By Brandon Moseley

Alabama Political Reporter

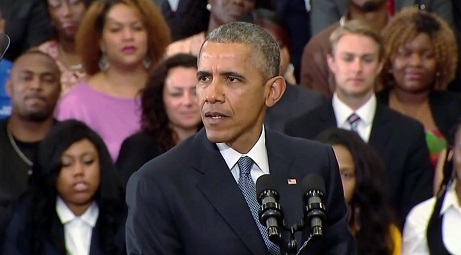

On Thursday, March 26, President Barack H. Obama spoke in Birmingham to announce new regulations by the Consumer Financial Protection Bureau (CFPB). Alabama Arise and the Southern Poverty Law Center both released statements supporting the actions by the President.

President Obama said to the crowd at Lawson State Community College: “We’ve been working to protect people so that they understand mortgages, and they don’t buy homes they can’t afford and end up in a situation not only hurting themselves, but hurting the financial system. And that’s why, as part of this reform, we created an independent consumer watchdog with just one mission, and that is to look out for all of you. And it’s called the Consumer Financial Protection Bureau — or CFPB. Now, these folks — the CFPB, it hasn’t been around a long time, but because of the work they’ve done — it’s not a big agency, but they’ve already put over $5 billion back into the pockets of more than 15 million families. (Applause.) Because they’ve taken on unfair lending practices and unscrupulous mortgage brokers. And they’ve gotten refunds for folks, and are working with state and local officials to make sure that people are protected when it comes to their finances. Because if you work hard, you shouldn’t be taken advantage of. And today, they’re taking new steps towards cracking down on some of the most abusive practices involving payday loans and title loans.”

The deputy legal director for the Southern Poverty Law Center (SPLC) Sam Brooke wrote: “The Consumer Financial Protection Bureau today announced much-needed proposals to stop the predatory lending practices that trap low-income consumers in high-cost, small-dollar loans, such as payday and car title loans. These common-sense safeguards are desperately needed to protect consumers in Alabama, a state where many vulnerable residents have found themselves trapped in debt by abusive payday and car title lenders.”

Arise Citizens’ Policy Project executive director Kimble Forrister said in a statement on Thursday: “It’s past time to rein in high-cost payday lending. The proposed new federal regulations that President Obama talked about in Birmingham today would be a big step toward keeping consumers out of debt traps in Alabama and across the country. The safeguards that the Consumer Financial Protection Bureau is considering would make life better for thousands of families in Alabama. A mandatory cooling-off period after repeated loans would protect borrowers and encourage responsible lending. It’s also heartening to see a proposal aimed at taking into account borrowers’ ability to repay loans.”

Director Brooke said, “The Southern Poverty Law Center has seen firsthand in Alabama – and across the South – how these lenders have profited off people who could not afford the terms of their loans. Far too often, they do not act as a responsible lender and consider a person’s ability to actually pay back the loan. As our report Easy Money, Impossible Debt shows, they are far more interested in trapping their customers in a cycle of debt that only keeps them paying off the interest, week after week and month after month.”

Executive director Kimble Forrister said, “As promising as these proposals are, work remains to be done. The CFPB should work to require all payday and title lenders to evaluate borrowers’ repayment ability. And the most important step – reining in the triple-digit annual interest rates on these loans – requires action from our state leaders. By capping these rates at 36 percent, Alabama lawmakers can strengthen our communities and protect families from the high costs of high-cost lending.”

Mr. Brooke said, “These lenders have proven that they care only about profits – not ethics or fairness to consumers. The bureau’s proposed rules are based on a simple principle: You should not offer loans to consumers unless they can afford to repay them. President Obama also recognizes the importance of these safeguards. They not only protect consumers, but can help stabilize and grow our economy. Unfortunately, these proposals have a long way to go before they are finalized. They also do not fully address the many abuses documented by the SPLC. For example, the bureau’s current proposal still includes loopholes that could permit lenders to continue issuing triple-digit interest loans to people unable to afford them. If the South is to benefit from these proposals, we must see even stricter regulations that will force these lenders to behave in an ethical way.”

Arise Citizens’ Policy Project is a nonprofit, nonpartisan coalition of 150 congregations and organizations promoting public policies to improve the lives of low-income Alabamians.

President Obama said, “Every year, millions of Americans take out these payday loans — here in Alabama, there are four times as many payday lending stores as there are McDonald’s. Think about that. Because there are a lot of McDonald’s. There are four times as many payday loan operations here in Alabama as there are McDonald’s.” “The average borrower ends up spending about 200 days out of the year in debt. You take out a $500 loan at the rates that they’re charging in these payday loans — some cases 450 percent interest — you wind up paying more than $1,000 in interest and fees on the $500 that you borrowed.“

Alabama has one of the least regulated consumer lending industries in the nation…..likely why the President came to the State to announce his new expansion of federal regulatory power. The Consumer Financial Protection Bureau was created by the Dodd-Frank Act early in President Obama’s term when the Democrats controlled both Houses of Congress.

For the past several years legislation to regulate the Pay Day loan business has been introduced in the Alabama legislature. These bills however have not passed into law because state legislators say that if the state shut down payday lenders and title loans those borrowers would simply turn to illegal loan sharks and the demand would empower a new business for organized crime.