a long time until they are raised again.”

Rep. Hill told legislators that the fee increase will generate an estimated additional $9 million in new revenues for the state of Alabama. Rep. Hill said that half of that money ($4.5 million) will go directly to the state’s general fund.

Rep. Hill said that the rest of the money (~$4.5 million) will go to the Alabama Department of Insurance. Half of that will go to fund the Department’s fraud unit. Much of the rest of that will fund the Strengthen Alabama Homes Program to strengthen houses from wind damage. This is primarily used on the coast where there the wind damage caused by a hurricane can be devastating to coastal communities. Homeowners that participate get reduced premiums on their homeowner’s insurance premiums.

State Representative Victor Gaston (R) said, “I want to thank you for bringing this bill.” Gaston asked if there had been opposition.

Rep. Hill said that no insurance company has approached him to object to the proposed fee increases.

The bill SYNOPSIS reads: “Under existing law, the Commissioner of Insurance collects certain fees, licenses, and miscellaneous charges for various purposes. This bill, effective January 1, 2016, would increase certain of those fees, licenses, and miscellaneous charges.”

The Governor has requested $571 million in new general fund revenues.

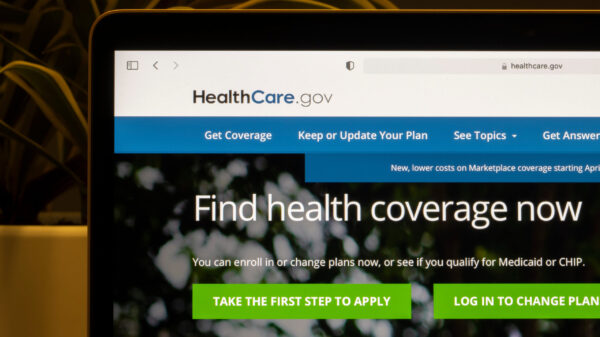

In Alabama the general fund pays for all non-education related state government functions including: the courts, the state’s executive officers, the legislature, the state troopers, the state crime lab, the Alabama Law Enforcement Agency (ALEA), the state parks, Agricultural inspectors, mental health, etc. with the largest part of that going to the state’s matching funds for Alabama Medicaid and the Alabama Department of Corrections. Roads (Alabama Department of Transportation) have their own earmarked revenue sources through the state taxes on gasoline and over the road diesel fuel. Schools similarly are funded by their own earmarked funds that go to the Alabama Education Trust Fund. Gov. Bentley estimates that there will be a $261 million shortfall in the 2016 General Fund budget.

HB92 passed easily in the House and goes on to the Senate.

To read the text including all the new fees, click here.